Anti-tax campaign steps up

(CNS): Organisers of the Facebook group opposed to government’s proposal to introduce a tax on expatriate workers' earnings are stepping up the campaign and offering government other solutions. The group’s founders say there have been numerous suggestions from the community about how the targeted $76 million surplus budget can be achieved and they intend to collate the suggestions and submit them all to government as soon as possible. The group will also be videoing and documenting public opinion on Friday evening, which will be posted on the Facebook page to give people a chance to voice their views.

(CNS): Organisers of the Facebook group opposed to government’s proposal to introduce a tax on expatriate workers' earnings are stepping up the campaign and offering government other solutions. The group’s founders say there have been numerous suggestions from the community about how the targeted $76 million surplus budget can be achieved and they intend to collate the suggestions and submit them all to government as soon as possible. The group will also be videoing and documenting public opinion on Friday evening, which will be posted on the Facebook page to give people a chance to voice their views.

Eden Hurlstone and Nick Pitman from the group Caymanians and Expats United Against Taxation, which now has close to 11,000 members, said that after some people were cut short during Wednesday evening’s meeting with the premier in West Bay and others were too intimidated to talk, they wanted to offer everyone the chance to record their views on how they feel about the discriminatory proposal to tax work-permit holders.

They were particularly concerned about a woman who was asking valid questions and opposing the tax who was cut short by the premier when he referred to her as a "little girl" and told her to give the microphone to someone else. The group has located her and she will be the first of the vox-pops the organisers plan to record.

“We will interview her today at Heroes Square at 5:15pm,” Pitman said. “We are inviting everyone who wants their questions or points recorded on this issue to come along. We plan to post them on the Facebook page and to give them to the media and the premier. We are also creating a United Cayman video.”

Pitman said many people were upset by the way the meeting went on Wednesday and felt the premier had shown a disregard for those who did not agree with him, but the world was changing and he pointed out that there were now many more ways for the people’s voices to be heard.

“The old methods are failing,” Pitman said as he pointed to the power of social media and the fact that the younger generation of Caymanians were waking up.

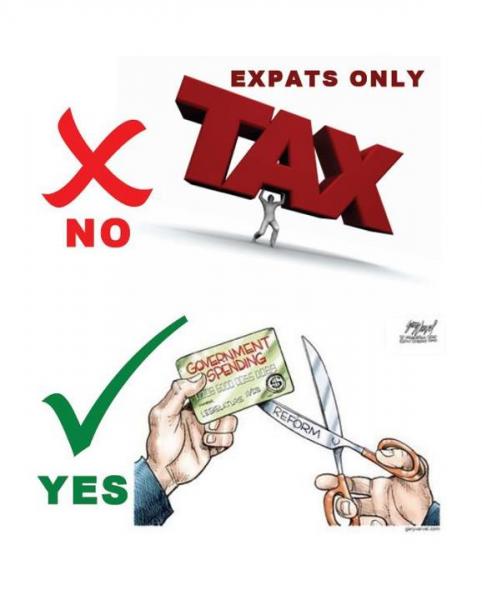

The group is now working hard in response to the premier’s invitation for people to submit solutions to come up with comprehensive and credible alternatives.

Speaking at his first public meeting on the proposed new tax on Wednesday evening, the premier said that if another source of revenue could be found, the government would not impose the so-called “community enhancement fee” as he said it was not a “desirable” option.

“If we can find an alternative that meets the revenue the United Kingdom says we must meet, then we have no problem,” he said, adding that the UK had imposed stringent parameters. He invited people to submit suggestions to the premier’s office for consideration, even though he has already sent the budget to London with the 10% expat tax on permit holders earning $36k per annum.

The Facebook group organisers plan to pull the alternatives together and present them to government on Monday before the evening’s rally, where these solutions will be discussed and displayed at the Heroes Square gathering.

“We need to approach this from as many angles as possible and present credible solutions on how government can raise the revenue it needs to meet the requirements set by the UK,” Hurlstone said. “Many solutions appear to have been posed and so far the premier has not explained why these numerous alternatives have all been rejected. If the community can demonstrate that there are other options, I feel the government will have to take note. It is quite clear from the reaction of the wider Cayman community that this discriminatory tax has virtually no support.”

The premier confirmed Wednesday that the tax will kick in at a rate of 10% on all work-permit holders earning $36,000 and above. Workers earning $35,999 will pay no tax but those that are salaried at $36,000 will pay $3,600 for the year, since the tax is not incremental.

Government has not yet answered all of the questions surrounding this new tax, which experts all say will be very difficult to collect, but what it has revealed so far is that it does not apply to any Caymanian or permanent resident. It is not clear, however, if it applies to key employees or those working in operation of the law. It does not apply to expat civil servants or any work-permit holder earning less than $36k.

