Archive for July 8th, 2009

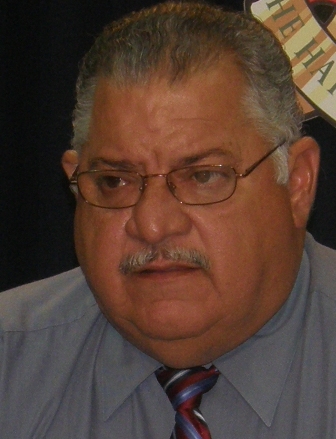

Tibbetts denies deficit deception

(CNS): The dispute between the previous administration and the financial secretary over the state of government finances for the year end 2009 rolled on today (8 July) following another lengthy statement by Leader of the Opposition Kurt Tibbetts questioning the explanation offered by Kenneth Jefferson in the Legislative Assembly last week. Tibbetts said that the FS had still not explained why he told Cabinet and Finance Committee there would be a $29 million deficit and total cash reserves of $126 million as at the end of June this year if he did not believe it.

(CNS): The dispute between the previous administration and the financial secretary over the state of government finances for the year end 2009 rolled on today (8 July) following another lengthy statement by Leader of the Opposition Kurt Tibbetts questioning the explanation offered by Kenneth Jefferson in the Legislative Assembly last week. Tibbetts said that the FS had still not explained why he told Cabinet and Finance Committee there would be a $29 million deficit and total cash reserves of $126 million as at the end of June this year if he did not believe it.

He also denies Jefferson’s inference that attempts by the PPM administration to reduce the predicted deficit was an exercise in deception.

“As far as my administration was concerned, this was a legitimate effort to reduce the predicted operational deficit. It was not some exercise in deception as the Financial Secretary seems to infer in his statement. At least, it was not so on our part,” Tibbetts said. “What he intended or perceived the purpose of the exercise to be is a matter which the Financial Secretary needs to explain, especially since he and his office played the key role in the exercise.”

The leader of the opposition has stated that at the end of that “difficult exercise, a revised budget position was arrived at which placed the projected deficit at $29M at the end of June, 2009 and overall cash reserves at $126M.” He said that although it was far from ideal it was based on the work that had been done and the assurances of the financial secretary, which, he added, was considered as the realistic position. “We had to face the fact that the government would be running an operational deficit at the end of the fiscal year and we would have to make this announcement to the country in advance of the impending General Elections,” Tibbetts acknowledged.

The leader of the PPM has accused Jefferson of being at pains, in his statement delivered to the Legislative Assembly on 1 July, to distance himself from this matter and of inferring that elected ministers fabricated the projections when he had told ministers that there would be a $68 million deficit.

“This is both untrue and an abdication of his responsibility as Financial Secretary to provide the Cabinet, Finance Committee and the Legislative Assembly with sound, objective and truthful advice in relation to the finances of government,” Tibbetts said. He added that the veracity of the financial secretary’s claims must be considered against the background of what he described as incontrovertible facts.

“The projections and the attendant Supplementary Budget were prepared by the Financial Secretary and his office, not by the elected ministers,” said Tibbetts. “The projections and Supplementary Budget were formally presented to the Cabinet by the Financial Secretary to be approved for presentation to Finance Committee. The Financial Secretary personally presented the Supplementary Budget to Finance Committee at its meeting on 20th and 21st March, 2009. The Revised Forecast Financial Results for 2008/9 presented to Finance Committee by the Financial Secretary on 20th March, 2009, stated among other things, that at the end of June, 2009 the Operating Deficit for the government would be $29.4M and that the closing Cash Balance would be $125.5M.”

Tibbetts noted that in the FS’s presentation to Finance Committee, he told members, among other things, that it was a realistic budget. At the time Jefferson had said: “The budget which the Government prepared and presented in April 2008, I believe, I am confident was a realistic budget. It reflected what the Government could do with the revenue expectations it had for this particular year, and indicated that the surplus expected for that year was approximately $14M ($13.8M).”

The financial secretary had gone on to say that there would be a deficit and told Finance Committee that there were many meetings held with chief officers, chief financial officers, where they were grilled over revenue expectations, the cost expectations, and therefore the March supplementary budget was realistic.

Tibbetts recalled again the 5 May cabinet note that the financial secretary presented to the elected ministers to which he had attached a Financial Report for the period from 1 July, 2008 to 31 March, 2009. “In this report the Financial Secretary set out what he claimed was the actual financial position of the government as at the end of March, 2009,” the leader of the opposition said. “The note stated that the net deficit for the 9 month period to 31st March 2009 was $18M and that the cash position or reserves of the government as at that date was $110M.”

