Archive for August 2nd, 2012

CITA says Mac’s new tax is ‘grossly unfair’

(CNS Business): Taking the government to task over the new payroll tax for expat workers, the Cayman Islands Tourism Association (CITA) has said that tourism businesses will do their part to help the economy “but without any demonstration of financial discipline from Government, without a core understanding ofwhere Government revenues are derived and little recognition that there is a line that should not be crossed, no sympathy or support will be given to any new taxation proposals.” In an unequivocal statement, CITA also notes the folly of removing the pension requirement and says the move to tax private sector expats only is “grossly unfair and divisive” which “runs counter to the aim and necessity of maintaining a harmonious community in the Cayman Islands.” Read more and comment on CNS Business

Bait and switch

It is inconceivable that after almost three decades in politics McKeeva Bush would be happy to go down in Cayman Islands political history as the man that introduced direct taxation. It may well be better than the ‘politician who faced the most police investigations’ but really, only marginally. So it seems probable that the latest proposal is a case of bait and switch.

The idea that he is proposing something so terrible that when the real policy (which may well be still pretty bad) emerges it won’t seem so awful certainly seems to be a popular sentiment. Those who are long-time students of Bush's political modus operandi appear to be in no doubt that this is the case, but so far the 'switch' remains a state secret.

Some have suggested it could be legalized gambling or even VAT, but are these really as bad as a disguised income tax (which is what the community enhancement fee is, no matter what euphemism one uses) that would lead Bush to create what is unarguably the greatest backlash against him since he took office as premier?

When the issue of the premier being under three police investigations emerged, with the exception of the opposition benches in the Legislative Assembly and Bush’s long time critics, none of the islands’ associations or organisations made much comment publicly. Of course, the muttering and head shaking has been going on in the boardrooms and swanky restaurants for some time now about the ‘Stan Thomas Affair’ but no one was prepared to stick their head above the parapet and openly criticise him.

But since he uttered the dirty words “enhancement fee”, every association and its dog has criticised the policy and made it plain that if Bush wishes to cling on to any futile hope that he will lead the next administration he needs to shelve this idea pretty sharpish.

When asked about the impact on the financial services sector of the Cayman Islands with the premier being under investigation for three different cases of possible bribery and corruption, the Law Society said it had no comment. Asked about the introduction of the payroll tax and the body launched a full scale attack, not just on the plan but on the government and its understanding of economic policy and foretold the downfall of Cayman for ever and ever.

All of the private sector associations, leading businessmen, work permit holders, young educated Caymanians and many others who in the past, for one reason or another, have remained more or less silent over each alarming policy and as each questionable budget unfolded under the premier’s leadership, have now found their voices.

It has been apparent since the first spending plans were presented by this administration that the premier has not taken the slightest bit of notice of the UK’s rather large hints that the country’s finances are a shambles. To quote his favourite Biblical reference, even blind Bartimaeus could see that the UK’s insistence that he cut operating expenses and seek new revenue would eventually lead to this financial crisis.

Bush has spent the last year stating over and over again that there would be no more borrowing because the UK would not allow it. But he still presented a budget to the UK with both long and short term borrowing requirements that he knew full well would be denied. The question, therefore, is what really is hidden up the West Bay magician’s sleeve?

Direct taxation is not the worst thing that can happen to a country, unless of course its main revenue source depends on a philosophy and principle that taxation on what you earn and own is wrong and things that help people legally avoid it are not.

It is also a problem introducing it when your small businesses and poorer people, including your immigrants, are already paying a disproportionately high percentage of taxation via indirect fees, such as duties, work permits, licences and other government taxes.

People earning just over $36,000 per year will be expected to give the government another $3,600. When we add up the percentage of earnings they already pay as a proportion of their income in duty alone, their rate of taxation is, ironically, among the highest in the world.

A common argument for direct rather than indirect taxation is that it is more fair to the poorer people. However, in this instance, since it appears that government plans to introduce its form of income tax on foreigners’ salaries only, this particular form of direct taxation will be a long way from fair.

Aside from all the powerful arguments against it — it’s incredibly discriminatory elements, the fact that it will mark a sea change for Cayman, as well as the point that not all of the alternatives have yet been exhausted — the tax seems an insane proposition, not least because of the obvious problems of collection. How government proposes to introduce a new tax authority, collection agency, enforcement arm, the ability to assess of all potential payers and an education campaign for employers in the next four weeks is impossible to imagine.

On top of that, government has a terrible track record of collecting the money it is owed and of enforcing the laws relating to what employers should pay on behalf of their workers.

But above all, this place is wall to wall with tax accountants and lawyers who have already come up with the ‘special purpose vehicles’ that willensure that no one earning more than $45k a year will pay a penny of this tax.

The UK has spoken of sustainability and for a tax to be sustainable you’ve got to collect it and it is clear that this tax plan is about the most difficult option when it comes to actually bringing in the money. There are many powerful arguments against this tax but the difficulty in collecting it and Bush’s unlikely desire to want to go down in history as Cayman’s first Zacchaeus, to use another Bible reference, means this absolutely has to be bait and switch.

