Archive for April 5th, 2011

Mac turns down UN invite

(CNS): The Cayman Islands’ premier has turned down an invitation to host the United Nation’s Special Committee on Decolonisation annual seminar here, his office revealed on Tuesday. Despite a release from the United Nations stating that the meeting would be held in Cayman next month, officials from the premier’s office said that McKeeva Bush had written to committee chairman, Francisco Carrion-Mena, on Tuesday morning stating that it would not be possible for his government to host the meeting. Although no reasons have been given as to why Cayman is refusing the invitation, officials said the CIG had never agreed to have it here in the first place. The UN “had jumped the gun” when it said the meeting would be held in Cayman, officials added.

(CNS): The Cayman Islands’ premier has turned down an invitation to host the United Nation’s Special Committee on Decolonisation annual seminar here, his office revealed on Tuesday. Despite a release from the United Nations stating that the meeting would be held in Cayman next month, officials from the premier’s office said that McKeeva Bush had written to committee chairman, Francisco Carrion-Mena, on Tuesday morning stating that it would not be possible for his government to host the meeting. Although no reasons have been given as to why Cayman is refusing the invitation, officials said the CIG had never agreed to have it here in the first place. The UN “had jumped the gun” when it said the meeting would be held in Cayman, officials added.

In his letter to the UN committee’s chair the premier reportedly offered his appreciation and gratitude for the invitation to host the annual meeting but turned it down without explanation.

The UN had released the information at the weekend indicating that the Cayman Islands had been selected following consideration of a number of factors in selecting the venue, including the political situation and logistics of several countries in the Caribbean. CNS has contacted the UN Decolonisation Committee to ask why it believed the CIG had already accepted the invitation and where the apparent miscommunication occurred and is awaiting a response.

The news that the meeting was planned to be held here had received a warm welcome from local activist group, the People for Referendum, which pointed to the importance of holding these meetings in the remaining colonies or non-self governing territories (NSGT).

The local group, which supports the idea that the Cayman Islands should move away from its current colonial status, said the matters discussed by this committee directly relate to the governance relationship between the territories and their respective administering power. The group said that holding seminars in the territories helps to educate the people about the governance options that the UN resolutions obligate all administering powers make available to the people in the territories.

The group said the decision not to hold the committee’s seminar in the Cayman Islands after all will deprive Caymanians of a valuable educational opportunity on governance. “Whether we like it or not, in 1945 and again in 1960 it was the UK that put the Cayman Islands on the UN Non-Self-Governing Territories list; the UK was one of the six member states that drafted the establishment of the UN Special Committee on Decolonisation and they also drafted the governing rules between the Administering Powers and Non-Self-Governing Territories,” the PFR said.

“One of these rules requires annual reports on each territory; these annual regional seminars are part of that reporting process when each territory’s government, civil society organizations and individuals have an opportunity to talk with the members of the UN.”

The group added that it was still important that Caymanians understand how their future is being discussed at these multinational meetings and that the public exercise their right of free speech.

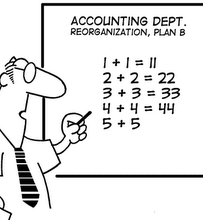

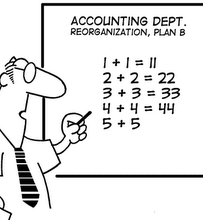

Auditor flags areas of risk

(CNS): With so little information backing up the accounts being submitted by government to his office, the auditor general says it is very difficult to say how well or even how honestly public money has been spent. Given the alarming number of disclaimers, adverse and qualified opinions he has had to give on core government accounts and some public authorities, it is considerably more challenging for his team to alert the authorities to irregularities that might indicate financial crime, he has revealed. However, Alastair Swarbrick said that during the audits of government accounts the office has identified areas of riskwhere there are concerns and his office will be issuing compliance orders to take a closer look.

(CNS): With so little information backing up the accounts being submitted by government to his office, the auditor general says it is very difficult to say how well or even how honestly public money has been spent. Given the alarming number of disclaimers, adverse and qualified opinions he has had to give on core government accounts and some public authorities, it is considerably more challenging for his team to alert the authorities to irregularities that might indicate financial crime, he has revealed. However, Alastair Swarbrick said that during the audits of government accounts the office has identified areas of riskwhere there are concerns and his office will be issuing compliance orders to take a closer look.

