Guest Writer

Guest Writer's Latest Posts

Stop your child becoming a screen addict

(BBC): It used to be that playing computer games was a fun and harmless pastime – but not any more. Although not officially classified as an addiction, parents and professionals are becoming increasingly alarmed at the rising number of young people shunning normal ‘fun’ activities and family life in favour of playing computer games in isolation. It is not uncommon for children to spend upwards of six to eight hours daily on their computers playing games. And now increasing numbers of childrenand teenagers are experiencing the negative effects of gaming.

(BBC): It used to be that playing computer games was a fun and harmless pastime – but not any more. Although not officially classified as an addiction, parents and professionals are becoming increasingly alarmed at the rising number of young people shunning normal ‘fun’ activities and family life in favour of playing computer games in isolation. It is not uncommon for children to spend upwards of six to eight hours daily on their computers playing games. And now increasing numbers of childrenand teenagers are experiencing the negative effects of gaming.

Regressive taxation & small business: a tale of woe

Successive governments in the Cayman Islands have sold to the populace that much of the success of islands is based on its indirect and highly regressive tax system. Given the Anglo-Saxon predisposition to measure “success” in terms of aggregates (GDP and conspicuous consumption patterns chief amongst the favoured measurements), they may well be correct.

Empirical data from diverse societies across all continents lend strong support to the view that a regime of regressive taxes (fee based levies, Value Added Taxes, etc.) substantially favour the rich and big businesses and unduly punish the middle and lower income groups and small businesses.

The Cayman situation is made ever more inequitable by the fact that the penalized groups account for the vast majority of the local populace, whilst the favoured groupings are in the main comprised of transients and convenience domicile seekers.

I would like to offer an insight into the small business operation I have been responsible for over the pastten years to fully demonstrate how the favoured taxation structure inhibits the growth of small businesses, particularly in the much vaunted financial service sector.

The company in question, Financial Integrated Services, is a locally owned and operated financial services company, geared towards the provision of a range of financial services to lower income clients and small businesses.

The most recently introduced regressive tax is directed at the relatively small remittance business (the levels of remittances effected through the licensed money services is less than 2% of the remittance activities of the banking sector).

In the case of FIS, the AVERAGE MONTHLY GROSS REVENUE generated on the remittance activity is in the region of US$100,000.00. Over 75% of the GROSS REVENUE is transferable to the principal, Moneygram, which provides the service’s global reach.

The GROSS REVENUE generated at the local operational level is in the region ofUS$25,000.00 per month. The Monthly Tax levied by Government on the local operation and its clients is 160%, yes a draconian 160% of the Gross Revenue generated to the local business. Medieval princes would indeed be envious of such an arrangement.

On the aggregate Gross revenues generated by the business, this equates to a tax rate of over 40%. The other 98% of the legal remittance business conducted through the commercial banking sector is in the meantime totally exempt from any fee levy/ transaction taxes. Not unsurprisingly the business is slowly migrating to the tax exempt banks.

The punitive nature of the tax regime extends to the other areas of the subject operation. The operation’s accounting function is geared to providing accounting support services to small business.

There can be no denial that in the modern environment small businesses if they are to be afforded the opportunity to grow and advance have to have reasonable access to affordable accounting services.

Work permit fees, which is the primary tax in this segment of the business, is $10,000.00 per accountant. The average charge-out rate for a big four accountant allows for a cost recovery rate of the attendant annual work permit fee that is at least three times as fast as the charge out rate that is tolerable at the small business level.

The picture is the same in the insurance segment of the business. I dare say that this picture is very much the reality for small businesses across the spectrum.

The particular irony of the specific case of this company is that all concerned have sought to structure the operation with a view to seeking to deliver the greatest possible economic benefit to the domestic economy, hence the staffing complement of 20 is comprised of 15 full time employees, of whom only two are work permit holders, and three of the four part time employees are active retirees, the other two being tertiary level students. The demise of the company would have a much greater lasting negative impact than in a case where a larger proportion of the work force were transient.