So come on, Mac! Bring on the switch. We can’t wait! Casinos? Legalized ganja? Strip bars and massage parlours? Let s face it, given the backlash in the community to the latest plan, any or all of those are likely to be far more welcome than direct taxation.

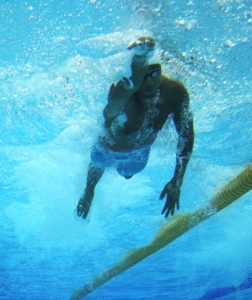

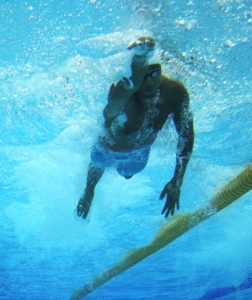

Olympics over for local swimming stars

(CNS): Cayman swimming hero Brett Fraser has made his last appearance in the pool at London 2012 after he failed to qualify for the men’s 50 metre freestyle semi-finals today. Fraser came in sixth in his heat with a time of 22.91 seconds, which was more than a second more than the fastest qualifying time of the day swam by George Bovell from Trinidad & Tobago at 21.77 seconds. Despite this disappointment, Brett swam a personal best and a Cayman record in the 200 metres last weekend and made it to two semi-finals, lining up with the best swimmers in the world. His brother Shaune, who was making his third Olympic appearance, also had an impressive games advancing for the first time to the semi-finals in the 100m freestyle. (Photo Ron Shillingford)

(CNS): Cayman swimming hero Brett Fraser has made his last appearance in the pool at London 2012 after he failed to qualify for the men’s 50 metre freestyle semi-finals today. Fraser came in sixth in his heat with a time of 22.91 seconds, which was more than a second more than the fastest qualifying time of the day swam by George Bovell from Trinidad & Tobago at 21.77 seconds. Despite this disappointment, Brett swam a personal best and a Cayman record in the 200 metres last weekend and made it to two semi-finals, lining up with the best swimmers in the world. His brother Shaune, who was making his third Olympic appearance, also had an impressive games advancing for the first time to the semi-finals in the 100m freestyle. (Photo Ron Shillingford)

All eyes now move to the track, where Kemar Hyman kicks off Cayman’s participation with the men’s 100 metre heats on Saturday. Commonwealth Champion Cydonie Mothersill will run in the women’s 200 metre heats on Monday, while Ronald Forbes will be hurdling on Tuesday.

Immigration to collect on 36K

(CNS): The premier has now confirmed that his expat tax will not kick in until foreign workers are earning $36,000 per year but it will start at 10% on earnings of that level and above and will not be incremental. He also revealed that the immigration department will collect what he calls "a community enhancement fee" with the help of new technology and it will not require any major investment to bring in the new source of revenue. McKeeva Bush revealed that collection would begin before the year end once the legislation was passed and the changes put in place to help the immigration department collect the cash from work permit holders.

(CNS): The premier has now confirmed that his expat tax will not kick in until foreign workers are earning $36,000 per year but it will start at 10% on earnings of that level and above and will not be incremental. He also revealed that the immigration department will collect what he calls "a community enhancement fee" with the help of new technology and it will not require any major investment to bring in the new source of revenue. McKeeva Bush revealed that collection would begin before the year end once the legislation was passed and the changes put in place to help the immigration department collect the cash from work permit holders.

Speaking to a packed audience in West Bay for closeto two hours on Wednesday evening before he allowed questions, Bush said the "fee" was not his first choice but until someone offered a viable alternative, it would go ahead. During the course of the evening he was asked about the various alternatives that had been posed to government from a number of sources in the community and what was wrong with them all, but he was unable to offer answers, insisting that he had heard “them all before" and they would not bring in enough revenue.

He condemned the media for calling the tax on foreign workers’ earnings an "expat tax" as he seemed to think those headlines, rather than his policy, would be the ruin of Cayman, and he took aim at everyone, from the governor and the auditor general, whom he said had all prevented his government from doing the things it needed to do for Cayman’s economic recovery.

He said the bloggers should be telling the UK’s representative to stay on the beach and “sun his buns" and not interfere with the elected politicians, as he railed against the UK pressure to produce a balanced budget.

He said the Foreign Office economist sent to the Cayman Islands by the overseas territories minister to help with the budget had insisted on a surplus for the 2012/13 spending year of $76 million. Bush told the West Bay crowd that his Cabinet had gone as far as it could to reach that target and had managed to bring the budget surplus to $70 million. He said the details of his government’s spending plans had gone to London.

The premier said he hoped to have the UK’s approval by Friday and intended to deliver the budget, complete with the new tax and a number of other fee increases impacting the offshore sector, on 9 August.

