(CNS): According to some of Cayman’s leading pension providers, less than 1% of their members have taken up the opportunity offered by government to take a holiday from the compulsory pension payment of 10% of earnings, made up of a joint contribution between employers and employees. Brian Williams, CEO of Saxon Administration, the agent for Silver Thatch, said the take-up is not as much as the industry was expecting and he believes employees recognise the advantage of gaining the 5% match from their employers and are reluctant to give it up. Although the temporary amendment to the law is relatively recent, Williams said he did not expect there to be any considerable increase over the coming weeks.

(CNS): According to some of Cayman’s leading pension providers, less than 1% of their members have taken up the opportunity offered by government to take a holiday from the compulsory pension payment of 10% of earnings, made up of a joint contribution between employers and employees. Brian Williams, CEO of Saxon Administration, the agent for Silver Thatch, said the take-up is not as much as the industry was expecting and he believes employees recognise the advantage of gaining the 5% match from their employers and are reluctant to give it up. Although the temporary amendment to the law is relatively recent, Williams said he did not expect there to be any considerable increase over the coming weeks.

“We don’t really expect to see any great demand for the holiday now,” he said. “It seems our clients recognise that pensions are a long term commitment and that in the long run it is in their best interests to continue paying into the fund. Also employees see that they will lose the contribution from their employer if they opt to take the break and most see how that is not worthwhile.”

Williams said that Silver Thatch worked hard on communicating with its members and believed that the flow of information had helped. He said the young people involved in the recent investment competition run by Saxon had also done a great job carrying the message home to family friends about the importance of long term investments and pensions for the future.

A spokesperson for Fidelity also said they had seen very few people opt out of its scheme and said figures were around 1% of their members. “It is still early and we may see a few more but we really don’t expect to see a major take up after all,” Fidelity said.

While Silver Thatch and Fidelity members tend to be employed by larger firms and professionals, the Chamber of Commerce Pension scheme has a wider membership among the lower paid sector and work permit holders. As a result, Robert Schultz the Customer Relationship Manager of the Chamber Pension Plan, says he expects the current low take-up to increase over the next few weeks but was surprised that it wasn’t more widely utilised.

“As it stands, about 2 percent of our active members have participated,” he said. “I expected more due to the demographic that I saw being effected most.”

Schultz explained that work permit holders from the Jamaican and Filipino communities tend to remit money and so he was anticipating a significant amount would be opting out and having a more marked impact on the plan. “Hopefully they are being properly educated by employers that if they participate then they give up the 5 percent match.”

At present only 112 people of the more than 6,250 active participants have taken up the holiday, but Schultz said more applications had come in so the figure would go up a little more.

CNS also contacted the Pensions Office last week but it said it could not reveal any of the statistics to the press without following the protocol of contacting the ministry for permission first, and as yet no information has been forthcoming.

However, a significant number of business owners told CNS that very few employees have chosen to take the holiday. A member of the Pension Board also said it was an unwise move for people to take up the suspension as it would have a much greater negative impact down the line, far outweighing any immediate cash gain in the short term. “Losing the five percent match is a significant disincentive for many people and its good to see most employees are smart enough not to take up thesuspension,” a member said.

There were, however, concerns from the board and in the wider community that one or two unscrupulous employers were cajoling members to opt out of their pension plans against their will.

Brian Williams said he had also heard this was happening but he said employees should not be coerced or threatened into taking up the holiday. He advised employers to talk with their staff properly and not force them to take the break.

“It seems there is some talk of coercion and we urge employers to have constructive conversations with their employees regarding the pension holiday and if businesses are struggling it may be better to reduce the contribution instead of stopping altogether,” he added. Williams suggested reducing contributions to 6% from 10% with each party paying 3% instead of five. He explained this will improve cash flow a little for both employer and employees without causing as much damage to their long term investment.

Amendments to the pension law were passed in the Legislative Assembly in February and came into effect at the end of April. The changes allow employers who are up to date with their compulsory contributions and who get the agreement of their employees to take a break from their legal obligations to pay into pension schemes for at least one year.

Rolston Anglin, the minister with responsibility for employment who brought the amendment bill, said the goal was to reduce the burden on employers as a result of an increase in work permit fees and to give employees who are also feeling the economic pinch access to the 5% contribution they are asked to make under the law.

Government also hopes it will give the numerous delinquent employers time to catch up on the significant outstanding payments. He said, however, that employees should not be forced to opt out and only employers in compliance with the law would be allowed to stop making contributions.

The holiday period is for 12 months for Caymanian workers and 24 months for those holding a work permit.

“This measure is to try and put people in a position to have more money in their pockets and should result in a general easing of pressure,” the minister stated. With no direct taxation in the Cayman Islands, Anglin pointed out that government did not have many tools to manipulate the economic pressure on its people in the same way other governments did and this offered a way to give the people a small economic break.