The tendency over the years has been for ordinary folks to presume that the regressive indirect tax structure that has been the mainstay of the fiscal policy of every government for the past 30 years is vital to the ongoing economic success of the country. Arguably the current tax regime serves mainly to preserve the “natural order” of our established trickle-down society.

We must challenge our leaders to show how the perpetuation of policies and incentive structures that favour transient activities and penalize domestic ally generated initiative can in fact be to the long term benefit of the citizens.

Case in point: How do they equate pronouncements by vested interests of the so-called successes such as of the listing of 7.7 billion of CAT Bonds on the on the Cayman Islands Stock Exchange, (ostensibly ascendancy to a global leadership position) in the period since the start of the global financial crisis, with the fact that its owner – the government – is having to cover the deficit on the backs of its heavily laden core of middle and lower income residents and citizens in its futile attempts to cover a comparatively modest deficit of under $100 million?

Ofcom calls for clarity in broadband speed ads

(BBC): Britons are not getting the broadband services they are being sold, research by the regulator Ofcom suggests. Its analysis of broadband speeds in the UK shows that, for some services, 97% of consumers do not get the advertised speed. It also shows a growing gap between the claims ISPs make for broadband and the speed being delivered. To fix the problem, Ofcom is revamping the code of conduct for ISPs and asking for changes to how broadband is sold. The regulator’s survey shows that the average residential broadband speed in the UK has risen in the last 12 months from 4.1Megabits per second (Mbps) to 5.2Mbps. The report also reveals the changing nature of UK broadband.

(BBC): Britons are not getting the broadband services they are being sold, research by the regulator Ofcom suggests. Its analysis of broadband speeds in the UK shows that, for some services, 97% of consumers do not get the advertised speed. It also shows a growing gap between the claims ISPs make for broadband and the speed being delivered. To fix the problem, Ofcom is revamping the code of conduct for ISPs and asking for changes to how broadband is sold. The regulator’s survey shows that the average residential broadband speed in the UK has risen in the last 12 months from 4.1Megabits per second (Mbps) to 5.2Mbps. The report also reveals the changing nature of UK broadband.

Motherly love ‘does breed confidence’

(BBC): Being lavished with affection by your mum as a young child makes you better able to cope with the stresses and strains of adult life, say researchers. Hugs, kisses and expressive declarations of love appear to rub off and foster emotional resilience. The results are from nearly 500 people, from the US state of Rhode Island, who were studied as children and adults. A secure mother-child bond may be key, the Journal of Epidemiology and Community Health reports. But experts say it is important to know when to stop.

(BBC): Being lavished with affection by your mum as a young child makes you better able to cope with the stresses and strains of adult life, say researchers. Hugs, kisses and expressive declarations of love appear to rub off and foster emotional resilience. The results are from nearly 500 people, from the US state of Rhode Island, who were studied as children and adults. A secure mother-child bond may be key, the Journal of Epidemiology and Community Health reports. But experts say it is important to know when to stop.

Over-mothering can be intrusive and embarrassing, especially as children grow older.

The Real Never Never Land

A local businessman, writing in this month’s Journal, struggles to explain to his 14 year old grand-daughter why her generation will be saddled with a debt run up by successive governments of his. A reader could be forgiven for concluding from this that the author is what political observers would call a "deficit hawk" (political observers themselves, deficit hawks are fiscally conservative beasts, decrying excessive government borrowing on principle).

But reading on, you may be surprised to find, as I was, that the only thing he considers worse than his grand-daughter having to pay for today’s government profligacy, is having to pay for it himself. A principled stance indeed.

You see the article’s author is ardently opposed to tax, comparing the Cayman Islands government to a hungry monster determined to eat you out of house and home. But politics is as full of paradoxes as economics and this particular conundrum is surely as old as parliamentary democracy itself: How do you stop governments over-spending? One method propounded by fiscal conservatives is to "starve the beast".

