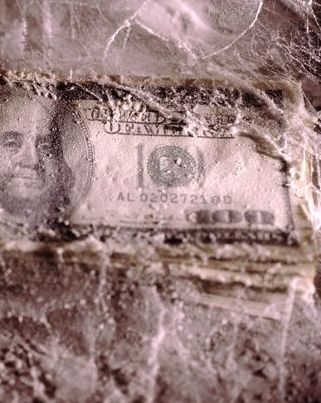

(CNS): A law passed in the Legislative Assembly in July giving government legal access to dormant accounts and as much as $10 milllionhas raised concerns throughout the financial services sector. Correspondence between the financial secretary, seen by CNS, and an industry body indicates that government will have to re-write the law to address what are being described as “unintended consequences”. Opposition MLA Alden McLaughlin said that despite claims by government that it had consulted widely with the industry before passing the law, it was apparent as a result of the planned re-write and from concerns he had heard from industry representatives that this was not the case and it was another example of a rushed law causing problems for the private sector.

(CNS): A law passed in the Legislative Assembly in July giving government legal access to dormant accounts and as much as $10 milllionhas raised concerns throughout the financial services sector. Correspondence between the financial secretary, seen by CNS, and an industry body indicates that government will have to re-write the law to address what are being described as “unintended consequences”. Opposition MLA Alden McLaughlin said that despite claims by government that it had consulted widely with the industry before passing the law, it was apparent as a result of the planned re-write and from concerns he had heard from industry representatives that this was not the case and it was another example of a rushed law causing problems for the private sector.

McLaughlin said that when the government brought the Dormant Accounts Bill 2010 to the parliament he had pointed out that the opposition had been given no time to examine the bill or consult with the industry over how the legislation was being presented and any possible problems with it. He said the opposition was not opposed to the principle of government having a legal means to access truly dormant accounts but it was the manner in which the law was rushed intp which was now resulting in significant changes to the law.

“This was rushed through the Legislative Assembly, as I noted at the time. The opposition was given no time to consult anyone about it,” he said. “The premier insisted at the time that there had been wide consultation with the offshore sector about the law but we now see evidence to the contrary as government is planning to re-write the law.”

He said the this legislation has caused major concerns in the financial services sector and as far as he was aware it was not just in need of minor amendments but was being completely re-written. The former cabinet member with responsibility for the financial sector said it was now very clear government had not consulted properly but it was illustrative of how the current administration was working.

In a letter to the Compliance Association, Financial Secretary Kenneth Jefferson indicated that, as a result of its impact on “certain investment fund and capital market transactions”, there would be a “moratorium on prosecution and inspection” on some special purpose vehicles andlonger term investment accounts. Jefferson wrote that until amendments could be made in the law a commitment had been gained from both the Attorney General’s Office and CIMA that they would not be going after the longer term instruments that fall outside the concept of “abandoned property” but appeared to have been caught up in the law.

The financial secretary further indicated in his letter that, aside from unintentionally including SPV’s in the legislation, the law had also raised concerns regarding the limitations restricting account holders from future claims. He told the compliance association that there would be further dialogue on the necessary amendments to the law and the challenges it was presenting.

The law obliges financial institutions to seek out the owners of financial accounts and products which have not been active for six years or more to give notice that government will be seizing the money if it is not claimed by the rightful account holder. However, it appears, among other problems, that the legislation encroached on some of the financial sector’s specialist long term investment products.

When CNS asked the financial services secretariat what was happening with the law and what changes would be coming, Dax Basdeo, the acting chief officer, gave a different impression of the amendments needed to those revealed in Jefferson’s correspondence.

“Due to the tight time frame in implementing the law with dates that had been agreed on with the banks, an extension of time was given to 30 September to allow them to complete their notifications," Basdeo said, but made no mention of the unintended consequences, the need for a re-write and the major concerns that appear to have been raised about the law in its current state.

