Keynes no good for Cayman

(CNS): The premier has said that Keynesian economic policy is no good for the Cayman Islands because the country is too small. He said the theory that government can buoy up a flagging national economy during a recession with major projects may be suitable for the world’s larger economies but it was inappropriate for Cayman. Criticising the PPM for their approach to spending when they were in office as the recession began to hit, McKeeva Bush said the government has first got to be more fiscally prudent before it can inject money into the economy. Bush said that his government was creating the environment for the private sector to stimulate the economy.

(CNS): The premier has said that Keynesian economic policy is no good for the Cayman Islands because the country is too small. He said the theory that government can buoy up a flagging national economy during a recession with major projects may be suitable for the world’s larger economies but it was inappropriate for Cayman. Criticising the PPM for their approach to spending when they were in office as the recession began to hit, McKeeva Bush said the government has first got to be more fiscally prudent before it can inject money into the economy. Bush said that his government was creating the environment for the private sector to stimulate the economy.

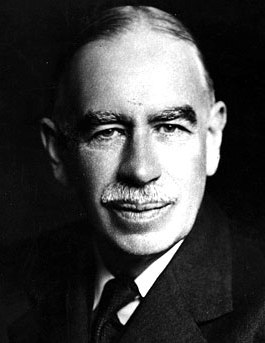

“It is okay for developed countries to choose the formula put forward by the great British economist, John Maynard Keynes, of increasing government spending during a recession, but this is not necessarily wise for small developing economies with fixed exchange rates, no large natural resources, little manufacturing, a deteriorating revenue base and, thus, limited capacity to borrow,” the premier stated in a clear indication of his government’s policy position.

“The growth of the national debt during the last PPM administration between 2005 and 2008 served to constrain our capacity to employ the Keynesian formula this time around. Given the evidence so far, we have made the right choices. We would leave the big spending to the big countries and act with fiscal prudence in the economic management of the Cayman Islands.”

He said that because of the action taken by the previous administration to keep on spending, leaving the country’s finances in a “very perilous state” nothing could be done by government to stimulate recovery until that situation was repaired. Quoting his Cabinet colleague and former accountant, Rolston Anglin, who said last year that in a free market economy a government has to listen and craft legislation to promote and protect the jurisdiction, Bush said he was adopting a more pragmatic approach, working with the private sector to create the wealth.

“When we therefore show that we have the guts to put our fiscal house in order, the right signals are sent to stakeholders in the international centres such as Washington, New York and London,” the premier stated, adding that the goal of his government was to depend on the private sector to boost the country’s economic fortunes.

“The government understands that the best strategy for achieving sustainable growth in the Cayman Islands’ economy is to inspire the private sector to do what the private sector does best — create wealth and generate jobs,” he said.

During the 2010/11 budget address Bush had placed a strong emphasis on partnering with the private sector to get out of the recession and he was continuing to do that to drive the economic recovery. He revealed that there will be no new borrowing by government over the rest of the political term and that each year government spending on capital projects would be limited to only $25 million.

Category: Business

Keynes was an idiot and those hanging on his every word are like cancer cells destroying the financial body of the world from within.

The lack of understanding of macroeconomics has now been put on paper for everyone to read. If the government was getting sound economic programming advice, from both the Freidman and Keynes models, it would be quite obvious that the slightly altered Keynes model is indeed the best suited for most countries, but most importantly for small countries. The Keynes approach promotes economic self determination for a county, something the Washington and London free market think tanks eliminate. Look as recently as last week. Ireland having to get a bailout to keep from defaulting on financing (given to them by large banks no more than a matter of years ago) now has to turnover all economic policy decisions to the EU, IMF, and World Bank, just to maintain the interest payments to the lenders. Now taxes will increase, government spending will be drastically reduced in a short amount of time. This hits the working class the hardest as goods and services become more expensive and they make less money. The number one economic policy becomes to maintain a balance of interest payments regardless of the soci-economic impacts.

This is not just in Ireland; this is almost all of the countries in the southern hemisphere that receive such funding. The total ‘free market’ theory described by Mr. Bush as the best way for Cayman, does nothing but take the economic self determination out of the hands of Caymanians and puts it into the hands of developers and financiers. If economic growth is controlled and administered as part of a long term economic plan, with input from all parts of the society, it creates more stable and long term economic growth. Only relaying on the market to create wealth just doesn’t work. Why? Because the market has no morals and treats humans as ‘labor capital’. It doesn’t take into account social impacts of economic practices because that does not create the most profits.

Keynes, nor Friedman’s, theories are fool proof. But if you look at the history of the Caribbean in particular over the past thirty years since Reagan created the OAS, multi-nationals have gotten richer and plight of the working class has reached the boiling point (See Jamaica, Haiti, Honduras, Puerto Rico to name a few) where the only way out is violence. As we can see from recent crime surges here, it is happening. The free market is leaving people by the wayside because they might not have as much ‘human capital’ as other people so they are ‘creating wealth’ the only way they can; violence.