The so-called "starve the beast" argument goes something like this. Governments spend money like it grows on trees. The only way to stop them spending more money is to not give them any more, that is, by constraining revenues, or taxes as they are better known. There is one tiny problem with this strategy: it doesn’t work. Governments still have access to the same, for all intents and purposes unlimited, reserve of cash no matter how much they raise in revenue.It’s called borrowing. For as long as the British government (bless its cotton socks) is willing to continue increasing the Cayman Islands’ credit limit, trying to stop the government spending money by constraining tax revenue is like trying to stop people drinking liquor on Sundays by closing liquor stores. Hey ho, there’s always the bar.

Citing "readily available statistics", the author reports that the Cayman Islands Government spends 31% of GDP while British government spending is "below 25%". A shocking statistic indeed… if it were true. According to HM Treasury (see page 59), the British government spends 47.3% of GDP. Whilst the mistake is no doubt an innocent one, The Journal itself, purporting to be a respectable business publication, should be ashamed of itself for publishing such egregious misinformation without question.

Even the staunchly ideological Miller Shaw Report disagreed that Cayman government spending was excessive compared to other western economies such as the UK, stating on page 12:

“The Cayman Islands enjoy a modest burden of government compared to most nations. Revenues consume less than 25 percent of economic output, roughly comparable to jurisdictions such as Singapore, Hong Kong, and Liechtenstein. Most developed nations, by contrast, divert larger shares of output to government, while some Nordic nations top the charts, with governments in Denmark and Sweden taking more than 50 percent of economic output.”

Citing the advice of "overseas professionals", the Journal contributor goes on, "Imposing, and then inevitably increasing taxes to paper over the ever-widening cracks will spell the economic death-knell for these islands". A broad statement, but what taxes is he referring to? I can see why his foreign friends might be scared of further fee increases or corporation tax but why would these "overseas professionals" care if Cayman brought in direct personal taxes? If anything, their costs would come down, as our government would no longer rely on them and their clients to pay its bills.

It is a preposterous over-simplification to claim that all taxes are bad for the economy, or society for that matter. Take the Danes, cited by the Miller Shaw report above, whose tax-happy government takes a 50% plus share of GDP in revenue. Perhaps the Danish government will find some comfort in their country being named the world’s happiest by a recent Gallup poll, as well as coming ninth in The Economist magazine’s authoritative 2005 study of national quality of life (among the other high-tax Nordic nations invoked by the Miller Shaw Report, Sweden came fifth, Norway third). Enough to make the most ardent fiscal libertarian pine for the fjords.

The writer offers an anecdote of business leaving the Bahamas after the introduction of nebulous "unattractive business conditions". He doesn’t go into detail, but whatever these new unattractive conditions were, they certainly weren’t direct taxes. The Bahamas have had a payroll tax since 1972. And again, in what way would direct personal taxes constitute "unattractive business conditions"? Perpetually increasing work permit and other business fees are pretty unattractive. Direct personal taxes would have precisely the opposite effect if the government were to continue to try to cut costs and simply rebalance some of the costs currently being borne by the private sector to the general public. And few things are as unattractive to business as an insolvent government.Dubai anyone?

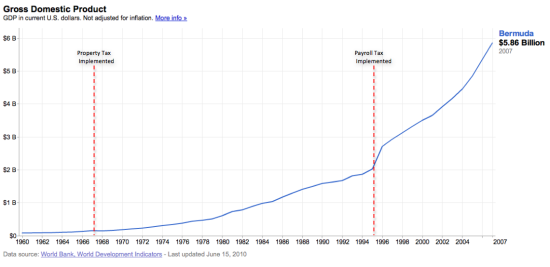

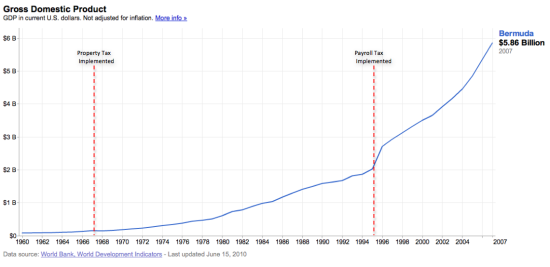

Just look what happened to those other down-and-out financial centres with direct personal taxes such as Bermuda with its annual property and payroll tax and its government spending a whopping 60% of GDP. No wonder Bermuda never amounted to anything after it brought in property tax in 1967 (well, not counting achieving the highest GDP per capita on the planet in 2005). But just look what happened when they brought in a payroll tax! Economic disaster! Right? Wrong. After introducing payroll tax in 1995, Bermuda’s GDP grew a record 35% in a single year (see chart below).