McLaughlin said that when the previous administration, in which he served, began examining the possibility of implementing a dormant accounts law this issue was raised by the industry. He said it was clear some three years ago that the legislation would need to be carefully crafted in order not to encroach on areas that were not genuinely abandoned and therefore avoid the risk of unnerving the industry as a whole, in particular, those who advise people to invest in financial products here.

As a result of the passage of the law however, local banks have already begun running advertisements in the local print media, with hundreds of accounts being listed as seeming to be falling within the definition of dormant and abandoned property, despite the need for legislative changes.

Government said at the time the legislation was passed that it could receive as much as $US10 million, for the public purse, which was welcome at a time when it was still struggling to meet its bills as a result of continuing declines in revenue from other sources, such as work permit fees and duty collections. However, there are now concerns that the law currently gives government the power to seize money that is not genuinely dormant, which it will then be forced to return.

(CNS): A law passed in the Legislative Assembly in July giving government legal access to dormant accounts and as much as $10 milllionhas raised concerns throughout the financial services sector. Correspondence between the financial secretary, seen by CNS, and an industry body indicates that government will have to re-write the law to address what are being described as “unintended consequences”. Opposition MLA Alden McLaughlin said that despite claims by government that it had consulted widely with the industry before passing the law, it was apparent as a result of the planned re-write and from concerns he had heard from industry representatives that this was not the case and it was another example of a rushed law causing problems for the private sector.

When McKeeva "Kill the golden goose" Bush announced his aborted money-transfer tax I understand that the Cayman Islands experienced a pre-emptive and massive outflow of banked capital, the likes of which had never been seen before, and notably a certain bank later needed a financial rescue by the issuance of more shares in order to deal with a certain lack of liquidity.

I wonder if this latest fiasco has caused another run on the bank?

Not that it bugs me. My money long since left Cayman. I’m just curious. Anyone know?

Esteemed partner,

I am premier of a small Caribbean island and found $60 million US in dormant bank accounts. It was left there after the sad death of the finance industry and I am named beneficiary in the will.

To get out of the country I need an honest god fearing partner and I have selected you as a person of good standing, reputation and honors. If you will help I can give 5 per cent of cash ($3 MILLION UNITED STATES DOLLARS)

Please forward your name and passport and address and bank card immediately by return of email in order that transaction can be complete.

BY receipt of this I will forward you 6 per cent ($2 MILLION DOLLARS) to bank account.

Please to help me in time of difficulty

Bless you future partner

Serendipity P Happiness

If I had a little more cash laying around, I would just take thoselong lists of "dormant accounts" from the compass, walk in to each of the banks and deposit one dollar in each account. That would act as activity, no?

Anyone with a little bit of cash to burn wanna have some fun at the expense of a ridiculous law?

If I cant pay my rent, I cant just move into a dormant house that has been sitting in North Side for 6 years because nobody has visited it…and if I cant afford my CUC bill I cant just take money from a dormant account to pay it!! Whats the difference? We all have our financial problems and deal with them ourselves…it also doesnt help that the cost of living is going up while salaries are decreasing!!

Just heard on the radio this morning a local Lawyer (who just happened to be in line for one of the easy jobs being handed out by McKeeva at one time) trying to blame the opposition for not stopping this legislation going through.

With logic like that I know that if I ever need a Lawyer he will be last person I would ever go to. Talk about being in McKeeva pocket! Perhaps he thinks we don’t realize we live in a Dictatorship now!

Mackeewa…please do us a favor and step down.

Coming soon, the 33rd Pirates Week Festival sponsored by the CI Dormant Accounts Law (Hastily Revised Version 2)

"That’s quite the young fella you have".

"Yes, Tim has had three paper routes and a job on weekends and he has a savings account and he doesn’t touch it. He’ll be going to college this year and he’s been saving for six years."

"Great! Where does he have his savings account?"

"In the Cayman Islands."

"!"

