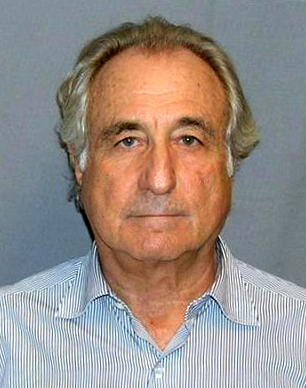

Funds and banks pile into madoff claims

(Reuters): Hedge funds and banks are piling into the secondary market for claims against Bernard Madoff, buoyed by the trustee’s success in recouping victim’s cash, one of Britain’s biggest hedge fund market makers said.The price of holdings in Madoff "feeder" funds such as Fairfield Sentry and Kingate has risen to 7 or 8 cents on the dollar from 1 or 2 cents six months ago on the secondary market, while buying a bankruptcy claims from a direct investor with Madoff can cost 30 or 40 cents."In the last three months it has increased dramatically," said Neil Campbell, head of alternative investments at brokerage Tullett Prebon, which makes a market in these stakes.

(Reuters): Hedge funds and banks are piling into the secondary market for claims against Bernard Madoff, buoyed by the trustee’s success in recouping victim’s cash, one of Britain’s biggest hedge fund market makers said.The price of holdings in Madoff "feeder" funds such as Fairfield Sentry and Kingate has risen to 7 or 8 cents on the dollar from 1 or 2 cents six months ago on the secondary market, while buying a bankruptcy claims from a direct investor with Madoff can cost 30 or 40 cents."In the last three months it has increased dramatically," said Neil Campbell, head of alternative investments at brokerage Tullett Prebon, which makes a market in these stakes.

"We’ve had these positions on our books for two years, and two years ago you couldn’t get a price. Up to six months ago it’s been one or two cents in the dollar, as optionality, but now it’s become more serious because there’s more competition," he told Reuters.

The secondary market in hedge fund stakes has been growing in recent years as investors look for ways to cash out of funds that have locked up clients, while specialist buyers prepared to wait for their gains hunt for a bargain.

Category: Business