How about Jersey with its 20% income tax? How much louder a "death knell" could you get for a small island than a 20% income tax? A look at the Jersey Finance homepage reveals that the jurisdiction is in all kinds of trouble these days having won a measly four international business accolades in the last year including Best Offshore Centre (Global Investor Awards), International Finance Centre of the Year (STEP), Best International Financial Centre (International Fund & Product Awards) and coming top among offshore jurisdictions in the Global Financial Centres Index. Funny that some of the very same overseas professionals reportedly predicting a tax-induced Caymanian death spiral appear to be doling out awards to an offshore competitor with one of the highest personal tax rates of any so-called tax haven. How their financial sector must rue the day their (solvent) government introduced income tax!

Do taxes, as the author contends, "take money out of circulation in the economy"? This is the kind of economics-is-too-complicated-for-you-to-understand soundbite that is plausible for only as long as you don’t actually think about it. The government doesn’t take the money it raises in taxes and hide it in a giant vault at the base of Mount Trashmore. It spends it, almost entirely in the local economy. In fact, in the hands of the public, money is much more likely to be "taken out of circulation" by being saved or spent overseas. Not that such a fate is a bad thing for your hard-earned dollars, but it is incontrovertibly a bad thing for the local economy.

Is the civil service inefficient? You bet. Governments are inefficient by nature. Is that the same as you and I not getting value for money for our tax dollars? Not necessarily. The Cayman Islands spends an average of around CI$12,000 per resident. It collects from residents less than CI$4,000 on average. The balance is paid by the private sector and tourists. Sacking every single civil servant and completely eliminating capex would reduce government spending to around CI$6,500 per resident. So, under such impossible (or as some would argue, idyllic) conditions, you and I would probably still be getting CI$2 of services for every CI$1 we paid. And who would we accuse of gross inefficiency then?

It is precisely the strategy of demonising taxes in general, and indignantly insisting the government should spend less even though it won’t, that has backed the Cayman Islands government into the corner it is now in, having to borrow money hand over fist and increase private sector "fees" left and right to make ends meet.

Why have so many fund administrators set up and expanded offices in relatively high tax Canada instead of the Cayman Islands? Because the Canadian government doesn’t expect fund administrators to pay for their roads. Canada, like nearly every other developed nation in the world, has the crazy "socialist" notion that public services ought to be paid for by the public.

The ultimate irony is that the best strategy to reduce government spending isn’t constraining revenue, or becoming apoplectic at the mere mention of taxes, it is creating the democratic will to reduce costs by making the electorate pay for the services they receive. The reality is that there will never be any real political will, in the broadest sense, to reduce spending so long as what is being spent is mostly other people’s money (that of private sector shareholders, tourists and government debt-holders).

In any case, our friend need not necessarily worry about his grand-daughter’s financial fate. So long as her peers are as successful scaremongering about taxes in her day as he and his peers have been in ours, neither of them will have anything to worry about.

British prime minister raids dormant UK accounts

(Bloomberg): UK Prime Minister David Cameron announced plans to use “hundreds of millions of pounds” from dormant bank accounts to fund community projects, while Business Secretary Vince Cable said lenders “ripped off” customers. Cameron said he will press ahead with a proposal set out in the coalition government’s program to establish a “Big Society Bank” to finance moves by charitable groups and not-for-profit companies to take over jobs currently done by the government. “These unclaimed assets, alongside the private-sector investment that we will leverage, will mean that the Big Society Bank will over time make available hundreds of millions of pounds of new finance to some of the most dynamic social organizations in our country,” Cameron said in a speech in Liverpool, northwest England, today.