Not that I am favour of the legislation but on a point of fact if the youngster had indeed been saving for 6 years (as opposed to having deposited a lump sum 6 years ago) his account would not be dormant as there would have been account activity over the period.

Mac, legislation is required to shorten the period for withdrawal of pensions. Why should those on rollover or leaving the island have to wait two years (when the account is dormant) to get their pensions? Please don’t get any ideas.

You don’t have to wait — you only need a similar vehicle in the jurisdiction to which you are moving!

@ Anonymous (Why is it that neither the banks…): Please note that under the Dormant Accounts Law, there is a right for the owner/account holder to reclaim assets of a dormant account collected by the Government as well as a duty for the Government to process such claim and repay accordingly. Also, the right to property is enshrined in the Constitution of the Cayman Islands.

@ Oops – instructions to automatically roll over a fixed deposit is considered "activity" under the Law and therefore would not be included unless instructions to automatically roll over have ceased for the dormancy period under the Law and the fixed deposit actually lays dormant.

Re @ Anonymous: the duty to repay is for a limited time; the right to any interest is lost (the interest is pocketed by the greedy CIG); and, here is the doozy, the CIG charges a person fees for them to get their own money back. Oh and yes elements of the law will be unconstitutional and are already against human rights.

Re @ Oops, forgive me but what section of the law actually says this? You see the whole law looks like it was drafted by a summer student who had a project of cutting and pasting from other countries’ legislation but erring on giving CIG as much free money on its balance sheet at the end of the financial year as possible. Trying to work out what is or is not a dormant account is often impossible, but get it wrong a you are going to jail. Sweet.

In fairness, once the account goes dormant at the bank it no longer earns interest. So there is no "right to interest" that is being lost and pocketed by CIG.

The Chuckster warned unna about McKeeva………he has been born again so many times…….more lives than a cat !!!

This is what Chuckie is talking about when he said that the opposition isn’t performing its role.

Why would they take McKeeva’s word for it that he had consulted the Financial Services Industry given McKeeva’s reputation ?

Why didn’t the opposition call an emergency meeting of the financial services industry to get there own feedback ???

Worthless bunch…..both parties !!!

The most important aspect of this proposal is to define Dormant Account as interpreted in the amended law. Then we will know its real benifit if any!

CNS maybe you can help with this.

Lastly, with all things relating to change there is going to be some snags, the question is how consequential are they and can they be fixed in order not to effect the greater good.

Isn’t CNS a news service not an attorney’s office? Maybe you could do a little bit of work yourself, find out where you can get a copy of the law (not too difficult), read it and let us know.

This law is atrociously drafted.

Any way Government what to "color" this picture to us, its stealing bottom line. Not everyone can afford to deposit money into their bak accounts weekly or sometimes monthly. Things being as expensive as they are here. I’m a Caymanian engaged to a US citizen only awaiting for the next year and a half until my daughter goes off to univeristy then I’m leaving this place. Not because I don’t love Cayman, I do. But the Government here only looking out to line their pockets and make the Caymanians and other people that live here suffer for their greed.

So call it what you want MLA’s it’s stealing in my book.

I thought the dormant accounts had to have had no change in value – but surely if they were earning interest, there would be an increase in time. Of course, the banks would have to be paying interest which is pitiful these days anyway…

So your latest incompetently-passed legislation now collapses and seizes SPVs and long-term investment products.

The international legal and financial communities carefully and painstakingly builds precise off-shore structures to use in the world of international high finance, and your Fearless Leader (perhaps brainless leader) lobs grenade after grenade into what we do, without so much as a "By the way…".

Enough is enough. See you in Luxembourg.

Dictatorship at its best.

This man does not have a lawyer friend obviously!

Not based on the decisions he’s making at a very fast rate.

where are those big hot shot lawyers he hired the other day are they collecting high salaries while he derails himself?