Speaking at a press briefing on Tuesday afternoon where he released the latest report on the progress government has made in dealing with its financial reporting, the auditor general said that he would be taking a look at some specific areas of risk. He said the office would be seeking to find supporting information for some of these riskier areas of spending that occurred between 2005 and 2008, he said.

The auditor said the office is still struggling to get information from the relevant government entities to support the financial statements, which not only continues to delay the goal of getting the accounts up to date, but also means that when the reports are completed and made public with qualified and adverse opinions or disclaimers, the reports are of little use and government is unaccountable for its spending.

“We simply can’t say if public money has been spent appropriately. It might have been but the government entities can’t provide the evidence to say it has,” said Swarbrick. “So government is not accountable to the people about how it spent public funds.”

He also noted that to manage any business, public as well as private, you need good financials to make proper decisions. You can’t be expected to run the business, in this case the business of government, without them.

With a growing number of reports now audited, the office hasrevealed that of the 46 ministry and portfolio reports from 2004 to present that have been tabled in the LA, only seven are unqualified. The information in the other 39 reports cannot be considered credible, reliable or useful, Swarbrick said in the report. While the statutory authorities have done better, with 62 unqualified reports, 44 qualified and 4 disclaimed.

With several more reports audited but still waiting to be tabled in the Legislative Assembly and made public, many more of those will have adverse opinions and disclaimers as well as qualified opinions. Swarbrick said that in his twenty years as a public auditor he had never issued anything worse than a qualified opinion as a result of a technical problem — until now.

And he said the office was still struggling to get the necessary information from the relevant government entities to support the ongoing financial statements — a problem which continues to undermine the government’s goal to clear the backlog. When it came to making progress, he said that although there was evidence that things were going to move forward, government had failed in its goal to clear the majority of the backlog by the end of February 2011.

“While some progress has been made, the government did not achieve its objective,” Swarbrick said. “I am concerned that any further delays, such as those we have been encountering in receiving submissions from individual entities, could impact the government’s ability to become compliant with the reporting requirements of the Public Management and Finance Law in a reasonable time period."

He said the whole point of the exercise was for government to provide more accurate information on time but the pace of progress would stop that from happening. He said the delays were impacting the next financial year and were now being compounded by the switch in focus from preparing the 2010/11 accounts to preparing the 2011/122 budget.

The full details on the progress of each ministry, portfolio, statutory authority and government company are set out in the full report which is now a public document.

Death row inmate gets reprieve over new lethal drug

(AP): The U.S. Supreme Court has blocked the first scheduled execution of a Texas death row inmate using pentobarbital. Cleve Foster was to have been executed Tuesday evening forthe 2002 slaying of a Sudanese woman in Fort Worth — the first Texas execution since the state switched to pentobarbital in its lethal three-drug mixture. On Tuesday morning, the high court agreed to reconsider its January order denying the 47-year-old’s appeal. That appeal raised claims of innocence and poor legal help during his trial and early stages of his appeals. Foster’s lawyers also argued that Texas prison officials violated administrative procedures when they announced the switch to pentobarbital from sodium thiopental.

(AP): The U.S. Supreme Court has blocked the first scheduled execution of a Texas death row inmate using pentobarbital. Cleve Foster was to have been executed Tuesday evening forthe 2002 slaying of a Sudanese woman in Fort Worth — the first Texas execution since the state switched to pentobarbital in its lethal three-drug mixture. On Tuesday morning, the high court agreed to reconsider its January order denying the 47-year-old’s appeal. That appeal raised claims of innocence and poor legal help during his trial and early stages of his appeals. Foster’s lawyers also argued that Texas prison officials violated administrative procedures when they announced the switch to pentobarbital from sodium thiopental.

There is a national shortage of sodium thiopental, which has been used already in executions in Oklahoma and Ohio.