It will be collected by the immigration department but government has not said when or how it will have to be paid. It will be on all remunerations earned by those who fall into the new tax-paying group, including bonuses and expenses. The legal requirement for employees and employers to pay 10% of salaries into a pension fund will now be removed. The premier claimed that eliminating this obligation would make the fee easier for employees to bear.

However, much of the opposition to the tax is not the actual issue of paying it. Most of those who oppose it are concerned about the inequality of the new direct tax and, in particular, the paradigm shift it represents for Cayman and the potential harm to the entire community.

Questions have also been raised about government failing to do the necessary research or analysis on the impact of the tax on the wider economy, the offshore sector or its sustainability, given it is targeting the country’s most transient group of workers.

Category: Politics

There must be consequences sufficient to clearly demonstrate to our community and the international community that this type of poorly considered thing will never happen again. If there are no consequences then confidence and calm will not return.

This is a response to the call for action from the big local families and their businesses.

We have been active in giving suggestions to the CIG.

We have been active in campaigning against this Tax.

As for policy, we have had to wait to see if this insane proposal was to come into effect.

We want to do whatever possible to keep our valuable staff, but the entire economy and all businesses (big and small) are under extreme pressure. There is only so much that a company can absorb.

In the case of retail to the local market, the additonal cost has to be passed on the the consumer. We don't want to increase the cost of living, but the margins that we all work on are very slim, so even a 1-2% change can make or break a business. We absorbed the work permit increases and this has hurt our bottom line. We could not absorb the 2% increase in duties, this had to been passed on. Adding the 10% tax, if we chose to compensate to keep our expat employees, this too would end up being paid for by the consumer. We have no other alternative. Costs can not be added in all directions and merely considered a "cost of doing business". There is only so much pressure that a business can take.

Some of the businesses that you mention have no ability to pass on these extra costs as they compete with the world market (not just local companies), so any increase in price takes away the fundamental advantage of being a travel retail destination. Many of these businesses are priced better than the US or UK retailers and this is why the tourists shop here instead of at home. Any increase in cost becomes a hit to profitability and I know for a fact that many of these businesses are having a tough time, so the expat workers would need to take this hit unfortunately as there is no other alternative.

Thank goodness it appears that this tax is no longer going through, but there will be some increase in fees to cover the overspending of the government (unfortunateyl rather than trying to cut costs it seems) as the end results would destroy Cayman.

So bear in mind that we should all keep the pressure on the Premier and CIG to cut costs rather than just examine new revenues. Any increase in costs will result, across the board, in and increased cost of living for everyone. Having said this, whether it it a 10% tax or not, you will take less to your savings unless we hold this government and the previous administration responsible for the waste.

It’s been scrapped!

The message from Cayman to Bush, from Caymanians & Expats alike, is clear and unequivocal:

United, Resilient, Angry: Cayman United No Taxation.

Why should my child pay your pension and health care for the rest of your life, she is not going to do it. Sharpen your fishing and gardening skills, you are going to need them.

CAYMANIANS

If you do not stand up and stop this man and the mindless UDP once and for all you will be effectively giving away the futures of many generations of Caymanians to follow. STOP THIS MADMAN.

This man could not even collect "garbage fees" of CI$100 per year for the best value service on the island being garbage collection at CI$1.00 per collect which was only ever paid by EXPATS.

He abolished garbage fees instead of collecting this tax.

He alows Ryan NOT to pay his taxes to the country.

He gives away 30 years of taxes to a multi billionaire Dart.

He waivers all taxes on Shetty.

He waivers all taxes on CEC.

He gives tax concessions to a multitude of other wealthy people and developers.

He has effectively given away the country's only earnings.

HE NOW EXPECTS EXPATS TO PAY FOR HIS GIVE AWAYS !

GOODBYE CAYMAN

Don't forget that he also gave away 3,000 status and kill the dreams and way forward for native Caymanians forever (where was the out cry then?) More expats have become Caymanians than more native Caymanians can every become expats. SO NOW NATIVE CAYMANIANS EXPECT THOSE THAT MUCH WAS GIVEN TOO, MUCH WILL BE DEMANDED FROM!

Native Caymanian with nowhere to go, who will eventually have to pay direct taxes if I want to or not.

THE TRUE PERSPECTIVE is we have a Dictator who consults no-one except himself and who does not have a high school diploma making a reckless decision to implement a discrimatory income tax on the very people who have absolutely no representation, rights or votes in the country and after he has given away the country's taxes and earnings to Dart for 30 years, Shetty, Ryan, CEC, and many others now wants and expects EXPATS to pay for the very shop he has given away. Does this sound like some-one of sound mind and clear thinking NO, this is a madman intent on destroying the country and Caymanians who stand by and allow this to happen are selling out the very futures of their children and grand children for it will take generations to correct the damge this man is doing to our country. SAVE CAYMAN and rid ourselves of this dictator and his blind UDP followers.