(Bloomberg): UK Prime Minister David Cameron announced plans to use “hundreds of millions of pounds” from dormant bank accounts to fund community projects, while Business Secretary Vince Cable said lenders “ripped off” customers. Cameron said he will press ahead with a proposal set out in the coalition government’s program to establish a “Big Society Bank” to finance moves by charitable groups and not-for-profit companies to take over jobs currently done by the government. “These unclaimed assets, alongside the private-sector investment that we will leverage, will mean that the Big Society Bank will over time make available hundreds of millions of pounds of new finance to some of the most dynamic social organizations in our country,” Cameron said in a speech in Liverpool, northwest England, today.

Video shows downside of Jamaica’s tourism industry

(Environment News Service): The Jamaica Environmental Trust on Thursday night launched "Jamaica for Sale," a 92 minute video documentary highlighting disturbing issues behind the island’s normally rosy sun, sea and sand tourism image. "We want to raise hard questions about the tourism industry, especially in light of the recent rise in a certain kind of tourism. There are costs. We are asking questions about these costs," said Diana McCaulay, chief executive officer of Jamaica Environmental Trust. The video features the faces and voices of Jamaicans and other Caribbean personalities talking about life in the wake of a burst of construction of mega-hotels across Jamaica’s coastline. The film shows how gains from tourism development come at a high price to the people.

(Environment News Service): The Jamaica Environmental Trust on Thursday night launched "Jamaica for Sale," a 92 minute video documentary highlighting disturbing issues behind the island’s normally rosy sun, sea and sand tourism image. "We want to raise hard questions about the tourism industry, especially in light of the recent rise in a certain kind of tourism. There are costs. We are asking questions about these costs," said Diana McCaulay, chief executive officer of Jamaica Environmental Trust. The video features the faces and voices of Jamaicans and other Caribbean personalities talking about life in the wake of a burst of construction of mega-hotels across Jamaica’s coastline. The film shows how gains from tourism development come at a high price to the people.

British Iraq war veterans to visit Cayman Islands

(X-Ray Mag): Four wounded British veterans of the Iraq war will be travelling to the British Overseas Territory of The Cayman Islands later this month to experience the islands’ acclaimed diving in an extraordinary rehabilitation programme known as Deptherapy, which has been pioneered by paraplegic Scottish diver Fraser Bathgate. The four British soldiers will be on the first ever British-led programme by The Deptherapy Foundation, which has been established by Bathgate. They will join six US soldiers to undergo a week of this unusual but highly effective form of intensive therapy. Deptherapy is in fact a scuba diving programme which has been specifically designed to help wounded soldiers rehabilitate after their return from active service.

(X-Ray Mag): Four wounded British veterans of the Iraq war will be travelling to the British Overseas Territory of The Cayman Islands later this month to experience the islands’ acclaimed diving in an extraordinary rehabilitation programme known as Deptherapy, which has been pioneered by paraplegic Scottish diver Fraser Bathgate. The four British soldiers will be on the first ever British-led programme by The Deptherapy Foundation, which has been established by Bathgate. They will join six US soldiers to undergo a week of this unusual but highly effective form of intensive therapy. Deptherapy is in fact a scuba diving programme which has been specifically designed to help wounded soldiers rehabilitate after their return from active service.

Dangers of permitting gambling in Cayman

The United Church in Jamaica and the Cayman Islands has always opposed gambling. This is principally because it is contrary to our Christian beliefs, but it affects all of society, with the evidence that gambling leads to a deterioration of the social fabric as it exploits human weaknesses, undermines work ethic, leads to increased crime, is destructive of family life and promotes personal and institutional greed. It exploits the most vulnerable in society and represents a major transfer of resources from the very poor to the very rich.

The United Church understands that government needs to broaden its revenue base. Various proposals for a national lottery and casinos have been brought up in the past, giving similar reasons, namely that government was running out of options to raise revenue. However, the country has managed to get by and find ways to keep the country prosperous without resorting to legalised gambling. It can continue to do so. An editorial on the subject in the Christian Science Monitor said it well: “A nation that fosters a reliance on chance and officially endorses a culture of irresponsibility all in the name of increased revenues and free enterprise is certainly playing games with its moral foundations.”

