Business

Business

Welcome mat out for property owners and business

(CNS Business): A number of changes to the immigration regulations are expected to make life easier for wealthy visitors, business people and property owners coming to the Cayman Islands. Policy directives that were recently approved by Cabinet will allow business travelers to remain in the country for up to 10 working days without the need to obtain a work permit and allow those who own property in the Cayman Islands and can demonstrate their wealth to stay for up to six months without having to check in with the immigration department for visa extensions. The directive announced in October was published on the government’s Gazette on Friday. (Read more on CNS Business)

Treasure in short supply as resort goes bust

(CNS Business): The future of one of Grand Cayman’s long standing resorts is in jeopardy after receivers were appointed last week to deal with Treasure Island. Restoration Cayman Ltd, the company that owns the 280-room resort on Seven Mile Beach in the heart of the tourist district, has gone into receivership in the face of serious financial problems. According to a release from the local firm Zolfo Cooper, which provides corporate advisory and restructuring services, its partners, Tammy Fu and Eleanor Fisher, have been appointedas joint receivers of the struggling company. Read more on CNS Business

(CNS Business): The future of one of Grand Cayman’s long standing resorts is in jeopardy after receivers were appointed last week to deal with Treasure Island. Restoration Cayman Ltd, the company that owns the 280-room resort on Seven Mile Beach in the heart of the tourist district, has gone into receivership in the face of serious financial problems. According to a release from the local firm Zolfo Cooper, which provides corporate advisory and restructuring services, its partners, Tammy Fu and Eleanor Fisher, have been appointedas joint receivers of the struggling company. Read more on CNS Business

RBC shutting down Caribbean wealth management

(CNS Business): The Royal Bank of Canada is pulling out of the wealth management business in the Caribbean, a decision that will impact Cayman jobs though the number of workers that will be hit has not yet been confirmed. This is the second Canadian bank with branches in the Cayman Islands that appears to be cutting its losses in the region after Scotiabank confirmed the closure of 35 branches in the Caribbean, with a potential loss of over 500 jobs. A spokesperson from Royal Bank’s Canadian HQ told CNS via email that the decision by that bank would not impact retail operations here but that RBC Wealth Management is “realigning” businesses within its international operations. Read more on CNS Business

(CNS Business): The Royal Bank of Canada is pulling out of the wealth management business in the Caribbean, a decision that will impact Cayman jobs though the number of workers that will be hit has not yet been confirmed. This is the second Canadian bank with branches in the Cayman Islands that appears to be cutting its losses in the region after Scotiabank confirmed the closure of 35 branches in the Caribbean, with a potential loss of over 500 jobs. A spokesperson from Royal Bank’s Canadian HQ told CNS via email that the decision by that bank would not impact retail operations here but that RBC Wealth Management is “realigning” businesses within its international operations. Read more on CNS Business

Bank remains mum on local job losses

(CNS Business): Following the announcement last week by Canada’s Scotiabank that it will be closing some 35 branches in the Caribbean region, with a potential loss of over 500 jobs, it is not clear how many of them will be in the Cayman Islands. Ahead of its fourth quarter earnings announcement next month, the bank said that due to the prolonged economic recovery and continued uncertain outlook it was restructuring in order to improve the speed and quality of service, to reduce costs and to achieve greater operational efficiencies but it has not yet revealed where the cuts will be. A spokesperson for the bank told CNS that the assessment of the downsizing was not yet complete and would not say if any of Cayman’s three branches would be effected. Read more on CNS Business

(CNS Business): Following the announcement last week by Canada’s Scotiabank that it will be closing some 35 branches in the Caribbean region, with a potential loss of over 500 jobs, it is not clear how many of them will be in the Cayman Islands. Ahead of its fourth quarter earnings announcement next month, the bank said that due to the prolonged economic recovery and continued uncertain outlook it was restructuring in order to improve the speed and quality of service, to reduce costs and to achieve greater operational efficiencies but it has not yet revealed where the cuts will be. A spokesperson for the bank told CNS that the assessment of the downsizing was not yet complete and would not say if any of Cayman’s three branches would be effected. Read more on CNS Business

Shippers club worries local retailers

(CNS Business): Cayman’s local shipping lines appear to have joined the Caribbean Shipowners Association (CSA), which local retailers fear will lead to future price hikes that will have to be passed on to customers. Some local merchants and wholesalers have raised concerns that with Hybur, Seaboard Marine and Tropical Shipping all joining the association and with no anti-trust laws in Cayman, they will be able to set rates that will hold importers to ransom, especially with peak seasonal hikes. Traders are now being told by the local shipping lines and their agents that they must now direct their shipping needs to a central person in Miami. Read more on CNS Business

(CNS Business): Cayman’s local shipping lines appear to have joined the Caribbean Shipowners Association (CSA), which local retailers fear will lead to future price hikes that will have to be passed on to customers. Some local merchants and wholesalers have raised concerns that with Hybur, Seaboard Marine and Tropical Shipping all joining the association and with no anti-trust laws in Cayman, they will be able to set rates that will hold importers to ransom, especially with peak seasonal hikes. Traders are now being told by the local shipping lines and their agents that they must now direct their shipping needs to a central person in Miami. Read more on CNS Business