Food and drug addiction linked says study

(LA Times): A new study from the Yale Rudd Center for Food Policy & Obesity suggests that a chocolate milkshake and a line of cocaine might not be so different. The study, published Monday in the Archives of General Psychiatry, found that addictions to food and drugs result in similar activity in the brain. "This past year we got interested in the idea of food addiction and the neural process," said lead researcher Ashley Gearhardt, a clinical psychology doctoral student at Yale University. "We just wanted to get down and deep into whether people really experience food addiction." The study included 48 women with an average age of 21 who ranged from lean to obese.

(LA Times): A new study from the Yale Rudd Center for Food Policy & Obesity suggests that a chocolate milkshake and a line of cocaine might not be so different. The study, published Monday in the Archives of General Psychiatry, found that addictions to food and drugs result in similar activity in the brain. "This past year we got interested in the idea of food addiction and the neural process," said lead researcher Ashley Gearhardt, a clinical psychology doctoral student at Yale University. "We just wanted to get down and deep into whether people really experience food addiction." The study included 48 women with an average age of 21 who ranged from lean to obese.

They took a test developed at the Rudd Center to measure food addiction, based on an established test for measuring drug addiction. The test includes statements such as, "I find that when I start eating certain foods, I end up eating much more than I had planned," and respondents rate how closely the statements match their own experiences.

Melting sea ice creates fresh water pool in ocean

(ABC News): Scientists are monitoring a massive pool of fresh water in the Arctic Ocean that could spill into the Atlantic and potentially alter the ocean currents that bring Western Europe its moderate climate. The oceanographers said Tuesday the unusual accumulation has been caused by Siberian and Canadian rivers dumping more water into the Arctic, and from melting sea ice. Both are consequences of global warming. If it flushes into the Atlantic, the infusion of fresh water could, in the worst case, change the ocean current that brings warmth from the tropics to European shores, said Laura De Steur, of the Royal Netherlands Institute for Sea Research.

(ABC News): Scientists are monitoring a massive pool of fresh water in the Arctic Ocean that could spill into the Atlantic and potentially alter the ocean currents that bring Western Europe its moderate climate. The oceanographers said Tuesday the unusual accumulation has been caused by Siberian and Canadian rivers dumping more water into the Arctic, and from melting sea ice. Both are consequences of global warming. If it flushes into the Atlantic, the infusion of fresh water could, in the worst case, change the ocean current that brings warmth from the tropics to European shores, said Laura De Steur, of the Royal Netherlands Institute for Sea Research.

German researcher Benjamin Rabe, of the Alfred Wegener Institute, said the Arctic’s fresh water content had increased 20 percent since the 1990s, or by a 8,400 cubic kilometers. That is the equivalent of all the water contained in Lake Michigan and Lake Huron in the U.S. or double the volume of water in Lake Victoria, Africa’s largest lake.

Mercedes-Benz recalls SUVS over cruise control

(Reuters): Daimler AG’s Mercedes-Benz is recalling 136,750 M-Class and M-Class AMG vehicles in the United States made from 1999 to 2004 for issues related to cruise control that may lead to a crash, U.S. federal safety regulators said. A filing with the U.S. National Highway Traffic Safety Administration shows that repairs will be made at Mercedes dealerships beginning in September. Applying the brakes to disengage cruise control may fail, increasing the chances of a crash, the filing said. There are other ways, including working a "cruise control stalk" or pumping the brakes, that will still engage the system in the event that applying the brakes fails, the filing said.

(Reuters): Daimler AG’s Mercedes-Benz is recalling 136,750 M-Class and M-Class AMG vehicles in the United States made from 1999 to 2004 for issues related to cruise control that may lead to a crash, U.S. federal safety regulators said. A filing with the U.S. National Highway Traffic Safety Administration shows that repairs will be made at Mercedes dealerships beginning in September. Applying the brakes to disengage cruise control may fail, increasing the chances of a crash, the filing said. There are other ways, including working a "cruise control stalk" or pumping the brakes, that will still engage the system in the event that applying the brakes fails, the filing said.

Close Bros faces $22m suit

(CNS): A writ filed in Grand Court on behalf of the joint official liquidators (JOLs) of the various Grand Island Funds, which collapsed in 2008, seeks to recover more than $22 million from the fund administrators, Close Brothers Ltd, and one of its employees. In the statement of claim Nick Freeland and David Walker say that the defendants failed to properly carry out their duties as administrators by ignoring obvious signs of fraud. The liquidators claim that the administrators failed to report Robert Girvan, the funds’ director and sole trader, who was convicted on 21 counts of theft and money laundering, despite many obvious red flags that should have alerted them to his illegal activities.