Hey! other than destroying families whether thru cancer or drunk related deaths, just how much revenue does alcohol & tobacco generates for the CI Gov.? A alcohol & tobacco tax could be introduced, or heavily taxing any existing one that's on the books is the possible way to go, I'll bet it's an astonishing figure

Here is a new game. Spot the Human Rights Commission. Can you see them? No, neither can I. As long as they block gay rights they are doing their job apparently.

As a Caymanian, I would pay the 10% if it applied to me since I'd be giving back to the country. I'm already contributing to the country by paying stamp duty on my new cars, house, customs duties on my furniture, clothes, and brand new 60-inch TV. So, although some may say that Caymanians are free from the "tax", most actually aren't free from it. No offence intended, but most work permit holders don't invest substantially in the country. PRs do, hence the reason they qualified for PR and that's why the "tax" doesn't apply to them.

On the other hand, there is the economic argument about Cayman's future. Who knows right?

Three certainties in life: 1. aging 2. death and 3. taxes.

PR with right to work = A type of guaranteed work permit. Hence tax would apply to them.

I am quite sure that expats pay the same duties and fees you do. Plus if they have children they have to pay to send them to private schools.

How about the houses they build and the rents that they pay. The rents help the locals pay their mortages and the land the fees sthat the land they buy goes to government.

WAKE UP….

Where is the Opposition?

Cowards!

The only thing the opposition can do to remove McKeeva Bush is by a vote of "no confidence". Is the second attempt being blocked still? You should be calling the UDP MLA's cowards. They made Mac premier, not the opposition and ONLY some of them siding with the opposition can remove him.

And where are the comments from the Kirkconnels, Thompsons, "Fosters", and Dart? I wonder if the government's public/private partner Dart supports the expat income tax? I'd like to ask the owners of Kirk Freeport, ALT, Fosters and the Dart corporation the following questions:

1) Are you going to take your expat staff out of pensions?

2) Are you going to subsidize the 10% tax in full or in part by giving your expat staff a salary increase?

I think the answers would be interesting.

Nobody likes too much Bush anymore! That was the seventies we in the new millennium now. Time to come clean man.

No matter what you think..I know one thing is for sure…

Confidence has been shaken and this will cause spending to drop…has anyone else notice people already running for the door?

I see them running every day straight of airplanes and onto the tarmac, thru immigration and for the door alright, out of the double doors of Owen Roberts airport and into the Cayman Isalnds seeking jobs and a better way of living.

I am surprised that we have not heard really any solutions from the PPM on this matter in the press, Not that I am a Mr. Miller fan but I have to “big him up” , Mr. Miller has spoken out and given some ideas some I agree with and some I don’t, I can’t believe I’m saying this but if the elections were today I would be voting for him… At this time in our history we need solutions. I have a few and have being preaching this for years:-

A majority of the posts are all about not having this TAX, giving example on we could charge more for Gov fees, this really is not the solution as the islands is already very expensive for Caymanians and Expats alike.

I believe we need to look at the following:-

Go out and collect all outstanding Gov fees i.e boat license fees, Trade & Business Licensing fees, I can’t recall the fee/fine but is was for derelict buildings and this came out some 2 plus years ago @ 25k per day, well the owner of the old Hyatt owner owes us 18million plus then. I am sure I’m missing a few

No we then have to look at cutting costs in the Government, I am really not sure where to start but here goes. Let’s say a Gov dept budget is 50 million a year, towards the end of year that gov dept has 5 million left you will see them go out and spend it, the next year theywill go out and ask for 60 million, and so on, so ,so on. We need to make the Senior managers in the CS responsible for this. If they submit a budget to the Cabinet say again for 50 million. The Cabinet ( Mac) should turn around and say no I’m going to give you 35 million. That’s it and you work with that….. if you can’t you FIRED!!!

We need to work on the Government Ministries and of course their expenditures, Travel around the world to some telecom conf. why, surely you can skype for free, if they are looking to sell something, I’m sure that company would fly here.

If this isn’t enough to make our short falls then we can look at increasing fees but no Income Tax.

Anyway, just a few ideas, which I am sure is going to go on deaf ears.

People, we can discuss the options to the not really tax thingy that is titled the “Community Enhancement Fee” or all the other options that can bring additional sustainable revenue into the government coffers. However, although I understand what the FCO wants from us, in that they want savings and additional income, I think if we simply press pause for a moment and look at this from a much more elementary view I think we can start to understand where the real problem lies. If we were to round off the numbers and say the budget is $600,000,000 (over half a billion, yes BILLION) dollars, and you divide that by say 50,000 people in Cayman, that comes to $12,000 of burden for every man, woman and child on this island.

