Archive for November 9th, 2009

EU fund directive slammed

(Reuters): A report for the European Parliament attacked a proposed EU directive to regulate hedge funds as "poorly constructed, ill-focused and premature", in a blow for lawmakers who have demanded tough rules for the sector. The impact assessment by Europe Economics said there was a "strong case" for additional regulation but said "the rationale for a directive of this form is weak". The report was commissioned by the European Parliament’s Committee on Economic and Monetary Affairs. The report is a setback for supporters of the directive, which has come in for heavy criticism by the hedge fund industry.

(Reuters): A report for the European Parliament attacked a proposed EU directive to regulate hedge funds as "poorly constructed, ill-focused and premature", in a blow for lawmakers who have demanded tough rules for the sector. The impact assessment by Europe Economics said there was a "strong case" for additional regulation but said "the rationale for a directive of this form is weak". The report was commissioned by the European Parliament’s Committee on Economic and Monetary Affairs. The report is a setback for supporters of the directive, which has come in for heavy criticism by the hedge fund industry.

Lawyers fly offshore flag in New York

(CNS): Lawyers from Conyers Dill & Pearman were promoting the advantages of offshore financial centres and pointing out the main difference between them and tax secrecy jurisdictions last month at an important seminar in New York. Over 100 lawyers and financial executives heard how the leading international financial centres in which Conyers operates have emerged in the post economic melt down world as those able to enact innovative legislation with sound financial regulation meeting the standards of international bodies, including the OECD and G20. (Richard Finlay, Managing Partner Cayman)

(CNS): Lawyers from Conyers Dill & Pearman were promoting the advantages of offshore financial centres and pointing out the main difference between them and tax secrecy jurisdictions last month at an important seminar in New York. Over 100 lawyers and financial executives heard how the leading international financial centres in which Conyers operates have emerged in the post economic melt down world as those able to enact innovative legislation with sound financial regulation meeting the standards of international bodies, including the OECD and G20. (Richard Finlay, Managing Partner Cayman)

The firm said that a panel of Conyers lawyers provided an in-depth look at the state of the market and the impact of the credit crunch on legal systems in the major jurisdictions of the Cayman Islands, British Virgin Islands, Bermuda and Mauritius.

Richard Finlay, Managing Partner of the firm’s Cayman Islands office, discussed developments in this jurisdiction. “Cayman has modernized its partnership legislation in response to the increased use of exempted limited partnerships by private equity and hedge funds,” he told the audience.

“Also, we are pleased to report this quarter that for the first time since 2008, there has been an increase in the number of funds being licensed in Cayman. Another important development isthe admission of

Robert Briant, Managing Partner of the firm’s BVI office, drew important distinctions between offshore financial centres and tax secrecy jurisdictions. “The jurisdictions we advise on are tax neutral locations that facilitate international cross-border transactions. Bank secrecy jurisdictions facilitate the confidentiality of one’s affairs. The difference could not be more stark,” he added.

“Each of our jurisdictions plays a legitimate role in global transactions, and all are on the OECD White List.”

Anthony Whaley, partner in the firm’s Bermuda office explained how the company is able to deliver insight on the leading jurisdictions to onshore lawyers, particularly during this time of global economic uncertainty.

Deputy governor defends civil servants from critics

(CNS): After 35 years in the civil service, Donovan Ebanks, who became Cayman’s first deputy governor on Friday, has said that he has not encountered many of the public servants to whom the major criticisms have recently been aimed. He said that during the current economic stress civil servants had become the scapegoats, widely accused of being overpaid and underworked. However, Ebanks acknowledged that in an environment where the public expects to be treated as valuable customers, the bar must continually be raised. (Photo: Franz Manderson and Angelique Howell 2 of the 5 FACE Award recipients)

(CNS): After 35 years in the civil service, Donovan Ebanks, who became Cayman’s first deputy governor on Friday, has said that he has not encountered many of the public servants to whom the major criticisms have recently been aimed. He said that during the current economic stress civil servants had become the scapegoats, widely accused of being overpaid and underworked. However, Ebanks acknowledged that in an environment where the public expects to be treated as valuable customers, the bar must continually be raised. (Photo: Franz Manderson and Angelique Howell 2 of the 5 FACE Award recipients)

“We cannot rest on the laurels of efficiency and experience either; today, we must also include quality customer service as a daily job requirement,” the deputy governor added, challenging the civil service leadership to continue to tackle the issue head-on.