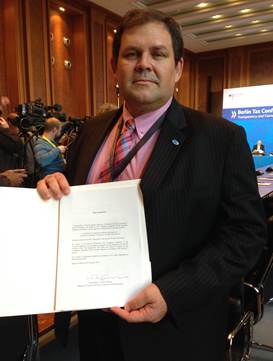

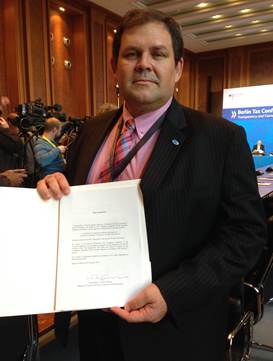

Panton signs latest global information exchange deal

(CNSBusiness): The Cayman Islands government joined more than 50 countries Wednesday, when it signed the latest agreement to tackle global tax evasion. Wayne Panton, the financial services minister, signed on the dotted line of the OECD’s Multilateral Competent Authority Agreement (MCAA) in Berlin, the latest worldwide standard for automatic exchange of information (AEOI) among tax authorities. “For Cayman to sign the MCAA is a logical progression in our longstanding international cooperation efforts, and we are pleased that so many countries and jurisdictions are now part of this worldwide effort to fight tax evasion via a global standard, across borders,” Panton said. Read more on CNS Business

(CNSBusiness): The Cayman Islands government joined more than 50 countries Wednesday, when it signed the latest agreement to tackle global tax evasion. Wayne Panton, the financial services minister, signed on the dotted line of the OECD’s Multilateral Competent Authority Agreement (MCAA) in Berlin, the latest worldwide standard for automatic exchange of information (AEOI) among tax authorities. “For Cayman to sign the MCAA is a logical progression in our longstanding international cooperation efforts, and we are pleased that so many countries and jurisdictions are now part of this worldwide effort to fight tax evasion via a global standard, across borders,” Panton said. Read more on CNS Business

CEC says physical campus ‘soon come’

(CNS Business): The development of the Cayman Enterprise City campus will be underway before the end of 2014, the management team told CNS Business Wednesday. Despite the numerous false starts for the project to find the right location at the right price, Charlie Kirkconnell, the CEO of the special economic zone, said CEC is committed to developing the physical zone as well as marketing the virtual one. With over 120 tenants in leased buildings around George Town and an estimated 300 potential new tenants, Kirkconnell said the development of the campus is essential to the future success of the zone and the developers have every reason to press ahead not avoid the project. Read more on CNS Business

(CNS Business): The development of the Cayman Enterprise City campus will be underway before the end of 2014, the management team told CNS Business Wednesday. Despite the numerous false starts for the project to find the right location at the right price, Charlie Kirkconnell, the CEO of the special economic zone, said CEC is committed to developing the physical zone as well as marketing the virtual one. With over 120 tenants in leased buildings around George Town and an estimated 300 potential new tenants, Kirkconnell said the development of the campus is essential to the future success of the zone and the developers have every reason to press ahead not avoid the project. Read more on CNS Business

SMEs swamped with myriad business challenges

(CNS Business): The high rate of duty, problems of bad debt, the black market, training challenges, as well as the cost of doing business were just some of the issues that small business owners said they are struggling with at a special session at the Chamber of Commerce last week. A representative from an arm of the European Union looking to spend as much as EUR15 million in the overseas territories helping the small business market told guests at the event that the money could be used to promote any number of projects, initiatives or advocacy programmes relating to small enterprises but it was an “on demand project” and down to locals to decide what they wanted. Read more on CNS Business

Tourism sector wants airport before port

(CNS Business): Many stakeholders in the tourism industry are calling for the Cayman Islands government to place more emphasis on the airport development and runway expansion, as opposed to focusing on developing the proposed cruise port. Much of the public discourse in the islands had surrounded the issue of a cruise berthing facility on Grand Cayman as a means of improving the tourism product and increasing trade. However, according to restaurateurs and water sports operators, this might be the wrong way around. They argue that cruise numbers are already robust and the airport should be the priority while improving the tendering process before eventually developing the port. Read more on CNS Business

(CNS Business): Many stakeholders in the tourism industry are calling for the Cayman Islands government to place more emphasis on the airport development and runway expansion, as opposed to focusing on developing the proposed cruise port. Much of the public discourse in the islands had surrounded the issue of a cruise berthing facility on Grand Cayman as a means of improving the tourism product and increasing trade. However, according to restaurateurs and water sports operators, this might be the wrong way around. They argue that cruise numbers are already robust and the airport should be the priority while improving the tendering process before eventually developing the port. Read more on CNS Business

Civil service bank accused of twitter leak

(CNS Business): A local activist who is well known for not taking what she sees as wrongdoing lying down has filed an official complaint with both the Royal Cayman Islands Police Service and the Cayman Islands Monetary Authority after details of her personal finances were ‘tweeted’ by a local bank employee. Sandra Catron is taking on another battle after a teller at the Civil Service Association Co-Operative Credit Union referred to confidential issues about her loan with the bank as part of a recent twitter thread about Catron’s exposure of two girls in an after-hours nightclub sex romp. Catron has said she is furious that the incident happened but even more incensed that the bank has taken the accusations so lightly. Read more on CNS Business

(CNS Business): A local activist who is well known for not taking what she sees as wrongdoing lying down has filed an official complaint with both the Royal Cayman Islands Police Service and the Cayman Islands Monetary Authority after details of her personal finances were ‘tweeted’ by a local bank employee. Sandra Catron is taking on another battle after a teller at the Civil Service Association Co-Operative Credit Union referred to confidential issues about her loan with the bank as part of a recent twitter thread about Catron’s exposure of two girls in an after-hours nightclub sex romp. Catron has said she is furious that the incident happened but even more incensed that the bank has taken the accusations so lightly. Read more on CNS Business