The Government has just invoked the law of unintended, though eminently predictable, consequences. The resulting damage to customers’ confidence in the Cayman Islands as a place to park their capital will cost us far more in the long run than the $10m gained by hijacking other people’s money. To a long-term investor 6 years is a short time. Banks are quite happy to lend money for 25 years for mortgages.

Kids!!!! Hide your piggy banks!!!!

Why is it that neither the banks nor the government have any interest in returning the money to their rightful owners?

Why is it that not a single voice in the LA is willing to stand up and say "publish the names of the account holders"?

Are times so hard that we (as a government) are willing to steal money from the rightful owner just because a bank has a post office box number that is no longer a valid address?

I say shame, shame, shame on all of them involved.

Have you even read the law? The banks have to try to contact the customers before doing anything, so if you keep your bank appraised of your current contact details you have nothing at all to worry about. Additionally, if funds are paid over to the Government and if the customers do eventually show up, they can recover their funds from the Government.

Names cannot be published because of the Confidential Relationships Law.

Hope that helps.

this make no sense at alll…of course efforts are made by the banks to identify beneficial owners and to make them aware of this particular government initiative. Which banker in his right mind would willingly turn over their capital/funding (in this case, customer deposits that the bank uses to lend to other customers and earn an interest margin) to the government? My point here is that the interests of the banks and government are not aligned in respect of this particular law. As to the suggestion to publish names, are you mad? Unless government are somehow indemnifying banks against potential claims arising from the banks breaching the Confidential Relationships Law as well as perhaps their fiduciary responsibilities to clients, a banker would be insane to publish this info. What purpose would it serve in any event (apart that is, from satisfying the public’s desire to meddle in a private person’s affairs)?

Sir / Madam – What about the deadline made between the FCO and the Cayman Islands Government to balance the country’s budget before 2014?

We are spending left-right and center, where are we going to get enough funds to prevent the UK from demanding we tax???

The Government does not want to shrink its size… and we will not see revenue from the projects any time soon at not yet until pass 2014… so money has to come from somewhere.

Caymanians don’t want tax! Taking money from dormant accounts is one out of many infamous option.

People please make up your mind what infamous one you want??? Money can’t grow on trees!

We want a lawful one.

I think people are a bit missinformed on this one.

1- The banks did say this was a very bad idea and raised all the issued the law was wrong on before passed. The Government simply did not listen. The consultation process is a joke, the government asks a week before promulgating, the banks answer within the week and the Government ignores all the comments.

2- The names are not listed because of the privacy law (wrongly called confidentiality law). Would any of you like to have the banks publishing in the paper your name with how much money you deposited? This is one of the biggest problems of this law.

They’ll simply do whatever they can to raise money and avoid doing what they need to do.

If I had a stronger option over thumbs up, I would click that! Please read this: the banks said this, the government did that! The people in charge either DO NOT HAVE CLUE or DO NOT CARE. Either way, we are f***ed!

" The names are not listed because of the privacy law (wrongly called confidentiality law). Would any of you like to have the banks publishing in the paper your name with how much money you deposited? This is one of the biggest problems of this law."

Amounts doesn’t need to be listed but I have a problem with names not being made known or contacting next of kin. For example if someone has has Alzheimers. Think this person would know their bank account numbers?

The only way tha tnames can be published without breaching the Confidentiality LAw ifs for a change to the LAw that would allow the publishing of the law .

Doesn’t the Government all over the world reap the benefits of Dormant accounts? Then why not Cayman? You all want Cayman to be like the rest of the world only in areas that suit you best!!!

Hmmm… our Minister of Finance pushes through legislation detrimental to our Financial Services industry. He’s in charge of Tourism and Development too? Is the goal here to disassemble everything that’s been created, returning the Cayman Islands to "the islands that time forgot"?

Every country is free to draw legislation, including that of claiming 1 million square miles in the Moon territory, however good old Cayman Commonsense should rule.

It is apparent that this money was not made in Cayman, but owners have been kind have the territory as the custodian of their monies through the Financial institutions, is this how you reward your customers?.