“Just because people need to access our services anyway, we must not shy away from understanding, developing and enhancing the customer-focus element. We must make every effort to get to know our customers and their needs; we must learn to empathize, and we must strive, always, to improve our service delivery.”

If public sector workers respect their clients, they will receive similar levels of respect in return, Ebanks observed, and said that Cayman could in time succeed in defying the worldwide stereotype of incompetency, inefficiency, and indifference towards civil servants.

Governor Stuart Jack also noted that it had been a turbulent 12 months for civil servants. “You have found yourselves in the midst of a global financial storm, intensified by a rapid decline in government income. I believe we still feel amazed at our survival, even in the face of continuing budget cuts,” he said. Every savings measure and every position left unfilled had translated into civil servants doing more and managing with less the governor observed.

“This year’s FACE campaign operated on a shoestring budget and has come to fruition largely because of numerous volunteer hours from the planning and nominations committees. And yet, even confronted by the trials and stresses that affect us all, we managed this time to receive 131 valid nominations for 93 civil servants,” he told those gathered for the awards.

He said the night’s list of nominees reminded everyone that customer service was not a forgotten art and that it never fails to make a positive impression. “Although the customer is not always right — and sometimes they are downright wrong — we must never lose sight of the fact we are here to serve, both the country and the public,” Jack said.

Selected from 93 nominees, this year’s winners were Deputy Chief Secretary Franz Manderson, Chief Inspector Angelique Howell, Environmental Health Officer Sydney Moore, Biohazard Waste Collector Clive Bennett and Cayman Brac Department of Sports Harold Sanford.

Dog lovers’ treat at bookshop

(CNS): Wildlife photographer Jack Kenner will be visiting Books & Books to give a visual presentation on the basics of wildlife and pet photography next week. Since waking up one morning in 2004 unable to speak above a fait whisper as a result of a recurrent laryngeal nerve that had disconnected from his vocal cord, Kenner has taken fine art portraits of hundreds of dogs, including Steven Segal’s Great Dane, Bukka, and Cybill Shepherd’s German shepherds. Kenner will sharing his experiences and sign copies of his books, Dogs I’ve Nosed and Dogs I’ve Nosed II, on 17 November.

(CNS): Wildlife photographer Jack Kenner will be visiting Books & Books to give a visual presentation on the basics of wildlife and pet photography next week. Since waking up one morning in 2004 unable to speak above a fait whisper as a result of a recurrent laryngeal nerve that had disconnected from his vocal cord, Kenner has taken fine art portraits of hundreds of dogs, including Steven Segal’s Great Dane, Bukka, and Cybill Shepherd’s German shepherds. Kenner will sharing his experiences and sign copies of his books, Dogs I’ve Nosed and Dogs I’ve Nosed II, on 17 November.

After spending 35 years in film, Kenner became totally immersed in digital fine art, black and white and colour, photography after losing his voice. Instead of putting his career on hold after being told it could take more than a year for him to recover, Kenner decided to teach himself digital photography and began bringing dogs into the studio to practice lighting ratios and giclees printing.

A native of Memphis, Kenner has worked as a professional photographer since graduating from the Brooks Institute of Photography in Santa Barbara, California, in 1980. After working several years in New York City, he returned to Memphis in 1985, where he established a reputation as a successful commercial and fine art photographer and opened his own gallery in 1997. His professional and personal assignments have taken him to five continents, capturing the images of endangered species and the landscape of the world.

CUC increases profits after rate increase kicks in

(CNS): Although 2009 has not been as profitable for CUC as 2008, the most recent quarter has seen an increase in earnings for the local monopoly power provider. According to its unaudited results for the third quarter, which ended 30 September, net earnings for the third quarter of 2009 were $6.6 million — a 22% increase compared to the comparative period for 2008. The three month earnings were positively affected by higher sales compared to 2008 and the 2.4% rate increase in June 2009, CUC stated. However, with the economic slowdown the company president and CEO Richard Hew said he was not expecting much growth over the next year.

(CNS): Although 2009 has not been as profitable for CUC as 2008, the most recent quarter has seen an increase in earnings for the local monopoly power provider. According to its unaudited results for the third quarter, which ended 30 September, net earnings for the third quarter of 2009 were $6.6 million — a 22% increase compared to the comparative period for 2008. The three month earnings were positively affected by higher sales compared to 2008 and the 2.4% rate increase in June 2009, CUC stated. However, with the economic slowdown the company president and CEO Richard Hew said he was not expecting much growth over the next year.

