Archive for July 19th, 2010

The Real Never Never Land

A local businessman, writing in this month’s Journal, struggles to explain to his 14 year old grand-daughter why her generation will be saddled with a debt run up by successive governments of his. A reader could be forgiven for concluding from this that the author is what political observers would call a "deficit hawk" (political observers themselves, deficit hawks are fiscally conservative beasts, decrying excessive government borrowing on principle).

But reading on, you may be surprised to find, as I was, that the only thing he considers worse than his grand-daughter having to pay for today’s government profligacy, is having to pay for it himself. A principled stance indeed.

You see the article’s author is ardently opposed to tax, comparing the Cayman Islands government to a hungry monster determined to eat you out of house and home. But politics is as full of paradoxes as economics and this particular conundrum is surely as old as parliamentary democracy itself: How do you stop governments over-spending? One method propounded by fiscal conservatives is to "starve the beast".

The so-called "starve the beast" argument goes something like this. Governments spend money like it grows on trees. The only way to stop them spending more money is to not give them any more, that is, by constraining revenues, or taxes as they are better known. There is one tiny problem with this strategy: it doesn’t work. Governments still have access to the same, for all intents and purposes unlimited, reserve of cash no matter how much they raise in revenue.It’s called borrowing. For as long as the British government (bless its cotton socks) is willing to continue increasing the Cayman Islands’ credit limit, trying to stop the government spending money by constraining tax revenue is like trying to stop people drinking liquor on Sundays by closing liquor stores. Hey ho, there’s always the bar.

Citing "readily available statistics", the author reports that the Cayman Islands Government spends 31% of GDP while British government spending is "below 25%". A shocking statistic indeed… if it were true. According to HM Treasury (see page 59), the British government spends 47.3% of GDP. Whilst the mistake is no doubt an innocent one, The Journal itself, purporting to be a respectable business publication, should be ashamed of itself for publishing such egregious misinformation without question.

Even the staunchly ideological Miller Shaw Report disagreed that Cayman government spending was excessive compared to other western economies such as the UK, stating on page 12:

“The Cayman Islands enjoy a modest burden of government compared to most nations. Revenues consume less than 25 percent of economic output, roughly comparable to jurisdictions such as Singapore, Hong Kong, and Liechtenstein. Most developed nations, by contrast, divert larger shares of output to government, while some Nordic nations top the charts, with governments in Denmark and Sweden taking more than 50 percent of economic output.”

Citing the advice of "overseas professionals", the Journal contributor goes on, "Imposing, and then inevitably increasing taxes to paper over the ever-widening cracks will spell the economic death-knell for these islands". A broad statement, but what taxes is he referring to? I can see why his foreign friends might be scared of further fee increases or corporation tax but why would these "overseas professionals" care if Cayman brought in direct personal taxes? If anything, their costs would come down, as our government would no longer rely on them and their clients to pay its bills.

It is a preposterous over-simplification to claim that all taxes are bad for the economy, or society for that matter. Take the Danes, cited by the Miller Shaw report above, whose tax-happy government takes a 50% plus share of GDP in revenue. Perhaps the Danish government will find some comfort in their country being named the world’s happiest by a recent Gallup poll, as well as coming ninth in The Economist magazine’s authoritative 2005 study of national quality of life (among the other high-tax Nordic nations invoked by the Miller Shaw Report, Sweden came fifth, Norway third). Enough to make the most ardent fiscal libertarian pine for the fjords.

The writer offers an anecdote of business leaving the Bahamas after the introduction of nebulous "unattractive business conditions". He doesn’t go into detail, but whatever these new unattractive conditions were, they certainly weren’t direct taxes. The Bahamas have had a payroll tax since 1972. And again, in what way would direct personal taxes constitute "unattractive business conditions"? Perpetually increasing work permit and other business fees are pretty unattractive. Direct personal taxes would have precisely the opposite effect if the government were to continue to try to cut costs and simply rebalance some of the costs currently being borne by the private sector to the general public. And few things are as unattractive to business as an insolvent government.Dubai anyone?