No one should be advised what to do with their hard earned money whether they keep it for 50 years or not. This law is so far fetched and just makes a fool of the spirit behind the Financial Industry in Cayman Islands.

There is nothing like a dormant account, one saves money for a rainy day which should not necessarily be in the limit of six years. A good question arises out of this; how much did the government consult on this law? the Charities Bill etc. We need serious people in that Legislative Assembly the current crop is just made of jokers, it is a case of impunity gone haywire.

They chicken out of laws that would threaten their self preservation such as the Environmental Law, This law will only create another hole to the deflating economy.

This is another Roll Over rule, they started with people leaving the country after 7 years which is okay because the territory belongs to the government, even pub owners say Management Reserves the Right to Admission.

However it seems that Roll over is so sweet, tempting and very contageous because it is creating ‘wealth maximization’ for government expenditure, such that they are introducing it to bank accounts. Where will they go next? Expats are still scared of the Community Enhancement Fee.

Most likely it will be houses bought by those who were rolled over, cars and other assets now that they have taken the money.

Caymanians be warned this mushroom will come back to haunt you, if expats flee like they have been doing the government will come for you,because the administration has to keep up the revenue to balance the budget.

The alternative is to allow the banks to whittle away the dormant monies by charging fees until it is all gone. Really are we arguing for protection of these banks? Don’t get me wrong, this law was clearly poorly drafted but it certainly provides a dormant holder a mechanism to re-claim all funds as opposed to having itdisappear through bank fees.

I guess "good old Cayman Commonsense" is not so common anymore!

As much as conspiracy theories are fun, they are not intelligent enough for something like this.

This is simply incompetence. The most concerning thing is that both parties look more and more the same…..

I agree. Most of what we see is not the result of some evil agenda, but simply a matter of elected officials being too stupid to know how to effectively carry out the functions of their office.

oops ! So my fixed deposit that sits and is rolled over automatically each month could be seized? Not a good message to be sending investors! Same goes for other instruments!

Better get busy re-writing then before this news is used to discredit us further. Then Pirates week will have a whole new meaning for Cayman.

How about getting busy calling for McKeeva Bush to resign.

The man has a list of grievious acts to be comitted against the people why not call his resignation in? That’s what real men and women do, sissys and little girls are scared. Alden, Kurt, Arden, Tony and Ezzard, What are you ?

A Premier that is ruining our financial industry should not be left alone to be leading the country into a ditch.

Alden you have a lot or mouth but because of your own selfishness you do not have the spine to CALL THIS MAN TO RESIGN NOR STAND BEHIND ARDEN MCLEAN IN HIS ATTEMPT. DID ARDEN LISTEN TO YOU AND KURT TALK HIM OUT OF CALLING FOR A NO CONFIDENCE VOTE IN THIS UDP LEADERSHIP. Yes you did him the samething you did Chuckie, Talk him out of marching! What a worthless set !

WE ARE REALLY TIRED OF BOTH OF YOU PARTIES. YOU ARE BOTH A LOST CAUSE!

Your last sentence answers your question. You are going to ask him to resign to replace him with what?

Unless we want to ask the man on the whitehouse on 7MB to take charge we better think twyce before asking for the anticipated removal of a Premier and the weakening of the embrionic democratic process.

"…and the weakening of the embrionic democratic process."

Let it die.

Were it a life form, labouring under the crushing disabilities that it does, we’d euthanize it out of a sense of simple mercy. Just let it die.

Direct rule will provide the stability that Cayman needs to recover in the decades to come. Democracy can be tried again in perhaps 25 years, giving the next generation its chance. This generation can’t cut it.

Definitely the man in the whitehouse on 7MB, he is down to earth, spends alot of his time in Cayman, mixes with the people, appears to be non-controversial and he is a gentleman. Needless to say he is also educated.