“We expect to see weak or no growth in sales through 2009 and into 2010. The company has reduced capital and other expenditures to mitigate the impact of flat sales on future financial results,” he said.

Net earnings for the nine months ending September 30, 2009 were still down $1.0 million or 7% compared to the net earnings of $15.1 million for the first nine months of 2008. The firm said this was due to a contraction in sales due to cooler and wetter than usual weather during the first six months of 2009 as well as slowed economic growth on the island.

Electricity sales for the third quarter of 2009 totalled 153.3 million kiloWatt hours in comparison to 145.8 million kWh for the three months ended October 31 an increase of 5% which was down to higher temperatures during July and August when a new peak load of 97.5 MegaWatts (MW) was recorded the firm said. It also stated that the sales variance was affected by the comparison of two slightly different time periods in reporting and as a result of slower economic growth on the island.

During this nine month period, which ended 30 September, CUC said there was a favourable fuel cost recovery of $2.5 million due to timing in 2008 partially offset by lower maintenance and finance costs. The introduction of a fuel tracker mechanism in the Company’s 2008 Transmission and Distribution Licence has eliminated favourable or adverse timing differences in fuel cost recovery for the financial reporting quarters subsequent to April 2008.

In response to the anticipated slower than historical growth on the island, CUC said that in September of 2009 it had told the Cayman Islands Electricity Regulatory Authority (ERA) that it no longer need to proceed with the previously announced bid for a 32 MW generation capacity expansion because of revised lower growth forecasts and the ERA has since cancelled the solicitation.

During the third quarter of 2009, the Company closed the second tranche, in the amount of $10 million, of a private placement of 7.50% Senior Unsecured Notes in the total amount of $40 million. Hew explained that with the availability of this capital and the delay of additional generation capacity, the company was positioned to weather the current economic circumstances.”

“The addition of 16 MW of MAN Diesel generation in September 2009, on schedule and below budget, also enhancesour operating efficiency,” he added. While the company continues to examine ways to reduce expenditures, he said it remains focused on reliability which is measured by the Average System Availability Index. CUC says it scored 99.95% which exceeded its Company targets and it said it would strive to maintain this performance through projects such as the Rum Point to Frank Sound transmission line completion and other operational improvements. “While the slowed economy on the island presents challenges to our business, we remain confident that we will be able to meet those challenges and preserve shareholder value,” Hew added.

After the adjustment for dividends on the Class B Preference Shares of the Company, earnings on Class A Ordinary Shares for the third quarter of 2009 were $6.1 million, or $0.21 per Class A Ordinary Share, as compared to $5.3 million, or $0.18 per Class A Ordinary Share for the three months ended October 31, 2008. After adjustment for dividends on Class B Preference Shares, earnings on Class A Ordinary Shares for the nine months ended September 30, 2009 were $13.3 million, or $0.47 per Class A Ordinary Share, as compared to $14.3 million, or $0.54 per Class A Ordinary Share for the nine months ended October 31, 2008.

Cayman remembers the lost

(CNS): Despite the inclement weather as a result of the proximity of the tropical storm, Ida, residents in the Cayman Islands battled the against the rain and turned out to mark the Remembrance Day ceremony at the George Town Elmslie Memorial Church. The service which comes ahead of the armistice day 11 November pays tribute to those who fought and died for in various wars around the world since the first world war and also the country’s mariners who were lost at sea.

(CNS): Despite the inclement weather as a result of the proximity of the tropical storm, Ida, residents in the Cayman Islands battled the against the rain and turned out to mark the Remembrance Day ceremony at the George Town Elmslie Memorial Church. The service which comes ahead of the armistice day 11 November pays tribute to those who fought and died for in various wars around the world since the first world war and also the country’s mariners who were lost at sea.

GIS reported that after the customary two-minute silence for those fallen on the battlefield, Captain Dale Banks read the poem In Flanders Field. This was followed by the laying of wreaths inside the church, led by the governor Stuart Jack. Wreaths were also laid by the new deputy premier, Juliana O’Connor-Connolly and Opposition Leader, Kurt Tibbetts. A break in the weather allowed the laying of additional wreaths at the Seaman’s Memorial in addition to a short police parade.