So if we look at this from that same simplified view, given I have a family of 4 (My wife, my 2 kids and I). My burden is a total of 4 X $12,000 for a total burden of $48,000 per year!

$48, 000 worth of burden for a family of 4! What!!!!

I admit that this is a very simplified way of looking at it, and in fact it is much more complicated and sophisticated than that. As we do have work permit fees, and import duty, passenger fees from crew ships, planning fees… Now where it gets simpler again is that when we give away massive concessions for development we give away additional revenue streams, so the burden gets closer to the simplified example I used above.

We have seen the issues that arise when we implement our wants rather than understanding that often we can barely afford our needs. We must never lose sight of our responsibility for the future and that what we simply give away or accept today (no matter how hard we try) we can almost never get or give back tomorrow.

We need to understand also that over a half a BILLION dollars is an absolutely enormous amount of money for a geographically petite country, and equally so in reference to the density of our population. $600,000,000 is more than enough to run this country and have ample surplus to put us in the black in a relatively short amount of time. We MUST stop subsidizing entities that are mismanaged creating a net loss. We MUST hold accountable any and all department/authority heads that allow the value for money ratio to drop below what would be achieved in the competitive environment of the private sector. We MUST not allow our civil service to be used as a dumping ground for enabled individuals that cannot function in the private sector with their present skill sets, attitudes and expectations. We MUST empower those who will be displaced by the new requirement of accountability, we MUST understand that this is a cultural issue not and individual issue, this is a national issue not a nationality issue. We MUST not fail in moving forward on a road that is truly sustainable, that is truly empowering and one that is truly CAYMAN!

Make no mistake, the foreseeable future will be a rough road, but if we put together a sensible unified effort, and utilize all the resources Cayman has to offer, without prejudice of being here “via plane” or “pain”. We can make sure Cayman is a viable option for our future generations.

Just a stupid IDEA. Why not install tolls on the road corridors, which would assist in building or improving roads throughout the Islands. Start with 25 cents in either direction, which would equate to 50 cents per day per trip. The heavy equipment could be required to pay more.

There could be 2 gates coming out of West Bay and one or two from the Eastern Districts. The NRA information from the traffic counters can be used to estimate the validity of this suggestion and estimated revenue. Food for thought.

They need to take this up with the UK's FCO. What the hell are they thinking?

This biggest mistake that is going to be made here is including the PPM and Ezzard in this protest. Remember what happened when the OMOV made Ezzard their "poster child?" It became nothing more than a PPM vs UDp fight and caused further division. This group needs to keep the focus on the tax not on people. When personalities get involved it becomes political and nothing good comes from politics in my opinion.

Keep the politicians out and don't align yourself with any of them. Remember both of these parties are to blame for our mess today. Cozying up to any of them is wrong and this protest will fail.

Maybe this is not the right place to pour out my heart. But I can relate with the mother with two kids who comment below. I am Caymanian and my father is in the 60s. He cant get a job because of age discrimination and he has to rely on social services for food vouchers. He suffers from depression and is alike child again. He worries alot about food. I can't help him that much because I make no money and 99 percent of it is gone in mortgage, bill, and maintenance. So he need s reall money to keep him for each week. The food voucher is not transport money and phone topup that he need as well. I ask his friends as to whether they could chip in and help. He lives alone. But they dont have any money to give him. I am very tired and stress about it. I had to go the doctor to get sleeping tablets. Iworry so much about hisfuture. I feel like leaving th eisland, but I cant because I cant see me abandoning my father. Like the commenter below, I have this grave concern, what will hap[en when they stop giving him the food vouchers? I can never imagine they cut social welffare.My father will kill himself if they do. He has depression and is suicidal. People may take my comment for a joke, but they dont know how it is like to have painful belly without food, our go days without taking a shower, and having to use candle to light up his house which has rodents and infestation. Please Politicians I implore you do not take my father off the care he needs. He has been seven years without a job and if they take him off, it will cause me to have to take care of him like a child tat I have to spoon feed and that is very humiliating. I have to live, I have to work, and my love for my father is great, but I have anoter child to take care off. People think it is easy, but it is not easy having someone you love and your hands are short.