To the best of my knowledge, there are two broad (macroeconomic theories) used to stimulate the market.

Keynesian economics is used in Fiscal policy focus, you know government spending, increasing size of civil service (all the UDP political-candidates-consultants etc), taxes (concessions).

Monetary policy focus will use money circulated, such as interest rate changes to stimulate the market.

So please tell me how the UDP hasn’t been using Keynesian economics. In my opinion, the ‘small’ business scenario should be taken step further….I keep hearing that is necessary to stimulate the economy or provide jobs. But that argument may be more appropriate for larger economies where the local people are the entrepreneurs Using their skills, professional qualifcation) and do not simply set up a small business and then improt all labour for that business.

Where are all the educated, well-informed consultanats?

The Premier is to be admired for his stance. Now he needs to make sure that the reality matches the rhetoric. So he must be deaf to siren calls from the private sector that Government should build, i.e. pay for, this or that piece of massive infrastructure. Equally, he must turn a deaf ear to populist FDR style "make-work" projects and government employment practices. If he truly succeeds in so doing, he will earn the well deserved gratitude of the nation.

There is a small problem with your point of view. As can be seen currently, the private sector in the US is returning to profitability but refusing to hire. Similarly, the banks are again making huge profits but, refuse to lend.

Furthermore, as the rich get richer, they do not spend and there is no "trickle down". On the other hand, someone making minimum wage will spend every last $ they make from a "make work" project.

As usual, we agree to disagree.

Sounds good Mac!

Keep the vision alive!

It is only the private sector that creates wealth! Government has always done a poor job at it!

:o)

If Mac doesn’t believe in Keynesian economics why is he introducing a Government stimulus package?

Mac is willing to give millions for roadside cleanup, and millions to the Development Bank that can then be passed on to keep failing businesses of UDP supporters alive for a few more months.

Mac just doesn’t want any visible evidence that government tried to stimulate the economy within a few months of it happening.

Interest rates are currently in the toilet, labour prices may have gone down slightly and the cost of goods and services has plummeted.. now is the time for Government to borrow out the @SS and SPEND! Government should not be spending on junkets and other endeavours that direct money out of the local economy, they should be investing in long term projects, mainly infrastructure. The schools should increase in pace, the GAB should be completed, roads should be built and upgraded, affordable housing should be developed, if we had public transport that should be strengthened, the hospital should be upgraded, the police force should be modernised, etc. Prioritise of course where they can get the "biggest bang for the buck", but INVEST.

Governments have the luxury of being able to go into greater debt than private sector organisations. When the economy is in a massive recession because the private sector isn’t spending the Government shouldn’t also clam up, they need to SPEND!

Intense Government austerity during a recession makes everything WORSE. Lip service to austerity and cutting back capital projects while continuing to overspend on frivolous and unethnical projects (first class travel, five star hotels, luxury meals, "perks", consultants, favouritism in tendering, Chief Officers sitting at home doing nothing) is downright suicide.

Check out this video for more: http://www.youtube.com/watch?v=go2bVGi0ReE&feature=player_embedded

Now Bush is an economist; the man is brilliant. Mind you only 17 days to go. That makes him a magician as well. Pity he cannot make himiself disappear.

The Public sector here could do their "job" very well if it didn’t need to pay so much of their hard earned profits to a government that does little to nothing in the way of earning their pay. Duty, fees, and all the other "taxes but not called taxes" go more toward paying for all the employable and non performing Government welfare system than any meaningful representation of private business interest. Just think for a moment what Cayman would be like and how much money could be used for a better Cayman future if all the wasted Government spending of the last 6 years were put into programs, schools, training, construction projects etc. instead of unaccountable and nothing to show for spending sprees that there is no record of even though vast sums of money was payed to many Government employees to do that very job. And it has not stopped. Current (leadership?) is a great example of what I am talking about. Grand Cayman will never get back to having a healthy private business economy until this problem is solved. Since those with the power to fix it are the very ones causing the problem the future of Cayman looks very grim.

Keynesian economics doesn’t benefit large countries either. It just prints money and devalues peoples’ wealth.

And yet the US economy is turning around, while Europe flounders and now turns to government stimulus as the Keynesian model has proved more successful than other measures. Go figure…

The US turn around is not due to the Government stimulus (just check where the funds went) but in spite of the stimulus.

hmm the turn around has nothing to do with the US Government stimulus? Well the employees & shareholders of GM or AIG or CitiCorp; or any number of other large corporations or banks might say something different.

Businesses of all sizes who were bailed out; or who were again able to get their lines of credit from banks (1) whose balance sheets were aided by being de-risked or (2) were able to again have confidence in the inter-bank money market, might say something different.

If not for the stimulus of the US Government there would be a whole different picture today – and one that is a lot more doom and gloom that we now face.

The stimulus has worked – the question is should more have been done. Many economists say yes.