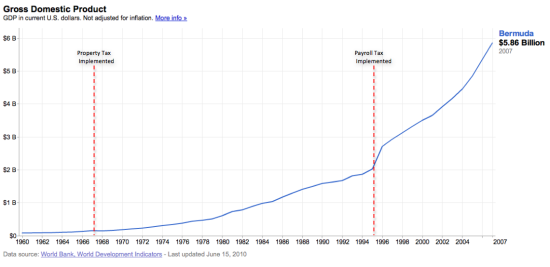

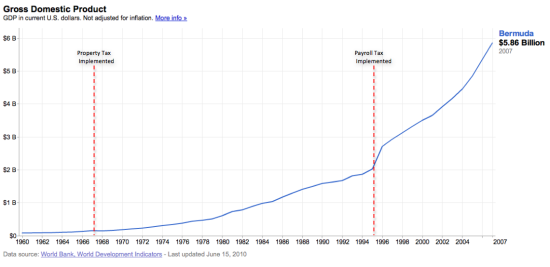

Just look what happened to those other down-and-out financial centres with direct personal taxes such as Bermuda with its annual property and payroll tax and its government spending a whopping 60% of GDP. No wonder Bermuda never amounted to anything after it brought in property tax in 1967 (well, not counting achieving the highest GDP per capita on the planet in 2005). But just look what happened when they brought in a payroll tax! Economic disaster! Right? Wrong. After introducing payroll tax in 1995, Bermuda’s GDP grew a record 35% in a single year (see chart below).

How about Jersey with its 20% income tax? How much louder a "death knell" could you get for a small island than a 20% income tax? A look at the Jersey Finance homepage reveals that the jurisdiction is in all kinds of trouble these days having won a measly four international business accolades in the last year including Best Offshore Centre (Global Investor Awards), International Finance Centre of the Year (STEP), Best International Financial Centre (International Fund & Product Awards) and coming top among offshore jurisdictions in the Global Financial Centres Index. Funny that some of the very same overseas professionals reportedly predicting a tax-induced Caymanian death spiral appear to be doling out awards to an offshore competitor with one of the highest personal tax rates of any so-called tax haven. How their financial sector must rue the day their (solvent) government introduced income tax!

Do taxes, as the author contends, "take money out of circulation in the economy"? This is the kind of economics-is-too-complicated-for-you-to-understand soundbite that is plausible for only as long as you don’t actually think about it. The government doesn’t take the money it raises in taxes and hide it in a giant vault at the base of Mount Trashmore. It spends it, almost entirely in the local economy. In fact, in the hands of the public, money is much more likely to be "taken out of circulation" by being saved or spent overseas. Not that such a fate is a bad thing for your hard-earned dollars, but it is incontrovertibly a bad thing for the local economy.

Is the civil service inefficient? You bet. Governments are inefficient by nature. Is that the same as you and I not getting value for money for our tax dollars? Not necessarily. The Cayman Islands spends an average of around CI$12,000 per resident. It collects from residents less than CI$4,000 on average. The balance is paid by the private sector and tourists. Sacking every single civil servant and completely eliminating capex would reduce government spending to around CI$6,500 per resident. So, under such impossible (or as some would argue, idyllic) conditions, you and I would probably still be getting CI$2 of services for every CI$1 we paid. And who would we accuse of gross inefficiency then?

It is precisely the strategy of demonising taxes in general, and indignantly insisting the government should spend less even though it won’t, that has backed the Cayman Islands government into the corner it is now in, having to borrow money hand over fist and increase private sector "fees" left and right to make ends meet.

Why have so many fund administrators set up and expanded offices in relatively high tax Canada instead of the Cayman Islands? Because the Canadian government doesn’t expect fund administrators to pay for their roads. Canada, like nearly every other developed nation in the world, has the crazy "socialist" notion that public services ought to be paid for by the public.

The ultimate irony is that the best strategy to reduce government spending isn’t constraining revenue, or becoming apoplectic at the mere mention of taxes, it is creating the democratic will to reduce costs by making the electorate pay for the services they receive. The reality is that there will never be any real political will, in the broadest sense, to reduce spending so long as what is being spent is mostly other people’s money (that of private sector shareholders, tourists and government debt-holders).