He doesn't want our suggestions. He does not believe in independent thought. He shoots down free speech on the radio, he tries to sensor what we write here on the opinion section of CNS, he endorses the sickening behaviour of his supporters yelling, clapping, threatening and talking over other community members and he tells the media that they are at fault for the world currently seeing Cayman in a bad light. He is not listening, he doesn't care. He is not really actively seeking participation from us, it's all just a save face exercise now. He is a law unto himself. Until we have a sheriff that will run him out of town, unfortunately this is what we are working with. And that is the point. I will be there on Monday to back the up and coming political leaders of this country. I will stand along side all the people of various backgrounds that make up our wonderful community on this island who have decided to act on their beliefs and opinions insteading of pretending they are for Cayman and its culture when it suits them, usually for profit. They will, I repeat, will have their turn at the microphone to ask questions and make suggestions in a peaceful and civilised manner. Mac can chose to listen or not but we will film it, we will place it on social sites like youtube so others can listen, really listen. I love Cayman! Peace.

you'll better hurry and submit your ideas it that would also save the govt workers!

I sorry no dis-respect intended but you say "lets unite"?, (an ad on ecay trade) When have we ever united? I have a question for everybody. Most, NOT ALL but most of the expats here don't even speak when we offer good mornings to them. And now that the government wants to imply these taxes, you want us to unit? I am sorry but that sounds like they need to use caymanians people like the use The Cayman Islands for their personal gane.

Listen I know this gornment is not perfect, none of them never are, but these Islands are in a mess and some one has to fix it, and this is what I am seeing from this administration they TRYING. ok maybe taxtion is not the way to go……..

But wait one hell of a mintue we are being TAXED people, what do you think licencing your car is? stamp duty? importion duty? just becasue the are not called "taxes" dose not mine they are not "taxes".

Anyways my point is, on face book a couple of days ago, I was reading the updates and came across one form the papermans coffee house (which is an exccellent place for coffee by the way) and the comments that Paul made, making some very awesome suggestions about putting a lottery sytem in place……….

Mr. Bush please take Paul's suggestions and use them cause if you do I promise you these Islands would have so much money you'll not know what to do with it.

Don't worry about the churchs and there members, because the members that sit in church on Sunday mornings and by 12:30 they walk out the church doors they on their cells calling to see what played.

Sorry this one Expat/Caymanian that will not join the mickey mouse club in front the AL building on the 6th of Aug, But where I will be is @ my house enjoying my family and Jamaica indapendants.

Premier McKeeva Bush is proposing that we contribute 10% of our family's income to a plan that will ultimately cause the erosion or collapse of the very financial sector that we depend on for our family's income. Admittedly, the thought of a 10% reduction to our income is disconcerting but what is far more upsetting are the long term consequences of this plan. My children were born here and I hope that they, along with all the other young people of these islands, have as good or even better opportunities than I have had here. Please give us the opportunity to participate in a plan that will create a bright and prosperous future for this country.

Spot on. With the addition that the proposal to discriminately tax the disenfranchised does nothing to address the bloated spending that is the root cause of the problem.

We're going to pay 10% of our income to a government without the slightest notion of fiscal prudence; that squanders money like it's going out of fashion. Despite all the recent tax increases, the UDP still cann't balance the budget. We may as well take the $ bills and flush them down the toilet.

Anyone got a history book Mac could borrow to see what happens when countries make moves that shake business' faith in stability and disallude the most transient population base? I lost mine and clearly they never got to "B" for "Bahamas" in grade 5…

MacNoodle "B" for Bahamas just to let you know that few Bahamians live outside of Bahamas and very, very few live in the Cayman Islands. They still live in a beautiful Country albiet they are an independent country. Their tourism product far out performs Cayman and a financial industry that now rivals Cayman (see article on CNS Viewpoints). Yes Bahamas did slow down to rebound in a far better position for their local population than Cayman and nothing is equal. For your information Bahamas is alive and performing quite well with its own people in control. Bahamians set the policies for Bahamas not anyone else and they are very proud of that fact.

Folks, talking about the UDP reviewing Alternatives. This just in from CayCompass:

"Cayman Islands Premier McKeeva Bush said Wednesday that his government has sent details of a $592 million spending plan to the United Kingdom’s Foreign and Commonwealth Office for approval.

Mr. Bush said he hoped UK overseas territories minister Henry Bellingham, who has overall responsibility for the Caribbean territories, would have a “favourable response” to the proposal – possibly by today (Friday). "

It is pretty much a done deal. The FCO has alreay breach so many rights against humanity. Say good bye to Cayman. Continue to march for your rights, but it looks like its a done deal.

Hi Sam

At a guess it is by no means a done deal yet…especially if it does not have the backing of the majority of the voters or other stakeholders, and more importantly the FCO.

There are already potential legal threats to this from many a source, and I for one am absolutely sure that both the Governor and the FCO will be looking to make sure any budget is watertight and LEGAL. This budget, without even seeing it, cannot be..it went from 10%, to 10% on sums over $20,000, to $30,000 to $36,000 in the space of hours..the homework is not done, it is just guess work. I cannot believe that the FCO does not understand that the economy will suffer more from this proposed idiocy, and revenues will fall instead of rise. The one thing the FCO is not, is stupid. They know the issues, they had to straigthen out Turks and Caicos from similar problems.