Tibbetts said the financial secretary also advised Cabinet that the projections on which the supplementary budget was based were holding true. However, the financial Secretary told CNS last week that he was not on the Island at that time and had not prepared the note or told government on 5 May that the $29 million deficit was still a realistic proposition.

In his latest statement, the opposition leader went on to say that the financial secretary did not advise his administration that there were any concerns about the deficit being substantially greater than had been projected during FinanceCommittee in March. Tibbetts stated that the information the financial secretary presented on 2 June, one week after the new government was sworn in, showing that over the course of the single month of April 2009 the actual deficit had risen by what Tibbetts described as a whopping $20M from – $18.8M to $38M — was information which he never shared with the PPM administration.

“To put this in perspective, the Financial Secretary is saying in his statement that although during the entire nine month period from July to end of March the cumulative deficit was $18.8M, the deficit for the month of April alone was $20M. This defies belief. It is inconceivable and the Financial Secretary has not explained how this could happen. Instead, he seeks to divert attention from this issue by stating that this indicates that the $29M deficit projected in March was unrealistic,” the leader of the opposition added.

“I believe that that the above facts must cast real doubt on the veracity of the Financial Secretary’s statement of 1st July. They must also, regrettably, raise questions about the accuracy of the various predictions and projections made by the Financial Secretary regarding both revenue and expenditure. That is so not just in relation to those projections on which my administration relied, but also to the present projections on which the present government is currently relying. This is an extremely worrying state of affairs and one which must be addressed urgently for the sake of the country.”

Tibbetts said that the present state of both the world and the local economy presented real challenges and well before the meeting of Finance Committee in March 2009, the PPM administration was keenly conscious of the challenges and that was why in October efforts were made to reduce operational expenditure.

He said he had issued a policy directive to the civil service to restrict the hiring of new staff and reduce expenditure by 6%. He said these were elected government initiatives and no action was suggested by the FS, who in October 2008 predicted an operating deficit at the end of June, 2009 of $16M. Accusing the FS of omitting critical facts Tibbetts said Jefferson was trying to pin responsibility for what he claims to be the financial position of the government entirely on the former elected ministers.

“If he is to be believed, it is tempting to ask why we need a Financial Secretary at all,” Tibbetts added. “More than 50% of the operational expenditure of government goes to pay for the civil service; salaries, health care, pensions, etc. These costs are therefore not very flexible and will only decrease if the number of civil servants is reduced or salaries are cut. Conversely, these costs will increase if the civil service grows. Under the present constitution elected ministers have no administrative authority and therefore cannot control decisions relating to the hiring of civil servants without the agreement and support of the Chief Secretary as Head of the Civil Service and the Chief Officers in the ministries and portfolios.”

Tibbetts stated that despite the provisions of the Public Management and Finance Law, elected ministers have little control over operational expenditure which, in addition to the costs relating to the civil service, includes the purchase of supplies and services to keep the engine of government running. These decisions are by and large within the province of Chief Officers.

“When the decision was taken in October, 2008 that operational expenditure had to be reduced it was important that this was implemented immediately, hence the reason it was effected by a process of directives to the civil service and a public announcement. If, as the Financial Secretary has suggested, we had waited and instead of issuing the directives had opted for the process of revising the budget provisions and calling a meeting of Finance Committee and of the House to reduce the overall budget, many weeks, indeed possibly as much as 2 months, would have elapsed before the decision would have had any effect.”

He said it would have taken time because of the work that would have been required by the Portfolio of Finance and Economics and the preparation of a revised budget for a meeting of Finance Committee.

Last week the Financial Secretary claimed that he warned the PPM in October 2008 that unless the matter was taken to the Legislative Assembly “there was a grave danger that without a cost-reduction Supplementary Budget exercise (by Finance Committee), the promised reduction would be spent as time went by in the financial year.”

Tibbetts suggested that the FS had put this forward as one of the principal reasons why the operational expenditure was not significantly reduced as a result of the directives given by Tibbetts’ administration. “Quite frankly, this is nonsense,” Tibbetts claimed. “Is the Financial Secretary suggesting that merely reducing the budget appropriations through Finance Committee would have the effect of containing operational expenditure by the public service? If so, then how does he explain what occurred since the budget was reduced by Finance Committee on 21st March, 2008 and the position at 30 June, 2009 during which period he says a further $19M in unauthorized operational expenditure has been incurred by the civil service?”