In any case, our friend need not necessarily worry about his grand-daughter’s financial fate. So long as her peers are as successful scaremongering about taxes in her day as he and his peers have been in ours, neither of them will have anything to worry about.

Officers on patrol discover stolen goods

(CNS): In the early hours of Saturday morning (17 July), officers engaged in mobile patrol duties in the George Town area stopped a suspicious vehicle in South Church Street at about 4.30am. The officers discovered a quantity of stolen property within the Mazda minivan, including a lap top computer, cell phones and a handbag. The two men in the vehicle, aged 18 and 28 years, were arrested on suspicion of burglary. Enquiries revealed that those items and a Hyundai motor car had been stolen from a home in South Church Street a short time earlier. The officers involved in the enquiry traced the stolen vehicle a short distance away.

About 5.00am that morning the householder awoke to find the property missing. As he was telephoning the police to report the matter he was advised that officers had arrested two suspects and that his property had been recovered.

Detective Sergeant Richard Scott is appealing for anyone who may have any information about the crime to contact George Town CID on 949-4222 or the confidential Crime Stoppers number 800-8477(TIPS).

British prime minister raids dormant UK accounts

(Bloomberg): UK Prime Minister David Cameron announced plans to use “hundreds of millions of pounds” from dormant bank accounts to fund community projects, while Business Secretary Vince Cable said lenders “ripped off” customers. Cameron said he will press ahead with a proposal set out in the coalition government’s program to establish a “Big Society Bank” to finance moves by charitable groups and not-for-profit companies to take over jobs currently done by the government. “These unclaimed assets, alongside the private-sector investment that we will leverage, will mean that the Big Society Bank will over time make available hundreds of millions of pounds of new finance to some of the most dynamic social organizations in our country,” Cameron said in a speech in Liverpool, northwest England, today.

(Bloomberg): UK Prime Minister David Cameron announced plans to use “hundreds of millions of pounds” from dormant bank accounts to fund community projects, while Business Secretary Vince Cable said lenders “ripped off” customers. Cameron said he will press ahead with a proposal set out in the coalition government’s program to establish a “Big Society Bank” to finance moves by charitable groups and not-for-profit companies to take over jobs currently done by the government. “These unclaimed assets, alongside the private-sector investment that we will leverage, will mean that the Big Society Bank will over time make available hundreds of millions of pounds of new finance to some of the most dynamic social organizations in our country,” Cameron said in a speech in Liverpool, northwest England, today.

Truck used to smash & grab

(CNS): Update 10:15am Monday: Police said Monday morning that an 18-year-old man has been arrested and is in police custody following an early morning “ramraid” at a George Town store yesterday. About 4.20am on Sunday 18 July, a white truck crashed into the door of Boosie Store in Mary Street, George Town. Two men jumped from the truck and grabbed the cash register from the store, and afterwards ran off towards Rock Hole. Police say that officers immediately attended and conducted a search in the area. As a result of the search an 18-year-old man was arrested on suspicion of burglary and is currently in police custody. (Photo by Dennie Warren Jr)

(CNS): Update 10:15am Monday: Police said Monday morning that an 18-year-old man has been arrested and is in police custody following an early morning “ramraid” at a George Town store yesterday. About 4.20am on Sunday 18 July, a white truck crashed into the door of Boosie Store in Mary Street, George Town. Two men jumped from the truck and grabbed the cash register from the store, and afterwards ran off towards Rock Hole. Police say that officers immediately attended and conducted a search in the area. As a result of the search an 18-year-old man was arrested on suspicion of burglary and is currently in police custody. (Photo by Dennie Warren Jr)

The second man involved in the incident has not yet been traced.

The suspects were described as having white t-shirts covering their faces and dressed in black clothing. Detective Constable Colin Pryce is appealing for anyone who may have any information about the crime to contact George Town CID on 949-4222 or the confidential Crime Stoppers number 800-8477(TIPS).