As I have written in another post, I am virtually convinced that what is happening is deliberate by Mad Macs. FCO could reasonably refuse the budget, and Mac will declare (as he already has) that the FCO, Governor and all are interfering without reason and he will declare independence, without the balloted support of the people. That would be illegal too, but at least finally the police would have a real reason to arrest him and make a charge stick!! And what a charge it could be! Treason!! The only hanging offence left in UK law.It might seem far fetched to some, but think about it…why else all this fuss about something that could be simply solved with the involvement of all stakeholders….why is he saying "he has done all he can", he has not done anything worthwhile. Bring it on. It would end this nonsense.

For me, it has now gone beyond just being about the income tax proposal, which I 100% believe is unfair and divisive. Since Wednesday night my main priority is all about Mr Bush himself and wanting him to step down as leader of this island before he does any further damage to the residents of this country and the culture of his people. He is arrogant and has an overly inflated favourable opinion of his abilities. Even knowing that he was being filmed for t.v. and broadcast on radio, he still could not reign in his childish impulses to be patronising and behave like a spoilt little brat by sitting down and refusing to answer questions from the community by himself like a real man and any other "leader" in the world would. Then again, it is obvious that he is horrible public speaker as once he deviates from the script written for him he resorts to immature words and phrases because he can't think intelligently on his feet. I guess we were all spared the embarrassment when Mr Anglin stepped up. I don't like either political party in all honesty. I wish there was an option to form a new party called something like, the United Cayman Party, which would include members of Cayman's brave young population that are currently stepping up to the plate showing the older lot of politicians how it is done as obviously they have learned nothing in 30 years on the job. The deal maybe done and I guess we will get to that bridge when we cross it. He might even have some other devious plan up his sleeve that we don't know about like others have suggested and hey this whole income tax thing could be ploy to confuse us and feel out how the community will react. But right now, not matter what the outcome, I think the majority of this population is united in one thing and that is calling for Mr Bush to step aside and do it now. Surely even the rest of his political party know that he is hurting them and their ideals. If they don't have an internal vote of "no confidence" and get him out sooner rather than later, it will take years to ever win back the support of voters for this party. I get angry every time snippets of Wednesday night flash into my mind. I feel sick every time I read a current news update in the paper. And my heart aches and breaks for Caymanians and those that have consciously decided to make this island their home because they are being misrepresented and abused by the one person who is suppose to stand up for them, care for them and protect them. Mr Bush you don't speak for me, my family or my friends. Please step down.

The FCO did not appoint the Premier of The Caman Islands, you (we) who Elected him are SOLEY responsible for the mess we have allowed him to put us in.

TAKE RESPONSIBILITY !!

I'm afraid it is more than us taking responsibility. The FCO and our government share in that responsibility by huge margins.

We deserve to request a full and complete accounting and balance sheet from the Finance Minister, rather than these dumbed-down media snippets. A proper Balance Sheet with footnotes and appendix.

The CIG is budgeting to expend $592mln (up about 20% since 2010) against revenue of $661.9mln (which includes 10% tax, does not factor 6-8% reduction in GDP). The civil service historically runs about $85mln. $50mln in undisclosed public construction projects, $23mln in "equity investments, and $33mln in undisclosed capital expenditures.

“But we can’t get rid of debt overnight and more so it need to be understood that this debt has resulted in the Cayman Islands government owning assets that we cannot afford,” Mr. Bush said, referring to two new government high schools now under construction and the new government administration building on Elgin Avenue in George Town.

The debt he blames on the PPM regime, stems from a 2009 loan with the UK for $275mln, which costs us <$30mln a year in interest payments. This is also the reason why all these years later we suddenly require the new payroll tax.

How does that amount of disclosure sit with everyone? Shouldn't we ask what he is doing with the other tens and hundreds of millions of dollars?!? Why is this tiny territory spending so much?

It should be public records available to anyone

When the books are unauditable as was in the case of First Cayman Bank, who knows what is in there.I hope the AG has a good forensic team!

This debt is a result from both PPM and UDP and goes futher back than that. No one can rule that both parties did what they pleased to win elections. It is the nature of parties to spend. This is what prominent Caymanians wanted, a two party system like Jamaica, and this is what they got. Since we adopted a two party system, we set the ground for the saying "divide and conquor," we set ourselves up

Go home and tell your governments in your countries that you will not pay taxes!

Tell that to IRS! lets see what happens.(LOL) lets see who is the boss.

Premier Bush is the Boss here, so settle down its for your own good.And don't make him mad, 'cause he knows exactly what to do with you.

