Cayman comes 4th in secret financial centres’ league

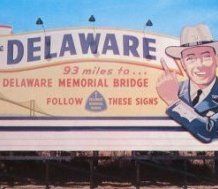

(CNS): A new league table measuring the secrecy of onshore as well as offshore financial centres, has listed the Cayman Islands as number four on its list of 60 jurisdictions. However, Delaware, the US Vice President’s home state, has taken the top spot and the City of London is only one spot behind Cayman in fifth place. In the first ever detailed ranking of the world’s financial hubs, Delaware has been found wanting in 11 out of 12 secrecy indicators making it the world’s most secret place to do business.

(CNS): A new league table measuring the secrecy of onshore as well as offshore financial centres, has listed the Cayman Islands as number four on its list of 60 jurisdictions. However, Delaware, the US Vice President’s home state, has taken the top spot and the City of London is only one spot behind Cayman in fifth place. In the first ever detailed ranking of the world’s financial hubs, Delaware has been found wanting in 11 out of 12 secrecy indicators making it the world’s most secret place to do business.

The report and league table, a joint effort by Christian Aid and the Tax Justice Network, which will be published on Monday, comes rather ironically in the wake of Michael Foot’s report on the UK’s crown and overseas territories which recommends they all increase transparency — despite the fact that all of the other jurisdictions (with the exception of the Cayman Islands) in this report are listed as more transparent that the UK’s own financial centre.

This new league table also comesat the start of a week when the new tax haven abuse bill is expected to be brought before the US congress and before the next G20 finance ministers’ meeting in Scotland.

The opaque nature of the east coast state of Delaware, home to half of all America’s quoted companies, which has now been given the title of the world’s most secret financial sector, is seen as America’s weak link in its fight against tax evasion, the financing of terrorism and drug money laundering. Both the FBI and the Financial Action Task Force, the high-level international body set up to combat money laundering and terrorist finance, have repeatedly expressed concern at the way some US companies use the state as a base from which to operate under their radar.

According to the report, Delaware fails to place on public record details of trusts, company accounts and, crucially, the identity of beneficial owners – the people who receive the profits. It also allows companies to relocate to other countries, leaving minimal trace.

John Christensen, director of the Tax Justice Network and one of the authors of the report, said that secrecy is a core feature of the global financial system. “Jurisdictions compete with each other to provide it, in order to attract financial flows. But this comes at a price. Financial secrecy provides cover for money laundering, tax evasion and avoidance, insider trading, terrorist financing, embezzlement, Ponzi schemes, illicit financial flows, fraud and much more," he observed.

Speaking to the UK’s Observer, Delaware’s assistant secretary of state, Rick Geisenberger, said that companies did not choose the state for secrecy but for the sophistication of its judicial system, a similar and persistent claim made by those working in Cayman’s own financial sector.

The Financial Secrecy Index reportedly took 18 months to compile and was researched by academics as well as accountants. It uses findings from the Financial Action Task Force and 12 key indicators involving bank secrecy rules, disclosure of beneficial ownership and trust law. The only financial privacy indicator on which Delaware scores positively is that it is party to a large number of international tax information sharing agreements, but this is because those agreements are signed by the United States.

Given the criticism Cayman has faced recently from the US and the UK, the fact that Delaware is top of the table and the City of London one place behind may be ironic in itself but the fact that Cayman is on the list at all has drawn derision from Cayman Finance Chair Anthony Travers.

"Anybody who claims to have evidence that Cayman is opaque hasn’t read the IMF and Financial Action Task Force reports nor the US version from the General Accountability Office,” Travers told the Observer. He said the report had a selective bias and was totally discredited, and will be seen as such by everybody in the financial world.

He went on to tell CNS that the extent of the blatant double standard the Cayman Islands Financial Services Industry has been subjected to was revealed in the Observer story, which he said highlighted the opacity of Delaware. “Those who have expressed doubt about the reach and effect of the Cayman Finance public relations initiative should note that our comment is now sought and included with due prominence. TJN will be dismayed that their “report” has been met by the leading UK press with appropriate scepticism.”

Regardless of how the report will be received, The Tax Justice Network Director has said he believes the secrecy jurisdictions listed have driven the neo-liberalisation project that has skewered financial markets and turned them into criminogenic markets. “They can attract capital with no questions asked. What this reveals is the massive hypocrisy of OECD states," John Christensen claimed.

The author also noted that London’s Square Mile had been placed on the list because of its sheer size and vulnerability to financial crime. However, its poor standing will come as a blow to the UK government, which has been attempting to reverse the City’s reputation for light-touch regulation in the wake of the financial crash. The report’s authors also stated that the UK bears responsibility for pushing its overseas territories and dependencies down the route of offshore banking and finance, and should be considering a long-term subsidy to help them reshape their economies.

The report reveals that half of the world’s most secret jurisdictions are located in Commonwealth countries, crown dependencies or British overseas territories, and the UK’s support for financial secrecy globally has been substantial.

Explaining to the Financial Times how the authors reached their conclusions, Christensen said the index outlined how financial markets have secrecy at their core. He added that the rankings were made by giving each of the 60 centres an “opacity score”, which was weighted according to the jurisdiction’s significance in the world financial system.

Delaware emerged as the runaway winner, with the City of London’s size putting it in fifth place, Cayman came in fourth and Bermuda seventh. European nations fare badly as well, with Belgium and Ireland as well as Luxemburg and Switzerland in the top 10. Singapore, a jurisdiction that th Leader of Government Business McKeeva Bush has said he would like Cayman to imitate, came in eighth place.

Category: Business

4th ? Thats it ? After all the international BS. All we get is 4th?

MAN the US beat us with 1st place… at least we beat out London…even if only be 1 place…

Delaware? Does Delaware have palm trees and beaches? How cold does it get in Delaware? This is an important financial consideration, can i wear flip flops in Delaware?

Where is Delaware?

It’s just north of Underware!

Delaware is a lot further north than I thought I found photos of Delaware beaches and they aren’t very ahh beachy. But you can wear flip flops there, but according to local custom.. not in the snow.

It’s a secret.

Well done one and all. It’s a team effort.

Oh, you say it’s a league of shame. Oh dear.

Don’t worry about it. It will only be of interest to readers of the "Guardian on Sunday" (The Observer) and they are idiot socialists.

Barak Obama should state this in his next "state of the union address" instead of meddling with the Cayman Islands who is internationally recognized as a well regulated financial centre. Imagine, Obama’s own second in command (VP Joe Biden) home’s state of Delaware USA, is at the top of this list.

Likewise, the UK should do something similarly instead of "beating the "Cayman Islands" over it’s head every opportuity it gets.

Ohhhhhh, such Hypocrites.

Ahhhhhh blame it all on the "New World Order" I guess.