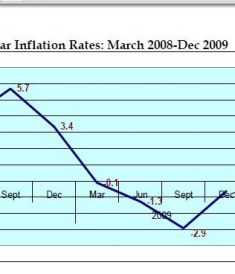

(CNS): The Cayman Islands went into a deflationary phase in 2009 for the first time on record, the Economics & Statistics Office has said. In its most recent Consumer Price Index report, published this month, the ESO reveals that the country’s deflationary position was at its deepest point at -2.9% in September 2009 followed by a slight rebound to -0.6% in December 2009. Prices fell on housing, utilities, fuel, transportation, health and communication. While price deflation in housing softened towards the year end and health and communication rebounded strongly, the average inflation rate for the whole year was -1.3%.

(CNS): The Cayman Islands went into a deflationary phase in 2009 for the first time on record, the Economics & Statistics Office has said. In its most recent Consumer Price Index report, published this month, the ESO reveals that the country’s deflationary position was at its deepest point at -2.9% in September 2009 followed by a slight rebound to -0.6% in December 2009. Prices fell on housing, utilities, fuel, transportation, health and communication. While price deflation in housing softened towards the year end and health and communication rebounded strongly, the average inflation rate for the whole year was -1.3%.

Examining the items in the new ESO basket, which was introduced in 2008, the office said that transportation price index fell by 8.8 percent due to decreases in the average cost of operations of personal transport equipment and transport services.

Prices for housing and utilities fell by 6.4 percent due to the movement in average prices for electricity, gas and other fuels (-33.6%), water supply and miscellaneous (-11.3%). Actual rentals for housing declined by 8.6% but the average cost of maintenance and repair of dwellings increased by 5.9%.

The ESO reported that the average price of food and beverage (non-alcoholic) increased by 1.3 percent because of the increase in the price of fish and seafood, which rose by 9.1 percent. Sugar foods also increased by 6.2% but these were offset by the fall in prices of vegetables (-7.9%) and other staple foods.

“The general negative price movements in the Cayman Islands may be associated with the downward movement in US prices where the annual inflation rate in 2009 averaged -0.4%,” the ESO stated in the report. “It may be noted that approximately 80 percent of local goods are sourced from the US. The deflation in 2009 may also be associated with the dampened demand for goods and services arising from the economic recession and projected decline in local population.”

(CNS): The Cayman Islands went into a deflationary phase in 2009 for the first time on record, the Economics & Statistics Office has said. In its most recent Consumer Price Index report, published this month, the ESO reveals that the country’s deflationary position was at its deepest point at -2.9% in September 2009 followed by a slight rebound to -0.6% in December 2009. Prices fell on housing, utilities, fuel, transportation, health and communication. While price deflation in housing softened towards the year end and health and communication rebounded strongly, the average inflation rate for the whole year was -1.3%.

I suggest that everyone learns what inflation and deflation REALLY are:

They are not prices going up or down. Inflation is the expansion of "money" and credit, while deflation is the contraction of "money" and credit. I say "money" because only gold is money. USD or CI$ are just pieces of paper.

In any event, Cayman has likely had deflation for quite some time now, because of the global credit crisis.

Prices are a symptom of inflation, not the definition of inflation.

Because credit has tightened and there is less investment, fees may have had to go up, but this is not "inflation" in the sense that is implied in the article.

I am not a financial professional, and this is not legal or investment advice.

And to think, many people actually believe the rollover is working.

What has got to do with rollover? You would prefer higher prices?

Let me spell it out.

I rented two apartments to expats. One is now empty and the other I had to reduce the rent to keep him in.

My mortgage still needs to be paid and my maintenance is going up.

What happens if my second tenant leaves?

I can’t sell because there is a glut on the market. Do you think you can figure out why?

Do you understand now?

Nothing to do with rollover really although I am sure you would like it to be. Has to do with a downturn in the economy as a result of which work permits are down by 3,000 since November, 2008. Believe it or not, not everything is about rollover.

Very few new people to the island are going to spend their money as if they have a future here. Rather they will save and spend it where they do have a future. And you really think the rollover has nothing to do with the downturn of our economy? You better understand the two are linked.

The economic downturn in Cayman is a reflection of the global economy in general and the U.S. economy in particular. It was not caused by rollover and neither will abolishing rollover cause economic recovery. Rollover is simply a convenient scapegoat. The essence of rollover over is that people go and people come. And no, rollover was not the real cause of businesses moving elsewhere. Principally that is a flight to what is perceived as more stable low-tax jurisdictions which have double tax treaties with the U.S., U.K. etc., or in other cases because specific tax incentives were given by those countries and there is a ready pool of talent.

You might have a point about investing if the issue was property purchases but it is about renting.

The unfortunate thing is that Mac is buying the propaganda that Mr. Travers and others are selling.

Who am I to believe, you or my tenants? Sorry, ex-tenants. Worse, they took their jobs with them.

"I can’t sell because there is a glut on the market."

You probably can’t sell because Cayman’s entire economy is on a knife edge and there is a real risk of a complete collapse in property prices to 40 or 50% of current values. The ludicrous transaction costs here – around 16% to buy and then sell a property here – also make it very unattractive to buy.

I assume this was calculated before duty and fees went up…

You are correct in your assumption, i think it was calculated up until the end of last year, and the fees didn’t go up until January 2010..