He rides in the front seat (rather than in the back) with his driver and they politely stopped in the road the other morning on the way to work to let me out. The bull in the china shop wouldn’t do that.

My vote goes to the present Governor!

He’s kinda cute too:)

I had a quick look at the law and it states "For fixed deposits, the dormancy period does not commence until after the fixed period expired." Now whether that covers a rolling deposit is probably one of those grey areas that they are talking about.

But even if its not covered the banks still have to send you a letter to tell you what they are doing and its a very good reason why you need to keep your details up to date.

Finally if that is not enough as long as you can prove who you are then you can claim the money back from Government.

Come on now, let’s not get stupid. How can a fixed deposit that ‘rolls over’ every month ever be considered dormant? The simple fact that it is ‘rolling’ or doing something every month, by definition then it could not be ‘dormant’. In the case of the banks (or this law) for it to be considered dormant, there has to be no change (up or down); no transactions, nothing for the period of time that they have determined, which I believe is 6 years in this case.

As expressed directly from the people responsible for the implementation and eforcement of this law a rolling time deposit is dormant after 6 years.

The law is not clear but that is their intention. Unless there is direct correspondance from the owner, new (not rolling) instructions of some kind or new money in or out, the account is dormant after 6 years

The future statue of the Premier in "Heroes Park" will bear the inscription, "FIRE, READY, AIM" and a list of all of the countries he visited at our expense, or maybe a list of the countries he didn’t visit because that would be much shorter.

more incompetence, flip-flops, u-turns…….direct rule please!

This bill and the Planning bill are examples of what happens when you do not have proper consultation and debate of all laws. They are still quietly trying to get the planning bill and regulations right, straightening out the errors caused by the private individuals that wrote the bill.

This bill as written could chase away investment and hurt or financial industry. I can see it now our new campaign to attract Financial business.

"Invest in Cayman where your money is safe for six years. Then it is Ours".

Yester Year – this was Islandwide support!

Now all of sudden, EVERYONE IS AGAINST IT!

Boy I tell ya…

No matter what you do, you can’t please everyone! I suggest the government move forward with this – we are on borrowed time. Now time to stop and deliberate for months on what to do about getting back money.

People were for the legislation because much needed funds would be raised for government AND because the Premier told us that the financial services industry had been consulted and were okay with the legislation. Now it appears that not only was the financial services industry NOT consulted but the legislation is having HARMFUL effects on the financial services industry. Minister Bush seems intent on killing the goose that lays the golden egg – in this case, the financial services industry. What is his REAL motivation?

No motivation, pure incompetence. Now incompetence on polititians I can almost understand and most countries need to put up with those (actors and musicians in the US, xxx actors in Italy and Brazil, etc.), but that is what senior civil servants are supposed to be there.

How can we still have the FS sitting there when he signed all communications on this law, when we still don’t haveGovernment accounts for several years, when Government supplyers are not paid, when the fiscal numbers change faster than the weather!

He is the prime example of why the private sector cryes for more accountability in the public sector. If he is not fired can someone tell me what do you need to do to get fired for incompetence in the public sector?

Actually, it was a clown in Brazil that was elected. And you asked one of the key questions that has never been answered: how can we still have the FS sitting there? Most of the current problems affecting the Cayman Islands locally should have been foreseen, seen, flagged, dealt with, mentioned, recognized, fixed by Kenneth Jefferson and yet NOTHING WAS DONE. Why is this man still collecting a paycheck paid for from the duties I paid? Goddamnit, this question deserves an answer!!!!!!!

Islandwide support?

It was rushed through the LA by MacKeeva, hardly islandwide support.

Getting back money? Was it yours to begin with?

Disgraceful and hugely damaging for Cayman’s reputation as stable politically and safe financially.

There is one important point that this article doesn’t address: who has lost their job as a result of this embarassing fiasco? Who is accountable??

Oh Oh! – the government has already spent the money on luxury travel. Now which fees are they going to raise?