(CNS): A writ filed in Grand Court on behalf of the joint official liquidators (JOLs) of the various Grand Island Funds, which collapsed in 2008, seeks to recover more than $22 million from the fund administrators, Close Brothers Ltd, and one of its employees. In the statement of claim Nick Freeland and David Walker say that the defendants failed to properly carry out their duties as administrators by ignoring obvious signs of fraud. The liquidators claim that the administrators failed to report Robert Girvan, the funds’ director and sole trader, who was convicted on 21 counts of theft and money laundering, despite many obvious red flags that should have alerted them to his illegal activities.

“By reason of their failure to carry out their duties as administrators or to follow their own internal policies and procedures, they failed to discover and so alert the other directors of the funds, the auditor or the regulatory authorities of the Cayman Islands that the funds were being managed by Girvan as a Ponzi scheme,” the JOLs’ lawyers say in the writ.

They present an exhaustive list of opportunities in the 42 page claim, which they say Close Brothers Cayman Limited (CBCL) and John Sutlic, who was a director of the fund and CFO at the firm, ignored. Despite the catalogue of discrepancies, the administrators continued to issue net asset values for the funds, the JOLs state, accusing them of negligence and recklessness.

According to the JOLs, the administrators simply accepted at face value what Girvan told them and the forged documents he sent, even though no reputable bank would produce statements with such obvious errors. The JOLs claim that as early as July 2003, less than six months after the first fund was established, the administrators were being sent very clearly false documents by Girvan. The false bank statements being sent to CBCL were picked up by an employee, who noted the significant discrepancies and alerted other people at the firm in an email of the need to get originals directly from the bank.

“It is not known what investigation, complete or otherwise, was in fact carried out,” the JOL claim states. “Had a proper investigation been carried out, the fact that Girvan was producing forged statements would have been discovered in July 2003.”

Despite this and other warnings, however, and the fact that the documents were so apparently false, Close Brothers continued for another five years to accept the doctored statements and issued fund values based on the forgeries, the liquidators say in the statement of claim.

Girvan was not arrested until 2008, when the real and substantial losses the funds had suffered through trading, further compounded by Girvan’s criminal attempts to cover up the losses, were revealed. He was accused of stealing more than $19 million and was sentenced to eight years in jail after pleading guilty. Girvan was able to commit the acts of theft and money laundering, the JOLs say in the writ, because of the failures of the defendants.

Aside from failing to pick up on Girvan’s poor attempts at forgery, allowing him to co-mingle money from the funds into other accounts, and failing to keep proper books of account, the JOLs claim that Close Bros had “at all material times … irreconcilable conflicts of interest” as a result of the firm’s existing relationship with the promoter of the funds, Naul Bodden, and that affiliates of CBCL were in investors in the various Grand Island Funds.

As a result of the “breach of fiduciary duty”, the JOLs claim that Close Brothers and Sutlic are liable for the losses and the money which was wrongfully transferred. They also say the administrators are liable for the redemption payments that were made based on the false net asset values they produced from the obviously false statements given to them by Girvan, which shouldn’t have been paid. The JOLs say the administrators should also pay back the fees, commissions and other charges they were paid as they were not properly earned.

In total the JOLs are seeking more than $22 million from the firm as well as costs, interest and damages.

The JOLs have confirmed that the litigation remains in the early stages, with the writ filed in late November, and so far no settlement has been reached. “However, we are always willing to consider sensible and realistic proposals that would achieve an acceptable outcome for the funds shareholders,” Nick Freeland told CNS.

Managing Director of Close Brothers, Linburgh Martin, acknowledged the litigation between the Joint Official Liquidators of the Grand Island Funds and Close Brothers (Cayman) Limited (CBCL) and various other parties in Cayman but denied culpability.

“We believe that CBCL and its employees acted appropriately in servicing the funds and that we have a solid defence to the various allegations against us in this unfortunate matter,” Martin added.