UN examines anti-corruption

(CNS): More than 1,000 delegates from 125 countries are meeting this week in Doha, Qatar, to review implementation of the United Nations Convention against Corruption. According to a United Nations press release, the delegates represent countries that have signed the United Nations anti-corruption treaty. In his speech to the forum, UNODC Executive Director Antonio Maria Costa called corruption "the cause and consequence" of the financial crisis. He criticized governments for having allowed the system to get out of control, and financiers and corporate tycoons for turning their dealings into a free-for-all game.

(CNS): More than 1,000 delegates from 125 countries are meeting this week in Doha, Qatar, to review implementation of the United Nations Convention against Corruption. According to a United Nations press release, the delegates represent countries that have signed the United Nations anti-corruption treaty. In his speech to the forum, UNODC Executive Director Antonio Maria Costa called corruption "the cause and consequence" of the financial crisis. He criticized governments for having allowed the system to get out of control, and financiers and corporate tycoons for turning their dealings into a free-for-all game.

Costa urged all states to use the UN anti-corruption convention as "a blueprint for restoring confidence in markets, businesses, and governments." He stressed that "corruption is preventable, not a fact of life, or part of business."

One of the main issues under discussion at Doha is the creation of a mechanism to review implementation of the treaty. "At the moment, corruption is in the eye of the beholder – there is no way to measure it," said Costa.

A review mechanism would, for the first time, enable states to see how effectively they are fighting corruption and identify where more progress is needed. The intention is to create a mechanism that is transparent, non-intrusive, inclusive and fair. "It must be a technical inter-governmental review to measure progress, not a game of name and shame," Costa added.

The head of UNODC urged delegates to "seal the deal" on the review mechanism by the conclusion of the meeting on Friday.

Bush to take local magazine on the road

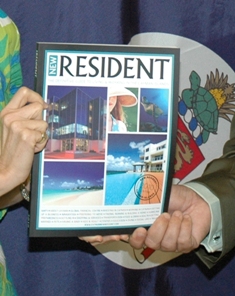

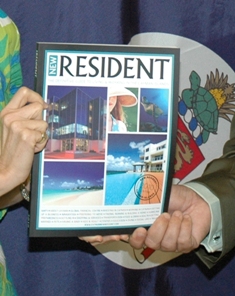

(CNS): As Cayman’s newly appointed premier goes on the road in the next few weeks to tell the world Cayman is open for business, McKeeva Bush says he will be taking the latest copy of New Resident magazine with him. Bush has made it clear in a number of public speeches recently that he wants Cayman to encourage outside investors not just to put their money here but come and live in the islands as well. Having expanded every year for the last seven years, the publishers said this latest edition is the most comprehensive ever to be printed.

(CNS): As Cayman’s newly appointed premier goes on the road in the next few weeks to tell the world Cayman is open for business, McKeeva Bush says he will be taking the latest copy of New Resident magazine with him. Bush has made it clear in a number of public speeches recently that he wants Cayman to encourage outside investors not just to put their money here but come and live in the islands as well. Having expanded every year for the last seven years, the publishers said this latest edition is the most comprehensive ever to be printed.

“I very much welcome the latest edition of the New Resident magazine and will be taking it on our international road tour when a delegation from Cayman visits five cities at the beginning of November,” Bush said when he received his copy of the magazine at the Legislative Assembly recently. “We needto encourage outside investors to move to the Cayman Islands to be residents and not just be a nameplate on a door, and if we don’t do this then Caymanians will not prosper.”

He said the quality and information in the magazine is excellent and that it provided the most comprehensive and up-to-date guide available for new people coming to Cayman, as well as those already here.

Charles Grover, Publishing Director at Acorn Publishing, said the complimentary magazine has nearly 270 pages crammed full with useful information to help both new and existing Cayman residents. “It contains a total of 25 chapters on subjects as diverse as preparing to move to Cayman; finding a health specialist; cost of living; pitfalls to avoid when buying or renting a home; schooling options; and it even suggests social groups to join and things to do at the weekend,” he added.

Re-emphasizing the benefits of sending a copy of the magazine to people before they move to Cayman, Grover said,

Conservative to lead tax team

(CNS): A former aide to Ronald Reagan and well known conservative economist has been appointed to head the independent commission which will examine the options for new revenue sources for the Cayman Islands government. James Miller III told CNS that he expected that the assessment would bevery challenging. Miller, who will be working with Financial Secretary Kenneth Jefferson and former UK Conservative MP, David Shaw, will also appoint the small team. Although the UK has asked Cayman to introduce direct taxation, Miller’s appointment as chair of the commission is a clear indication that government is hoping for alternative solutions.