Brac seamen rebuild shelter

(CNS): An unofficial emergency shelter on Cayman Brac’s Bluff has been rebuilt following its destruction during Hurricane Paloma in 2008. The Cayman Brac and Little Cayman Veteran’s & Seaman’s Society has, for the second time, raised funds to build the shelter, which was officially re-opened on Saturday 17 July, 20 months after the storm. With no reserve funds and no insurance, the V&SS members set about raising the half a million dollars to rebuild, and the society’s president, Roy Walton, said they never doubted at any time that they would do so.

(CNS): An unofficial emergency shelter on Cayman Brac’s Bluff has been rebuilt following its destruction during Hurricane Paloma in 2008. The Cayman Brac and Little Cayman Veteran’s & Seaman’s Society has, for the second time, raised funds to build the shelter, which was officially re-opened on Saturday 17 July, 20 months after the storm. With no reserve funds and no insurance, the V&SS members set about raising the half a million dollars to rebuild, and the society’s president, Roy Walton, said they never doubted at any time that they would do so.

Donations included CI$100,000 from HSBC (Cayman) and $60,000 from the government’s Paloma Relief Fund, as well as $10,000 each from the Maritime Authority of the Cayman Islands, the private Brac Relief Fund, and funds donated by staff at PricewaterhouseCoopers. Phoenix Construction did the construction work for cost plus 5%, and among the individual donations, Linton Tibbetts and thefamily of Captain Charles Kirkconnell made significant contributions.

The semi-circular, coated steal roof of the first Veteran’s & Seaman’s Centre, though designed to withstand 110mph winds, crumpled as the storm passed about 6:00am on Saturday, 8 November 2008, when it is believed a tornado tore into the shelter, leaving the main hall severely compromised. Approximately 94 people were in the shelter at the time, though no one was seriously injured and everyone was able to cram into the kitchen and bathroom area until the storm passed. (Right: The V&S Center after hurricane Paloma)

The semi-circular, coated steal roof of the first Veteran’s & Seaman’s Centre, though designed to withstand 110mph winds, crumpled as the storm passed about 6:00am on Saturday, 8 November 2008, when it is believed a tornado tore into the shelter, leaving the main hall severely compromised. Approximately 94 people were in the shelter at the time, though no one was seriously injured and everyone was able to cram into the kitchen and bathroom area until the storm passed. (Right: The V&S Center after hurricane Paloma)

Rebuilt almost from the foundation, the reconstructed building sits on the same footprint (96 feet by 45 feet) as the original, built with steel reinforced concrete block and poured concrete. Replacing the steel roof was considered too expensive, so the new roof is a more traditional hip design, with an exterior 6:12 pitch and interior 3:12 pitch. The new doors are all steel and there is now a wheelchair ramp to the south side entrance.

After the opening, Walton told CNS he was “as happy as a lark” and extremely proud of the members. “We’re a ship that has good crew on board,” he said.

After the opening, Walton told CNS he was “as happy as a lark” and extremely proud of the members. “We’re a ship that has good crew on board,” he said.

The president (right) and Vice President Arlin Tatum (left) said that right after Paloma the S&VS members were discouraged but were determined to rebuild, no matter how long it took. Now that the centre is open they hope that it will be used for functions, for which there is a small charge that goes towards upkeep and fundraising.

The Veterans & Seaman’s Centre was officially opened in May 2003 by the Earl of Wessex.

It is built on land provided by government on a 99-year peppercorn lease on Ashton Reid Drive, close to the Aston Rutty Civic Centre, the largest shelter on Cayman Brac.

At the reopening, the ribbon was cut by the society president and vice president, MLA Moses Kirkconnell and District Commissioner Ernie Scott. Acting Premier Julianna O’Connor Connolly attended, but because flights were cancelled due to rain, many of the dignitaries and supporters of the V&SS were unable to be there for the occasion. (Right: the interior of the building after Paloma)

At the reopening, the ribbon was cut by the society president and vice president, MLA Moses Kirkconnell and District Commissioner Ernie Scott. Acting Premier Julianna O’Connor Connolly attended, but because flights were cancelled due to rain, many of the dignitaries and supporters of the V&SS were unable to be there for the occasion. (Right: the interior of the building after Paloma)

The society has approximately 115 members on all three islands and in the US. Members either have three years experience at sea or in the military, or are the children of veterans or seamen.

See full list of awards presented at the reopening ceremony.