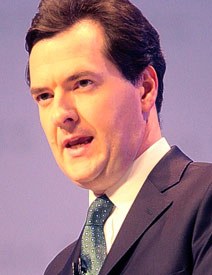

UK chancellor to review tax on multinationals

(FT.Com): George Osborne as expected to set out his stall on Monday for restoring Britain’s tax competitiveness with a consultation on a far-reaching overhaul of rules blamed for the departure of several multinationals in recent years. The Treasury will propose making the tax system more “territorial” by restricting its right to impose tax on profits earned in low tax jurisdictions, as part of a drive to make the UK “the most competitive corporate tax system in the G20”. The reforms to the “controlled foreign companies” rules, the anti-avoidance regime affecting foreign profits, are designed to stop companies moving their tax base out of Britain to countries with no CFC rules, such as Ireland.

(FT.Com): George Osborne as expected to set out his stall on Monday for restoring Britain’s tax competitiveness with a consultation on a far-reaching overhaul of rules blamed for the departure of several multinationals in recent years. The Treasury will propose making the tax system more “territorial” by restricting its right to impose tax on profits earned in low tax jurisdictions, as part of a drive to make the UK “the most competitive corporate tax system in the G20”. The reforms to the “controlled foreign companies” rules, the anti-avoidance regime affecting foreign profits, are designed to stop companies moving their tax base out of Britain to countries with no CFC rules, such as Ireland.

The Treasury is under pressure to make the reform of the rules radical enough to satisfy footloose companies while reassuring businesses that fear their taxes may rise to pay for the CFC changes.

Category: Headline News