Crime is a serious, escalating problem in the Cayman Islands. Statistics from around the world substantiate that gambling increases crime. The poor and the youth are most vulnerable but the problem of gambling can affect anyone regardless of age, gender, race, or social status. The Commonwealth nation of Australia, that has long advocated gambling as a national pastime, is now reviewing its policy because of the growing rate of addiction and the impact on the social fabric of the nation.

It is estimated that 10% of problem gamblers and two thirds of those who are receiving counselling have committed a crime because of their gambling. The first gambling-related crime is often perpetrated in the same year as, or just a few years after, starting regular gambling.

Gambling crime can be divided into four categories: illegal gambling, crimes committed to support a gambling habit, crimes that occur around the gambling locations, family abuse.

The major reason for gamblers to commit crimes is to fund their gambling activities. Gambling crime includes theft, forgery, embezzlement, fraud. It can also include domestic violence, assault, child neglect, suicide, prostitution, vandalism, breaking and entering, and home invasion. A significant amount of the crime related to gambling is not reported to authorities.

Organised crime has a big stake in the gambling industry. One former Florida gGovernor has said, “The Mafia follows gambling like sharks follow blood.” Casinos are particularly attractive to organised crime. Casinos present ideal opportunities for the skimming of profits as well as the laundering of moneys already earned through crime. Related crime such as loansharking and prostitution follow closely.

Local proponents of gambling emphasise the supposedly tremendous employment benefits but have not published hard facts to support this contention. In the US, there have been, instead, reports of the grave economic difficulties faced by many employees of casinos. We certainly cannot afford to have any more people in Cayman being employed in poverty creating jobs. A study published by the Federal Reserve Bank of St. Louis summarised that: “The employment effects of casino gaming are difficult to quantify. A casino may draw labor from outside of the local area, thus leaving local employment conditions unchanged … It is possible that casino gaming may reduce employment in other local industries… The net effect of gaming could be positive or negative depending upon the degree to which casino gaming substitutes for or complements consumption at other local businesses.”

That possibility should not be overlooked here, where existing businesses are struggling to maintain their individual share of the tourist’s wallet. With casino gambling now so readily available in the US and our neighbouring islands, surely the question must be asked as to how will Cayman outshine their gambling industries that would cause tourists to incur the higher expense of a Cayman vacation to do what they can do at home or in one of our lower-cost neighbours. Certainly it seems basic to ask how will gambling differentiate our tourism product from that of our competitors where it is already available. It is widely suggested that this blurring of our tourism product in recent years has been a major factor in its relative decline and instead we must seek to recapture the differential advantage we previously offered.

The Cayman Islands has traditionally been known for its friendly, hospitable, Christian, hard working people. Crime used to be almost non-existent. We must all work together to restore that reputation. Introduction of legalised gambling will not do this. Government has a moral responsibility to enact laws which do not undermine or weaken the moral fabric of society. Let us clearly convey this to our elected representatives as they seek to hear the will of the people. Cayman can learn from the serious problems encountered by other countries that have extensive gambling and not follow down that same path. Any potential short term gain does not justify the long term detrimental effects that gambling will have on our society.

Teenagers ‘risk premature babies’

(BBC): Pregnant teenagers are more likely to give birth prematurely and have a small baby than women in their 20s, says an Irish research team. Fourteen to 17-year-olds were also more likely to give birth early if they were having a second child, a study of more than 50,000 women in England found. The findings, reported in BMC Pregnancy and Childbirth, highlighted the importance of routine medical checks. The team said more studies were needed to find out why the young were at risk. The study included all women aged between 14 and 29 who had given birth in north-west England over a two-year period.

(BBC): Pregnant teenagers are more likely to give birth prematurely and have a small baby than women in their 20s, says an Irish research team. Fourteen to 17-year-olds were also more likely to give birth early if they were having a second child, a study of more than 50,000 women in England found. The findings, reported in BMC Pregnancy and Childbirth, highlighted the importance of routine medical checks. The team said more studies were needed to find out why the young were at risk. The study included all women aged between 14 and 29 who had given birth in north-west England over a two-year period.