He also noted that the recent sale of CBCL and its Cayman affiliates was not related to the Grand Island Funds case.

“The sale follows the recent sale of our Group’s ‘UK Offshore’ business in the Channel Islands, as the Group concentrates on expanding its core UK asset management business. We are confident that CBCL’s Cayman business will go from strength to strength and the sale will prove to be an excellent strategic move for our business,” Martin told CNS.

Crime plan falls short

(CNS): The leader of the opposition says people will be disappointed with the long awaited national crime strategy because, despite being a well researched document, it does nothing to address the immediate issues facing the community. Alden McLaughlin said government must take ownership of the current rise in violent crime. The new report, which has been in the works for well over a year, has some excellent proposals to tackle the issue of criminality in the long term, he revealed, but it falls short of what people are expecting when it comes to protecting them from violent robbers. With criminals getting away with daylight robbery – literally — Cayman has to change its approach to policing, the PPM leader has said. (Photo Dennie WarrenJr)

(CNS): The leader of the opposition says people will be disappointed with the long awaited national crime strategy because, despite being a well researched document, it does nothing to address the immediate issues facing the community. Alden McLaughlin said government must take ownership of the current rise in violent crime. The new report, which has been in the works for well over a year, has some excellent proposals to tackle the issue of criminality in the long term, he revealed, but it falls short of what people are expecting when it comes to protecting them from violent robbers. With criminals getting away with daylight robbery – literally — Cayman has to change its approach to policing, the PPM leader has said. (Photo Dennie WarrenJr)

Speaking at a public meeting in the Bodden Town district hosted by his fellow MLA Anthony Eden, McLaughlin said that the National Security Council’s crime strategy report, which has finally been revealed to members of the Legislative Assembly, contains import information and potentially long term solutions, but no immediate solutions to protect people from the surge in robberies.

The document, which has not yet been adopted by Cabinet, addresses the root cause of crime and the social issues that have fuelled its increase. The report, he said, was a comprehensive look at failures where children are concerned, programmes that have not worked, and a lack of rehabilitation in the prison system, all of which he said were important.

“The report deals with the causes of crime, and there is much that is good in the report, but in the short term we have to deal with issues that confront people on an almost daily basis,” McLaughlin stated. With four bank robberies in just over one year, none of which have been solved, the people were scared and the robbers were facing no deterrent as they were being rewarded for their crime, he added. “We need an immediate plan to deal with the crime that is facing us every day,” McLaughlin told the district audience.

He said the most recent statistics from the RCIPS showing a decline in overall crime did not reflect the reality of how people felt, and with a more than 200% increase in robberies the overall reduction did not instil confidence as it was these crimes that were frightening people.

“We have to change our approach to the way we police and how we manage our security,” McLaughlin told the audience at the district meeting. “I am not an advocate of arming police but it is clear at moment there is no deterrent, especially when bank robbers are getting away with it.”

He said the question had to be how can the safety of customers and staff at a bank be ensured if someone can walk up to a security guard and put a gun to his head and rob the customers?

“We have to accept Cayman has changed,” he added. Echoing the sentiments of the community as a whole, he said it was only a matter of time before somebody gets seriously hurt or killed during a robbery.

The immediate problem of crime had to be addressed through policing, McLaughlin said, adding that law enforcement is down to two fundamental things: one is resources and the other expertise to deal with detection. “Somewhere we are failing,” he said. “The current government will not own the problem and it keeps pushing the issue on to the governor.”

He was not suggesting a PPM government could have resolved it overnight, he said, “but we wouldn’t have stopped pushing to try and address the short term issues.”

Crime is nothing new, he noted, but said Hurricane Ivan was the watershed for the Cayman Islands when it came to social behaviour and crime. In the wake of the disaster the island witnessed lawlessness and criminality never seen before and it had been difficult to get the genie back in bottle.

He pointed out that the previous government had focused on addressing crime, especially with resources, despite it being the responsibility of the governor. With the introduction of the National Security Council under the new constitution, he said the elected armed of government now had more power as the government was bound to take the council’s advice.

“The government is playing down its role on national security so it can avoid accepting responsibility,” McLaughlin said.