The premier stated that he had cut spending in the civil service as much as he could but it was down to the governor and deputy governor to cut pay and jobs as he insisted he could not do it.

Bush promised the crowd that there was no way that the "community enhancement fee" would ever be extended to Caymanians, underscored by the fact that immigration would be the auditor, collector and enforcer of the payroll tax. He said the fee was also levied in a number of other countries around the region, such as Bermuda and BVI, so why couldn’t Cayman also raise revenue this way?

He dismissed comments from members of the audience about what research, analysis and assessments had been done by economic experts about the potential long term harm, how the tax would be collected, the potential for evasion and avoidance as well as other problems, saying, “We believe it’s going to work.” However, he offered everyone the opportunity to send alternative suggestions to his office as quickly as possible.

Bush said that every solution that his government had put forward to try and solve Cayman’s economic problems had been shot down or opposed by someone "causing fire storms", as he railed against his critics and opponents.

Although several issues regarding the tax have not yet been clarified as previously stated on CNS this only applies to work permit holders and not to foreign nationals working in the civil service.

Check back to CNS later for more from the meeting and the plans for the 2012/13 budget.

Mac attacks officials

(CNS): The governor and the auditor general were once again in the premier’s sights as he launched a full scale attack on senior government officials at a public meeting last night. Not for the first, McKeeva Bush accused the governor of hindering rather than helping with the budget process and Cayman’s economic recovery, assisted, the premier claimed, by his "hit-man" the auditor general. He accused the menof stalling projects and “scaring people off” and telling everyone, himself included, that they were doing something wrong. Bush said the governor had no business interfering with the jobs of elected government members. (Photo Dennie Warren Jr)

(CNS): The governor and the auditor general were once again in the premier’s sights as he launched a full scale attack on senior government officials at a public meeting last night. Not for the first, McKeeva Bush accused the governor of hindering rather than helping with the budget process and Cayman’s economic recovery, assisted, the premier claimed, by his "hit-man" the auditor general. He accused the menof stalling projects and “scaring people off” and telling everyone, himself included, that they were doing something wrong. Bush said the governor had no business interfering with the jobs of elected government members. (Photo Dennie Warren Jr)

Speaking at the West Bay meeting on Wednesday night (1 August), which was billed as being an information session regarding the UDP administration’s plans to introduce a 10% direct tax on work permit holders, the premier used much of the time to slam his opponents and critics, and in particular Governor Duncan Taylor and Auditor General Alastair Swarbrick.

He attacked the men for a number of issues but was particularly angry with Governor Taylor for making an appearance on the morning radio talk show this week, where he had talked about the budget process. Bush said the governor had not told the premier or other Cabinet members he was doing that. Bush said the bloggers should be writing about how the governor is interfering with elected politicians and tell him “to go sun his buns” on the beach. The premier stated that the constitution was clear that the elected arm of government was responsible for the day to day running of the country and the governor had no right to interfere so much.

Bush said there had been many types of governors in Cayman’s history, from “ineffectual ones to those that spent millions on investigations,” referring to the last UK representative, Stuart Jack, who presided overthe controversial and expensive police corruption investigation Operation Tempura.

“Not until now have we had one so disposed to interfere with local affairs,” Bush said, adding that it was not good for him to be on the radio publicly airing their differences. The premier said there were ways for a governor to be active in local government and that was to try to help. “This one has done nothing to help,” he added.

Bush complained that the governor had prevented the UDP administration from divesting the Water Authority and the sewerage system. He also said that the Governor’s Office was behind the blocks facing a committee formed to look into other possible public private partnerships for government. “After nine months there has been no progress,” he said, adding that because the committee was being stalled it had been suspended.

The premier said the sewerage project could have injected millions into the economy and created a thousand jobs but the governor “and his hit-man, the auditor general,” had done everything they could do to stop it.

“Every time a civil servant made a move, the auditor general was there to frighten them,” Bush told the audience as he accused Swarbrick of running to the papers saying something was “radically wrong" every time he tried to do something. “These people are hell bent on destroying this country … that is my opinion. If I’m put in jail, I don't care. It is time for them to stop interfering,” the premier said.

Bush said the governor had failed to help when the government had put forward its budget to the FCO.

“When we put forward the budget in June to the UK, it was strong by usual standards. So why didn't the governor intervene on our behalf and explain we can’t do everything in one year? Why did he not go to bat for us?” he asked. Bush claimed the two month stop-gap period was too short for the government to work out all the financial problems and it was hurricane season as well, but the governor did not support him in his efforts to get a longer time period, the premier lamented.

He accused Taylor of making him look bad with his recent statements as he called on him to stay out of the political affairs. However, Bush did say the governor was the one responsible for the civil service and he was the only one who could cut numbers or pay.

“The governor can't say he’s not responsible. He is responsible not the premier,” Bush stated, adding that none of the other Cabinet members could hire and fire or sign any contracts for civil servants. “That is the governor’s responsibility under the constitution and he himself can explain why the civil service numbers are so high.”