“Given the economic hardship at the moment, people have been askingfor some form of relief,” Anglin told the LA. “We don’t have an income tax that we can use to manipulate the economy … we needed to find a mechanism by which we could help and we will see if a change in this law will have the desired effect.”

Anglin said the suspension would be reviewed after the first twelve months.

Continue Reading

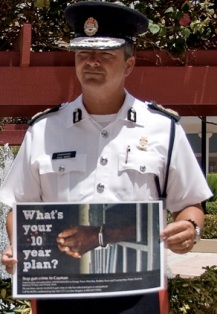

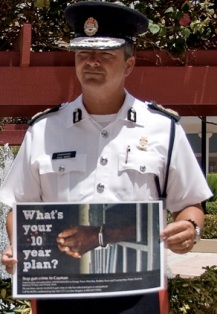

(CNS): Many of the current inmates in the country’s prison know only too well the dire consequences of firearms, and the police hope they can influence the prisoners to send a message to their family and friends on the outside to give up illegal weapons during the current amnesty. Over one hundred posters advertising the RCIPS gun amnesty have been placed in prominent areas within HMP Northward as the campaign goes ‘behind bars’. The posters ask people to consider “What’s your ten year plan?” – ten years being the sentence imposed for possession of illegal or unlicensed firearms. (Left Police Commissioner launches amnesty. Photo by Dennie Warren Jr)

(CNS): Many of the current inmates in the country’s prison know only too well the dire consequences of firearms, and the police hope they can influence the prisoners to send a message to their family and friends on the outside to give up illegal weapons during the current amnesty. Over one hundred posters advertising the RCIPS gun amnesty have been placed in prominent areas within HMP Northward as the campaign goes ‘behind bars’. The posters ask people to consider “What’s your ten year plan?” – ten years being the sentence imposed for possession of illegal or unlicensed firearms. (Left Police Commissioner launches amnesty. Photo by Dennie Warren Jr)

(CNS): According to some of Cayman’s leading pension providers, less than 1% of their members have taken up the opportunity offered by government to take a holiday from the compulsory pension payment of 10% of earnings, made up of a joint contribution between employers and employees. Brian Williams, CEO of Saxon Administration, the agent for Silver Thatch, said the take-up is not as much as the industry was expecting and he believes employees recognise the advantage of gaining the 5% match from their employers and are reluctant to give it up. Although the temporary amendment to the law is relatively recent, Williams said he did not expect there to be any considerable increase over the coming weeks.

(CNS): According to some of Cayman’s leading pension providers, less than 1% of their members have taken up the opportunity offered by government to take a holiday from the compulsory pension payment of 10% of earnings, made up of a joint contribution between employers and employees. Brian Williams, CEO of Saxon Administration, the agent for Silver Thatch, said the take-up is not as much as the industry was expecting and he believes employees recognise the advantage of gaining the 5% match from their employers and are reluctant to give it up. Although the temporary amendment to the law is relatively recent, Williams said he did not expect there to be any considerable increase over the coming weeks.

(CNS): Despite the lure of the more sophisticated computer and electronic games nineteen families still took part in a more traditional games night recently as part of Child month. Hosted by Hobbies and Books kids of all ages got done to some classic board games from dominos to snakes and ladders. Planned by the Child Month Committee and the Department of Children and Family Services (DCFS Chairperson Cassandra Parchment said the night was “a tremendous success,” with more families turning out than anticipated.

(CNS): Despite the lure of the more sophisticated computer and electronic games nineteen families still took part in a more traditional games night recently as part of Child month. Hosted by Hobbies and Books kids of all ages got done to some classic board games from dominos to snakes and ladders. Planned by the Child Month Committee and the Department of Children and Family Services (DCFS Chairperson Cassandra Parchment said the night was “a tremendous success,” with more families turning out than anticipated.

(CNS): Police officers and soldiers were killed and injured as the civil unrest in Jamaica continued on Monday and security forces engaged in fire-fights with gunmen in Kingston. According to the Jamaican press, civilians, including at least one woman, have also been shot as the violence escalates and spreads to other parts of the city, including the old capital of Spanish Town in St Catherine. The Jamaica Observer reports that soldiers had launched on offensive in Tivoli Gardens, Christopher ‘Dudus’ Coke’s home ground and the power base of Prime Minister Bruce Golding’s West Kingston constituency.

(CNS): Police officers and soldiers were killed and injured as the civil unrest in Jamaica continued on Monday and security forces engaged in fire-fights with gunmen in Kingston. According to the Jamaican press, civilians, including at least one woman, have also been shot as the violence escalates and spreads to other parts of the city, including the old capital of Spanish Town in St Catherine. The Jamaica Observer reports that soldiers had launched on offensive in Tivoli Gardens, Christopher ‘Dudus’ Coke’s home ground and the power base of Prime Minister Bruce Golding’s West Kingston constituency.