Tibbetts said the new government had without question chosen to present the current financial difficulties of the government in the worst possible light in order to discredit the administration. “That is not unusual. But what is unacceptable is that they appear to have found a willing ally in the Financial Secretary in carrying out this exercise.”

Tibbetts then suggested that the 1 July statement by the FS raises more questions than it answers and that there remains much for the him to account for in relation to the advice and guidance which he gave to the PPM government over the past year.

“It is critical that the government develops a better system of projecting both revenue and expenditure. I do believe that the advent of an elected minister with responsibility for finance under the new constitution will go a long way to introduce the level of accountability necessary to ensure good governance in a democracy,” Tibbetts added in his statement.

The PPM Leader said it remained a mystery why the FS chose to make the statement after and not during the recent debate in the Legislative Assembly when the new government sought and obtained approval for appropriations totaling $573M for the first 4 months of the new fiscal year.

“Might it be because he did not wish to have his statement made the subject of scrutiny and debate in the House?” Tibbett asked, adding that he believed the Jefferson still owes the country and the previous administration an explanation for the huge variance in the projections which hegave to Cabinet and to Finance Committee in March of this year and the position which he has now stated.

“This is even more necessary since he later confirmed those earlier projections in a Cabinet Note dated 30th April which he presented toCabinet on 5th May. Even now, after all this time he has still not provided a satisfactory explanation,” he declared.

Eleven down one to go?

(CNS): The Cayman Islands signed its eleventh tax information exchange agreement (TIEA) on Wednesday at a ceremony held at the Netherlands’ Ministry of Finance in The Hague. Government said the agreement with the Netherlands is based on the Organisation for Economic Cooperation and Development (OECD) standard for bilateral exchange of information on tax matters and is seen as another step in removing the Cayman Islands from the post G20 OECD ‘grey list’ with the eventual signing of twelve TIEAs.

(CNS): The Cayman Islands signed its eleventh tax information exchange agreement (TIEA) on Wednesday at a ceremony held at the Netherlands’ Ministry of Finance in The Hague. Government said the agreement with the Netherlands is based on the Organisation for Economic Cooperation and Development (OECD) standard for bilateral exchange of information on tax matters and is seen as another step in removing the Cayman Islands from the post G20 OECD ‘grey list’ with the eventual signing of twelve TIEAs.

Signing on behalf of Cayman, Leader of Government Business McKeeva Bush said it affirmed the Cayman Islands’ commitment to openness and transparency that characterise the way that business operates in the two jurisdictions.

As Cayman struggles to elevate its international reputation in the wake of an onslaught from the world’s leading nations seeking to crack down on so-called tax havens, the new UDP government has committed to signing agreements with as many OECD countries as possible. However, there are a number of indications that the signing of the target twelve treaties may not necessarily be enough to remove Cayman from the ‘grey list’. The OECD may soon be pushing for more TIEAs or evidence of the effectiveness of the agreements and implentation before elevating what it defines as uncooperative jurisdictions to the ‘white list’.

“The Cayman Islands, as far back as 2000, gave an unequivocal commitment to the OECD to co-operate on the issue of the exchange of tax information,” Bush said at the ceremony. “This signing today is a further illustration on our part to honour that commitment. It also demonstrates our willingness to partner with other countries to discourage those who are so minded to, from seeking to evade their obligation to pay their taxes to their respective jurisdictions.”

He added that the Cayman Islands have repeatedly reassured the rest of the world that we provide no safe harbour to those who are involved in any unlawful activities, be it tax evasion, money laundering or any form of trans-national criminal activity.

“We pride ourselves as a major international financial service centre that guarantees high standards of services underpinned by internationally recognised and accepted levels of regulation,” Bush noted. “We therefore welcome the kind gesture of the government of the Kingdom of the Netherlands to host this signing ceremony. We are grateful to all those who have worked very hard to facilitate this occasion, and we look forward to our two countries working together to ensure the effective implementation of this agreement.”

Thanking all those involved he said the signing ceremony marked the culmination of meaningful negotiations between the technocrats in Holland and Cayman.

Bush was joined by a number of delegates from the Cayman Islands including Attorney General Samuel Bulgin, and JC de Jager, State Secretary for Finance, signed the TIEA on behalf of the Netherlands.

