Liquidators reach compromise over Madoff funds

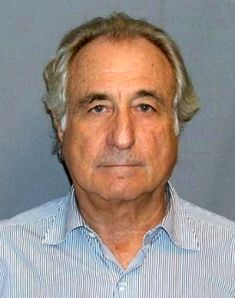

(CNS): The Joint Liquidators of the Fairfield Funds have reached a compromise with Irving H. Picard, the Trustee for the liquidation of Bernard L. Madoff Investment Securities LLC to resolve the matters in dispute between the funds and the trustee. Kenneth Krys and Joanna Lau of KRyS Global, said the settlement resolves the parties’ claims against each other, avoiding contentious, costly and uncertain litigation. Kenneth Krys, who is based in Cayman but, a licensed insolvency practitioner of the BVI and one of the Joint Liquidators of the Fairfield Funds, said the firm was very pleased with the result.

(CNS): The Joint Liquidators of the Fairfield Funds have reached a compromise with Irving H. Picard, the Trustee for the liquidation of Bernard L. Madoff Investment Securities LLC to resolve the matters in dispute between the funds and the trustee. Kenneth Krys and Joanna Lau of KRyS Global, said the settlement resolves the parties’ claims against each other, avoiding contentious, costly and uncertain litigation. Kenneth Krys, who is based in Cayman but, a licensed insolvency practitioner of the BVI and one of the Joint Liquidators of the Fairfield Funds, said the firm was very pleased with the result.

“These negotiations were hard given the significant issues between the parties and took significant time and resources to reach a conclusion,” he said. “We are of a view that the final result is very good for the stakeholders in the three Fairfield Funds. It provides certainty to stakeholders as to how recoveries will be received and allocated to the estates and will allow the Joint Liquidators to now focus their efforts and resources on recovery efforts rather than being hindered and diverted by the impact that the claims by the BLMIS Trustee may have on the Fairfield Funds’ estates.”

The BLMIS Trustee had filed a complaint in New York against the Fairfield Funds and other entities asserting that the funds were liable to the BLMIS estate for the monies Fairfield Sentry withdrew from BLMIS in the 6 years before December 2008, totalling in excess of $3 Billion.

In turn, Fairfield Sentry had filed customer claims against the BLMIS estate pursuant to the Securities Investor Protection Act, which, based on the method for calculating such claims as employed by the BLMIS Trustee and as approved by the U.S. Bankruptcy Court, total approximately $1.2 billion. The BLMIS Trustee asserted, under applicable provisions of the U.S. Bankruptcy Code, that Fairfield Sentry’s claims should be disallowed unless and until it satisfies its entire liability to the BLMIS estate.

However the settlement resolves these issues and provides a structure that enables the Joint Liquidators and the BLMIS Trustee to work jointly and cooperatively recover assets to enhance their respective estates for the benefit of the stakeholders.

In a statement about the compromise officials said the general terms of the settlement are such that certain pools of litigation recoveries that are pursued by the Joint Liquidators of the Fairfield Funds and the BLMIS Trustee will be shared depending on the nature of those pools and other factors.

“In addition to the agreement to share these assets, the Joint Liquidators of the Fairfield Funds and the BLMIS Trustee will work together to cooperatively maximize the assets that are recovered for the benefit of their respective estates,” it said.

Pursuant to the agreement, the Joint Liquidators will pay $70 million from Fairfield Sentry’s account to the BLMIS Trustee, and in exchange the Trustee of BLMIS will allow a customer claim of Fairfield Sentry in the amount of $230 million. The Joint Liquidators will receive the principal benefit of litigation recoveries from third party service providers of the Fairfield Funds, with the exception of a smaller share of recoveries from claims against their former investment manager and affiliates thereof – the Fairfield Greenwich Group and certain affiliates – which claims will be assigned to the BLMIS Trustee.

With respect to the recoveries of redemptions from the Fairfield Funds which are being pursued by the Joint Liquidators and the BLMIS Trustee, the Joint Liquidators will receive from 85% to 40% of such recoveries for the benefit of the Fairfield Funds’ estates, depending on the nature of the claim.

The agreement is subject to approval of the U.S. Bankruptcy Court for the Southern District of New York and the Eastern Caribbean Supreme Court in the British Virgin Islands.

The Liquidators acknowledged the efforts of the BLMIS Trustee, Irving Picard, and those of his counsel at Baker Hostetler LLP — particularly Thomas Long and Mark Kornfeld — in reaching this important settlement.

Category: Finance