Like what do you think he is going to do with me? I'd be interested to hear.

why every time things happen they have to use jamaica as an example i dont live cayman any more but if all the expat think like me its time to move on if you are in a country more than five years and dont achieve anything leave go some where else worst if people talks about you all the time ,dont be afraid to take a step ,stop limiting yourself to where you can go or what you can do about it,people who ar upset about the gov do something dont just talk,(jamaica) they block roads burn cars tyres and shut down streets till there voice have been herd ,you all know where the gov officials live stop them from going work shut down there main streets let your voice be herd all people have is talk no one has the guts to stand up and do some thing

He keeps harping on about the PPM loan being the problem – the 30M loan repayment out of 592M is less than 2% of the budget! Interest payments on that loan are NOT the cause of the currect budget crisis, overspending is.

How about breaking down into % all of the other HUGE expenditure items like accruing for pensions (if that is even being done), or any other major budget item.

Anyone find it ironic that giving away 10M from the slush fund is OK but paying interest on a loan for a new building which saves huge amounts of rent, electricity and water bills is not?

SMH……….

"Speaking at his first public meeting on the proposed new tax on Wednesday evening, the premier said that if another source of revenue could be found, the government would not impose the so-called “community enhancement fee” as he said it was not a “desirable” option." – I for one don't like this Premier nor the expat tax, but I hope Ezzard and Alden have alternatives other than proposing to cut civil servants and having more people unemployed. As a Caymanian, I love my people and my community, and if there is anything wrong with that, show the reasons why I shouldn't be upset to see my loves one unemployed and made into criminals because of layoffs and people taken off social benefits.

Asa expat, I can relate. I hope government finds a way by which everybody can be happy.

Wow! A true Polyanna. I thought they went the way of unicorns.

There is an enormous amount of revenue for this territory to cover expenses, obligation and live very well. The problem is accountability and disclosure. It matters very little which spendaholic is in charge when the boat leaks as it does. The common underlyer is that none of these bandits want to plug the holes as they bide their time for their turnat the trough.

Another source of revenue is…………..cutting expenses, which in turn is…laying off CIG people….which in turn is …….getting things done more efficiently…which requires education….

Then it will never happen here.

And therein lies the problem – an entitlement mentality. There are jobs all over but you have to be willing to suck it up and work them.

In the 70's, all the bartenders, wait staff, cleaners, etc in the service industry were Caymanian, today? Nearly none.

Do you know that many waitstaff take home hundreds of dollars a week in tips? Sales people the same in commissions. But you have to be happy, cheerful, smiling and genuinely interact like you enjoy your job to get the sales and tips. I give 20% or more at bars and restaurants for a pleasant experience… And for a poor experience, I won't goabove 10%.

Sorry if the truth hurts, but as one who has seen Cayman evolve in the last 30 years, I have experienced it first hand.

Now, the Bahamas on the other hand… Their population was flush and living high on the hog through banking, then came independance. When the banking industry evaporated as a resultin the 70's (read this really carefully) they were dropped on their a$$e$ overnight. It took a while but they sucked up their pride, went to school, and today, you can barely find a non Bahamian in the service indusrty. It might be worth really taking note of that last bit – if government stays the course, history will definitely repeat itself here in the next few months…

Cayman benefitted from the Bahamian migration, who's going to win when Cayman suffers the same through this poorly advised tax??

It's so ironic that the problem being created by the PPM administration now leaves them with no solutions.

I am very concerned that they have not suggested to revert back to the financial system that was working prior to their implementing the new one.

Also how could the UDP present slides at Wednesday's meeting showing the financials, when the system that we now have cannot produce any proper accounts?

unfortunately if this tax is imposed there will be a number of business that relocate leaving Caymanians in the private sector unemployed.

The correct link for Miller's proposals is Cayman Islands News Sorry for the error. Submitted by Anonymous (not verified) on Fri, 08/03/2012 – 16:38.

Nobody “makes ” anyone a criminal. People become criminals because thet decide that they can ignore the laws which are the foundation of our social structure – and that way Anarchy lies.

Geez …. and we wonder why people have this give me, give me attitude. Just stop spending on unnecessary things. Cut wherever you can until you are back on your feet. The government need to cut their out of control spending before they attempt to reduce the spending power of the expats.

How about an "ex-pat and tourists only" casino – loads of revenue here to be collected. Not being discriminatory here you understand but this way it safeguards certain people "wasting" their money!

That is a very discriminatory and offensive plan. are you saying that Expats and tourists can handle gambling but that Caymanians can't? I assume that there would be an exemption of the Premier we know how he loves to gamble!