RCIPS still at UCCI Brac campus

(CNS): The Cayman Brac RCIPS has been based in the UCCI building opposite the District Administration building in Stake Bay ever since Hurricane Paloma hit the Brac about 8 months ago, when the police station at the Creek was heavily damaged. The roof was torn off and the interior of the building received a lot of damage. To this day, the station is still in its broken state. The UCCI campus has a total of 6 class rooms, 2 of which the RCIPS are currently occupying.

(CNS): The Cayman Brac RCIPS has been based in the UCCI building opposite the District Administration building in Stake Bay ever since Hurricane Paloma hit the Brac about 8 months ago, when the police station at the Creek was heavily damaged. The roof was torn off and the interior of the building received a lot of damage. To this day, the station is still in its broken state. The UCCI campus has a total of 6 class rooms, 2 of which the RCIPS are currently occupying.

Obviously this decreases the amount of space available for classes, but it wasn’t that much of a problem for the academic year just passed, according to Campus Director, Martin Keeley. “The upcoming year however is expected to be a lot busier and the space issue will definitely pose a problem” he said.

Keeley said, “In September we are going to have about 50 new students coming in, added to the 30 or so Civil Service students and the 100 second year students, and that’s about 180 students.” He noted that one classroom can hold about 15 people.” While it’s understood that classes won’t happen all at once, 4 rooms amongst 180 students just isn’t enough. “We will have a problem in September. We need to solve it,” were the words of a concerned Keeley.

According to a police spokesperson, the RCIPS themselves are not responsible for the funding of the repair. However, the government has earmarked some money for repairing the police station in the Creek. Floor plans have already been drawn up and construction is believed to begin shortly. CNS understands that the building isn’t owned by government. We tried to contact government on the matter of whom it belongs to and if the government bought it, but have not yet received a reply.

According to a police spokesperson, the RCIPS themselves are not responsible for the funding of the repair. However, the government has earmarked some money for repairing the police station in the Creek. Floor plans have already been drawn up and construction is believed to begin shortly. CNS understands that the building isn’t owned by government. We tried to contact government on the matter of whom it belongs to and if the government bought it, but have not yet received a reply.

Currently the RCIPS have a Service Level Agreement with UCCI and they pay the college $4,200 per month for the use of the space plus utilities. The RCIPSs suffer from lack of space as well. There aren’t any holding cells and the prisoners must be kept around until they can get on a flight to Grand Cayman. While they have areas for evidence and equipment, there isn’t enough space for it all.

The Police Station is still damaged and it seems as if nothing is being done to it. Save for a few pieces of tarpaulin no repairs have been done. It seems that repairs aren’t going to be finished anytime soon and it is highly doubtful that the RCIPS will move out before the new semester begins.

Immigration guilty of maladministration, OCC finds

(CNS): The Immigration Department’s tardiness in giving a refund to a small business was beyond acceptable limits even by relaxed standards and amounted to maladministration, the Office of the Complaints Commissioner (OCC) found. And in a Special Report following an initial investigation, the OCC further found that the Immigration Department had not complied with a recommendation made by Complaints Commissioner Dr John Epp that properly documented refund requests should be paid by the department within 30 days.

(CNS): The Immigration Department’s tardiness in giving a refund to a small business was beyond acceptable limits even by relaxed standards and amounted to maladministration, the Office of the Complaints Commissioner (OCC) found. And in a Special Report following an initial investigation, the OCC further found that the Immigration Department had not complied with a recommendation made by Complaints Commissioner Dr John Epp that properly documented refund requests should be paid by the department within 30 days.

The original investigation followed a complaint in September 2007 registered by a small business which had been waiting more than four months for the refund of a deposit of CI$2,000, according to a release from the OCC.

At that time of the investigation, the Immigration Law stated that employers had to deposit a sum of money with the Immigration Department to cover the possible repatriation of work permit holders and their dependents. This security deposit, which varied depending on the worker’s country of origin, was refundable once he or she departed the Cayman Islands.

Immigration processes request for all refunds, including those associated with work permit applications, while the Treasury Department generates the cheque for the Immigration to post.

While the complainant was refunded within the timeframe recommended by the Commissioner following his investigation, a second recommendation, that the department’s officer responsible for all refunds from Immigration be instructed to process those due within 30 days of properly documented requests, has not been complied with, the release said.