(CNS): A former aide to Ronald Reagan and well known conservative economist has been appointed to head the independent commission which will examine the options for new revenue sources for the Cayman Islands government. James Miller III told CNS that he expected that the assessment would bevery challenging. Miller, who will be working with Financial Secretary Kenneth Jefferson and former UK Conservative MP, David Shaw, will also appoint the small team. Although the UK has asked Cayman to introduce direct taxation, Miller’s appointment as chair of the commission is a clear indication that government is hoping for alternative solutions.

The professional assessment aimed at diversifying the government’s revenue base was part of the conditions imposed on the UDP administration in exchange for permission from the UK to extend the country’s borrowing beyond the limits established under the Public Management and Finance Law.

Speaking at last week’s press briefing, the premier, McKeeva Bush, said the team would be looking at possibilities for direct taxation as well as other proposals. However, given Miller’s political views on economics and as a supporter of using the private sector in government, he is more likely to steer towards alternative sources of revenue and reduction of government expenditure using private finance initiatives.

The team will be expected to review the present revenue-generation mechanisms and how these have been affected by competition, the global recession and internal actions. They are also expected to make recommendations for the improvement and expansion, and more efficient operation, of these existing mechanisms.

Miller and his team will also be examining estimated government revenue sources and expenditures for the 2009-10 budget year, and recommending measures to ensure it will balance.

Alternative financing for government’s current short- and long-term debt will also be assessed in order to identify possible savings. Actual government policies will be reviewed to recommend cost-effective approaches to spending, as well as ways to reduce spending.

Bush said the assessment would be set against Cayman’s location, size, population base and cultural background to determine if any potential sources would provide a more sustainable revenue base.

“In making this assessment, the commission should consider the impact of any form of direct taxation on overall economic activity and examine, in particular, the impact on the attractiveness of the Cayman Islands as a financial centre,” the premier said. He added that the commission’s recommendations would provide government with a five-year or longer projection of revenue against expenditure, including a discussion of the optimal size of government in relation to its GDP.

When Chris Bryant, the FCO minister with responsibility for overseas territories, gave the government permission to borrow a further $225 million to balance the 2009/10 budget, he said it was on condition that Cayman would increase its future revenue base and move away from its dependence on its status asa tax haven.

“In the present global economic and political environment, I believe that it will be increasingly difficult for Cayman to rely on indirect taxation for its economic future,” he wrote on 8 October. “When the independent report on further revenue options is completed, I very much hope that you will determine to extend your revenue base on a more equitable base, with some form of progressive, direct taxation.”

However, James Miller, a conservative economist and the man selected to undertake the independent assessment is a well known opponent of increased taxation and described by pundits on the right as a conservative hero because of his opposition to tax increases and support of free-market principles and efforts to increase the role of private enterprise in the operation of the US.

He is currently senior advisor at Husch Blackwell Sanders, LLP, an international commercial law firm and also a member of a number of think tanks and organisations on the opposite side of the political debate over taxation from the current UK government.

Shaw, who is a chartered accountant and finance expert, was a former Conservative Member of Parliament for Dover who lost his seat in the 1997 election, and was involved with parliamentary committees covering finance, taxation and financial services regulation, among others.

Vandals blacken sign of complex

(CNS): The sign at the entrance to L’Ambience apartments was vandalised last night. One of the owners said it looked as though the culprits used a blow torch to melt the sign and blacken the wall. She said the sign, which was made up of three palm trees with the name of the complex and the street number and name underneath, was disfigured but it did not appear that the fire was set from the ground up, and there did not appear to be any other damage anywhere else at the entrance.

(CNS): The sign at the entrance to L’Ambience apartments was vandalised last night. One of the owners said it looked as though the culprits used a blow torch to melt the sign and blacken the wall. She said the sign, which was made up of three palm trees with the name of the complex and the street number and name underneath, was disfigured but it did not appear that the fire was set from the ground up, and there did not appear to be any other damage anywhere else at the entrance.

The apartment complex is located on Fairbanks, George Town, near the Agape Christian Centre. It is a complex of 52 apartments, 90% owner occupied. The apartment owner said she saw that the sign had been vandalised when she was leaving for work this morning at 8:15 and reported it to the police at that time. She said she was woken up last night about 4:00am by a loud popping noise but was not sure what it was and went back to sleep.