It was meant tonge in cheek. As we know, the premier has been gambling with all of our money for years, yet this is meant to be a country where gambling is banned. I am not saying that Caymanians would not be able to "handle" gambling as you put it, however, my understanding is that many would not want it on the island nor to take part in it – therefore, by excluding some and only making others pay (hmmm, I seem to have heard these words very recently to) would just be a suggestion to generate revenue, that's all.

You will have to expand your "ex-pat" and "tourist" only definition to include "hornourable".

Can you imagine McKeeve being denied entry into the casino? DRAMA! BIG TIME!

Lol, then my idea would get the blame for more debt – don't tell me he'd bring his OWN money to play with lol!

"Source of funds to enter Mr Bush" – "my own personal of course, called the Nation Building Fund".

Can we please stop referring to it as the "community enhancement fee", and simply call it what it is: the "McKeva Bush Incompetence Tax".

Can you just imagine the offer letter;

We would like to offer you the position of ______ at a salary of $36,000 per annum. Once our offer is accepted, we would apply to the government for your work permit. When this has been approved, you will need to send us $3600 so that we can finalize your permit. Then you will be allowed to come to our country and work for us.

Pay to come work…. Not so sunny a paradise now is it?

Why people keep calling this island a Paradise with the stinky DUMP of enourmous proportions? North Sound is already polluted.

I bet expats feel like they have won the lottery when they get a nice job and tax free salary in the Cayman Islands. I wonder if your countries would welcome me (or any Caymanian) on a tax free basis. Unfortunately, paradise just got expensive like the Ritz Carlton but still better than a rose garden.

I personally know two Caymanians and their children who are currently in the UK with full welfare, house, do not pay tax and will do that for at least the next two years.

So yes, you would be welcome. The welfare, housing, free education, healthcare is extended to British Overseas Territories.

If you have a British passport, by extension of the Schengen agreement, you can travel and work in almost every country in Europe.

If you do not like this 'one sided' arrangement, I suggest you hand your British Passport back.

I don't think there is much this campaign can do now, but show the world that they oppose a tax. I believe government will push this through to the FO Minister Bellingham. It would be nice if the media powerhouses of the UK sensationalize this event and expose the Foreign Office and this government under them. The FO and this puppet government is in the business of destroying the goose that lays the golden eggs.

I am so impressed with the Young Caymanians. They are intelligent, well mannered, respectful and everything that the government is not. There is hope for the future of Cayman with this calibre of youth to lead.

I say, get together and form a party and run the island, show theold goats how it is done. You have the capabilities.

Yeh, they may be. But where are they? Hiding behind "Anonymous" name. Everyone knows everyone here, and intimidation and threats are real- remember 5 young people got shot within just a few days. I actually don't blame them for that. Not enough of them to make a difference on this tiny island of 20,000 Caymanians.

Don't worry, unlike my pedecessors, I am at university at the moment getting a degree before I go ahead and jump into politics. (It's not political science)

Have no fears, its not at the University of South West North Tampa; its a top 10 university in the UK.

So excuse me, if I haven't gotten involved yet.

I would be interested to know what Linda Evans says about all of this, given its her department being expected to collect these taxes? Was she consulted? Does she know? Does she (and ex HR professional herself) agree to this discriminatory tax?

As for Mac's complete disrespect for the young Caymanian lady, this is not the first time. I have seen him do this first-hand at a BT meeting in 2010:

http://centos6-httpd22-php56-mysql55.installer.magneticone.com/o_belozerov/31115drupal622/local-news/2010/11/09/ppm-criticises-mac-over-treatment-young-leader

Caymanians, is this really the kind of person you want leading your country?

Come on, they all got to do as their Dictator says, so she did not have to be consulted!

He is the Premier. It seems that, for now, Caymanians want this guy. This is, after all, a "democracy".

You see I am not against tax. Tax is what is needed to sustain a government. We are presently under an indirect tax system. We are paying taxes today. Work Permit fees, guess what that is – AN EXPAT TAX. It's called a fee, but it is a discriminatory tax! You can't patch it up and call it another name. The tax may not be direct but it is indirect and it may be called a fee, but the employer is paying directly into it, and at times, illegally, the employer deducts from the expats salary, the monies need to pay the fee. But Cayman Islands have taxes now and that the point I am making. I hope Opposition doesn't make this into a campaign against TAX – leave that to the facebook fans. I thinkthe issue that they should be focusing on, is the UK's response to government. How much more time will they give government to balance the budget? Will the FCO continue supporting the tax proposal made by government? Will they at least help instruct the government to make cuts? Instead of trying to win voters and oppose the UDP, will Opposition come now with solutions? So I hope that the issue of tax does not become political and we forget the real issue at hand here today. My two cent

The elephant in the room is still corrupt and incompetent spending.

Deal with it.

More revenue will simply encourage the corruption and incompetence.

The only sensible and sustainable way to fix things is to deal with the elephant.