Refunds from the Immigration Department are certainly made, the OCC found, and there is an informal target of completing a least one batch of refund cheques each week. However, according to the OCC, there are no consequences for inefficient service, and there appears to be a laissez-faire attitude built into the system. Responsible governance should have expectations and targets clearly stated, and it is the view of the OCC that these targets should accord with its recommendation.

The monitoring of the second recommendation began in December 2007. The OCC granted the Immigration Department a six-month period with which to comply with the recommendation, after which an audit, involving interviews and a review of documents and records, would establish compliance.

The OCC monitored a sample of 37 requests (out of a total of 350) made during May 2008, representing about 10% of the total for the month. When they returned on 13 August, only 10 (27%) had been processed within 30 days, while the slowest had taken 72 days.

OCC staff also looked at temporary work permits for the month of June 2008. Even though such refunds were supposedly processed much quicker, thanks to the use of a different system, only 80 (66.7%) of the 120 refund requests were processedwithin 30 days. The largest timeframe for such cases was 52 days.

The reasons given as to why refunds were taking so long included the existence of a multi-source intake framework; a complex refund process; the use of aged and imperfect software; difficulties interacting with Treasury; the Department’s workload volume and working conditions in general; the complexity of the job; a lack of resources; and the lack of clearly stated internal performance targets.

However, the OCC found that it was unacceptable that such a state of affairs had been allowed to exist.

While the accounting system uses a complex programme (IRIS), which can be unavailable from time to time and which can crash in the middle of the entry of data for a cheque batch order, such technical problems should not be considered as a major contributory factor to refund delays, the OCC found. Similarly, the process of assessing and approving a refund was in need of redesigning. In addition, the OCC did not accept that the Financial Department was short staffed, but if so, it should take action to fill the post of Accounts Officer.

A draft copy of this report was given to Chief Immigration Officer for his comment in the event that he took issue with any of the findings of fact or conclusion, but no response was received.

“In accordance with the Complaints Commissioner Law, if we find that inadequate action has been taken to carry out the recommendation of this Office, a special report must be laid before the Legislative Assembly,” explained Epp.

“It is particularly disappointing that there was little effort to comply with our recommendations. The work of this Office provides government departments with an opportunity to improve their service to the public, which should be the aim of all department heads. Cooperation with our investigation is in the best interest of both the public and department staff,” Dr Epp added.

The OCC is located on the 2nd floor, 202 Piccadilly Centre, Georgetown, Grand Cayman, phone number (345) 943 2220. The website is www.occ.gov.ky.

Brac Athletic Club Success

(CNS): The Brac Elite Athletic Club (Track & Field) is one of the most successful sports clubs on Cayman Brac. This is the output of dedicated members and hard training. Athletes of the club have won multiple medals and titles in and outside of the Cayman Islands. Out of all members, it is safe to say that Madison Bush, age 11, has been most successful. She is a 4 time medalist at USA Track and Field Youth National Championships and has been awarded the title ‘Female Track and Field Athlete of the Year 2008’ by the Sports Association of the Sister Islands (SASI). Madison has also competed in the Junior Olympics twice.

Other accomplishments of the the club are Andrew Frederick, who earned SASI’s ‘Male track athlete of the year 2008’ and competed in Carifta 2009; Jonathon Frederick was Under-14 Champion in shot put, discuss, and javelin for the Cayman Islands; and Ameilia Gillispie, who preforms several events, represented Cayman Islands at CAC Junior Championships 2009 taking home a 3rd place medal in High Jump. All are trained by Flynn Bush. Flynn is a serious coach in T&F and was appointed as a National Coach strictly for the Island Games in the Aland (pronounced Oh-land) islands.

Success did not come easy. The athletes train a total of five days a week at 6am on Mondays and Wednesdays and at 4pm on Mondays, Tuesdays, Thursdays and Fridays. Each athlete also has to sign a contract which requires them to commit to training consistently, working hard on track and at school, to be respectful of others and themselves, and to produce result that are competitive when compared to top tier athletes of their own age in the USA and region. The Athletic Club Started with 16 members in September 2008. Out of the group, 7 preserved. Out of the seven athletes, 4 have kept this contract while 3 are on probationary status.

Hurricane Paloma took a toll on the athletes by disrupting training for 2 weeks in November 2008. Even the athletes homeless and important equipment lost, they still resumed training vigilantly. It’s this kind of dedication that brings the BEAC the success it’s already attained and much more is expected in the future.

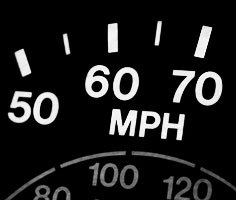

Police net dozens of drivers for traffic violations

(CNS): In the last week police have caught 70 drivers breaking the law in the Eastern Districts with ‘speeding’ accounting for over half the offences detected, the RCIPS said yesterday (7 July). Officers reported that 42 people were caught driving above the prescribed speed limit and 23 people were caught for not wearing the seatbelts. The remaining five offences were for failing to display a current coupon, 4 drivers and one person was caught driving with a defective light.

(CNS): In the last week police have caught 70 drivers breaking the law in the Eastern Districts with ‘speeding’ accounting for over half the offences detected, the RCIPS said yesterday (7 July). Officers reported that 42 people were caught driving above the prescribed speed limit and 23 people were caught for not wearing the seatbelts. The remaining five offences were for failing to display a current coupon, 4 drivers and one person was caught driving with a defective light.

“Public safety is our primary concern and it is a disappointment to see so many people breaking the traffic law,” said Area Commander, Chief Inspector Richard Barrow. “The rules of theroad are in place to help keep all road users safe and drivers should bear that in mind at all times.”

Barrow also called on dump truck drivers to remember that their loads need to be covered at all times and to be mindful of the narrow roadways in BoddenTown. “When travelling through the Eastern Districts, dump truck drivers should be mindful of the noise they can produce. I ask all drivers to slow down, ensure their loads are covered and not use their brakes in a way that will cause annoyance to the community,” he said.

CI Barrow stressed that officers will continue to monitor the roads and any traffic violators will be dealt with accordingly, stating that preventing collisions and ensuring public safety is a top priority.

Anyone with information about crime taking place in the Eastern Districts should contact their local police station or Crime Stoppers on 800-8477 (TIPS). All persons calling Crime Stoppers remain anonymous, and are eligible for a reward of up to $1000, should their information lead to an arrest or recovery of property/drugs.

Murder trial opens with key prosecution witness

(CNS): William David Martinez-McLaughlin (32) appeared in Grand Court this morning to face trial for the murder of Brian Rankine last year. Rankine’s naked body was found in a parking lot around midnight on 16 May 2008 in McField Lane, George Town. A jury of eight women and four men heard first from Jason Hinds, the prosecution’s primary witness, who told the court he was with both McLaughlin and the deceased on the night the victim was murdered. Hinds testified that he saw McLaughlin hold a cutless (machete) over his head and chop at the victim.

Hinds, who has pleaded guilty to being an accessory after the fact of murder and is awaiting sentencing, is the Crown’s primary witness. After a short opening statement from Solicitor General Cheryll Richards, where she explained that Crown’s case was based on Hinds’ testimony, Hinds took the stand and told the court that he and McLaughlin had been work colleagues for some time at a local plumbing firm.

He told the court that he and McLaughlin had been together on the night of 16 May and described the events. Hinds said that he and the defendant had met the victim in a bar that night in East End and had both drove with him in their work van to George Town. Hinds related to the court an exchange which took place outside the van between the deceased and McLaughlin when the three arrived in McField Lane in George Town that started with an argument over what he said looked like a white piece of paper with something in it.

Hinds said he saw McLaughlin grab the victim by the neck and drag him towards some bushes. The witness described a scuffle between the two men and then said that as he went over towards them they both stumbled to the floor with the victim on his belly and McLaughlin on top of him holding his neck.

Hinds testified that he attempted to pull McLaughlin from the man by grabbing his arms from behind and telling him to let go of the victim but had felt a pointed metal object in his hand and moved away.

“I got scared and went back to the van,” Hinds told the court. “I thought he might try to stab me with what he had in his hand.” He described how he could no longer see both of them from his van but that McLaughlin rushed back and pulled a cutless from behind the passenger seat and a white plastic bag and went back to the man (Rankine).

“I saw him start chopping,” Hinds told the court and described McLaughlin raising the cutless above his head. “He was chopping very fast, chopping like he was crazy and not hisself.”

Hinds said he couldn’t see both men but just the chopping action. “I was terrified,” he told the court and described how he stayed in the van for a while before he pulled open the door and ran to see if he could stop him.

“When I reached over there he was pulling off the man’s clothes and stuffing them in the bag,” Hinds stated. He told the court that he held McLaughlin’s wrists and told him to leave the man alone and McLaughlin did not say anything.

Hinds went on to describe how he had driven McLaughlin home to East End but had stopped at two locations on the way home to allow McLaughlin to dispose of the cutless and clothes and how he was afraid he too would be attacked. He also said that he buried his own clothes the next morning in his own garden as they had blood on them and cleaned his boots with bleach before going to collect McLaughlin and going to work. He described how the two men were then arrested and how he had eventually told the police everything and taken them to the murder scene and the places where McLaughlin had disposed of the clothes and the weapons.

Following his account of the night, Mark Tomassi, lead counsel for the defence, began a short cross examination before the day’s proceedings were adjourned. Focusing on the truth and honesty, he asked Hinds if he believed that burying his own clothes and cleaning his boots were honest or dishonest acts.

Hinds indicated his confusion and said that he had been scared.

The trial before Justice Alex Henderson is expected to last nine days and Hinds continues on the stand today (8 July).

Goal posts move on TIEAs

(CNS): On the eve of Leader of Government Business McKeeva Bush’s appointment to sign Cayman’s 11th Tax Information Exchange Agreement, this time with the Netherlands, two OECD countries have indicated that the proverbial goal posts may have shifted once again when it comes to measuring cooperation on fighting global tax evasion. According to reports from a summit in Evian, France, British Prime Minister Gordon Brown and French President Nicolas Sarkozy have called for a March 2010 deadline for sanctions against tax havens that fail to bring their transparency up to international standards.

(CNS): On the eve of Leader of Government Business McKeeva Bush’s appointment to sign Cayman’s 11th Tax Information Exchange Agreement, this time with the Netherlands, two OECD countries have indicated that the proverbial goal posts may have shifted once again when it comes to measuring cooperation on fighting global tax evasion. According to reports from a summit in Evian, France, British Prime Minister Gordon Brown and French President Nicolas Sarkozy have called for a March 2010 deadline for sanctions against tax havens that fail to bring their transparency up to international standards.

The UK and France have indicated their desire to see country by country reporting and that twelve agreements alone are not enough to rescue countries from the infamous ‘grey list’.

As Bush prepared to sign a TIEA in Holland on Wednesday, 8 July, in an effort to reach the OECD standard of twelve tax agreements to remove Cayman from the ‘grey list’ and the stigma of an un-cooperative jurisdiction, both France and the UK said they will remain vigilant in ensuring that the 42 countries still on the OECD ‘grey list’ meet their commitment to apply international standards for the exchange of tax-related information.

France and the UK indicated that they will combine efforts to reinforce the coherence and effectiveness of international action over tax evasion. “We agree that the threshold of 12 tax information exchange agreements should be seen as a starting point in the move towards greater tax transparency. If progress stalls we will expect the threshold to rise above 12, bringing those who have not made further progress back into the ‘grey list.”

Former chair of the Cayman Islands Monetary Authority and offshore expert Tim Ridley told CNS that this communiqué echoes the sentiments voiced in the wake of the recent summit by the OECD. "This development is unfortunately only confirming the noises previously coming out of the OECD, i.e. that effective implementation is now to be the benchmark,” Ridley stated. “Whether Cayman will make it past the post before this policy is formally implemented by the OECD (at the direction of their political masters, the G8-20) is hard to call. Although Bermuda’s recent promotion to the white list gives some cause for optimism, I err on the side of caution, as history tells us that Cayman traditionally and unfairly gets the run around. I hope I am wrong."

Speaking in Evian on Monday, Brown said: "The world should be in no doubt that the writing is on the wall for tax havens," Brown said. "Tax transparency, full exchange of tax information and reducing tax avoidance are crucial for the health of the global economy," Brown said.

The indication that 12 agreements may not be enough but that actual evidence of implementation would become the real key to movement from the ‘grey list’ was given by OECD Secretary General Angel Gurria at the close of the Berlin Summit. In his address on 23 June he said that while the 12 agreement threshold is a good indicator of progress, it should not be seen as just a “numbers game”.

“All countries must aimto have high quality agreements which are effectively implemented with all interested countries,” he said. “It is for this reason that the Global Forum will strengthen its peer review process to focus on effective implementation of the transparency and exchange information standards.”

Meanwhile, in the OECD’s updated list published on 3 July the Cayman Islands remained on the grey list with 10 TIEAs signed. The footnote acknowledging the jurisdiction’s unilateral mechanism remained, stating that the OECD was reviewing this legislation.