The Real Never Never Land

A local businessman, writing in this month’s Journal, struggles to explain to his 14 year old grand-daughter why her generation will be saddled with a debt run up by successive governments of his. A reader could be forgiven for concluding from this that the author is what political observers would call a "deficit hawk" (political observers themselves, deficit hawks are fiscally conservative beasts, decrying excessive government borrowing on principle).

But reading on, you may be surprised to find, as I was, that the only thing he considers worse than his grand-daughter having to pay for today’s government profligacy, is having to pay for it himself. A principled stance indeed.

You see the article’s author is ardently opposed to tax, comparing the Cayman Islands government to a hungry monster determined to eat you out of house and home. But politics is as full of paradoxes as economics and this particular conundrum is surely as old as parliamentary democracy itself: How do you stop governments over-spending? One method propounded by fiscal conservatives is to "starve the beast".

The so-called "starve the beast" argument goes something like this. Governments spend money like it grows on trees. The only way to stop them spending more money is to not give them any more, that is, by constraining revenues, or taxes as they are better known. There is one tiny problem with this strategy: it doesn’t work. Governments still have access to the same, for all intents and purposes unlimited, reserve of cash no matter how much they raise in revenue.It’scalled borrowing. For as long as the British government (bless its cotton socks) is willing to continue increasing the Cayman Islands’ credit limit, trying to stop the government spending money by constraining tax revenue is like trying to stop people drinking liquor on Sundays by closing liquor stores. Hey ho, there’s always the bar.

Citing "readily available statistics", the author reports that the Cayman Islands Government spends 31% of GDP while British government spending is "below 25%". A shocking statistic indeed… if it were true. According to HM Treasury (see page 59), the British government spends 47.3% of GDP. Whilst the mistake is no doubt an innocent one, The Journal itself, purporting to be a respectable business publication, should be ashamed of itself for publishing such egregious misinformation without question.

Even the staunchly ideological Miller Shaw Report disagreed that Cayman government spending was excessive compared to other western economies such as the UK, stating on page 12:

“The Cayman Islands enjoy a modest burden of government compared to most nations. Revenues consume less than 25 percent of economic output, roughly comparable to jurisdictions such as Singapore, Hong Kong, and Liechtenstein. Most developed nations, by contrast, divert larger shares of output to government, while some Nordic nations top the charts, with governments in Denmark and Sweden taking more than 50 percent of economic output.”

Citing the advice of "overseas professionals", the Journal contributor goes on, "Imposing, and then inevitably increasing taxes to paper over the ever-widening cracks will spell the economic death-knell for these islands". A broad statement, but what taxes is he referring to? I can see why his foreign friends might be scared of further fee increases or corporation tax but why would these "overseas professionals" care if Cayman brought in direct personal taxes? If anything, their costs would come down, as our government would no longer rely on them and their clients to pay its bills.

It is a preposterous over-simplification to claim that all taxes are bad for the economy, or society for that matter. Take the Danes, cited by the Miller Shaw report above, whose tax-happy government takes a 50% plus share of GDP in revenue. Perhaps the Danish government will find some comfort in their country being named the world’s happiest by a recent Gallup poll, as well as coming ninth in The Economist magazine’s authoritative 2005 study of national quality of life (among the other high-tax Nordic nations invoked by the Miller Shaw Report, Sweden came fifth, Norway third). Enough to make the most ardent fiscal libertarian pine for the fjords.

The writer offers an anecdote of business leaving the Bahamas after the introduction of nebulous "unattractive business conditions". He doesn’t go into detail, but whatever these new unattractive conditions were, they certainly weren’t direct taxes. The Bahamas have had a payroll tax since 1972. And again, in what way would direct personal taxes constitute "unattractive business conditions"? Perpetually increasing work permit and other business fees are pretty unattractive. Direct personal taxes would have precisely the opposite effect if the government were to continue to try to cut costs and simply rebalance some of the costs currently being borne by the private sector to the general public. And few things are as unattractive to business as an insolvent government.Dubai anyone?

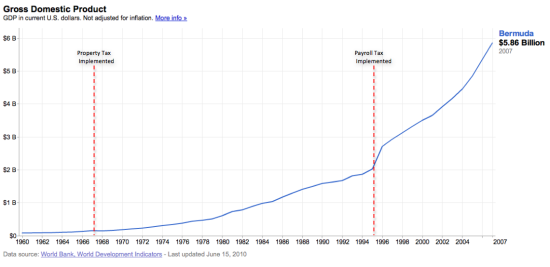

Just look what happened to those other down-and-out financial centres with direct personal taxes such as Bermuda with its annual property and payroll tax and its government spending a whopping 60% of GDP. No wonder Bermuda never amounted to anything after it brought in property tax in 1967 (well, not counting achieving the highest GDP per capita on the planet in 2005). But just look what happened when they brought in a payroll tax! Economic disaster! Right? Wrong. After introducing payroll tax in 1995, Bermuda’s GDP grew a record 35% in a single year (see chart below).

How about Jersey with its 20% income tax? How much louder a "death knell" could you get for a small island than a 20% income tax? A look at the Jersey Finance homepage reveals that the jurisdiction is in all kinds of trouble these days having won a measly four international business accolades in the last year including Best Offshore Centre (Global Investor Awards), International Finance Centre of the Year (STEP), Best International Financial Centre (International Fund & Product Awards) and coming top among offshore jurisdictions in the Global Financial Centres Index. Funny that some of the very same overseas professionals reportedly predicting a tax-induced Caymanian death spiral appear to be doling out awards to an offshore competitor with one of the highest personal tax rates of any so-called tax haven. How their financial sector must rue the day their (solvent) government introduced income tax!

Do taxes, as the author contends, "take money out of circulation in the economy"? This is the kind of economics-is-too-complicated-for-you-to-understand soundbite that is plausible for only as long as you don’t actually think about it. The government doesn’t take the money it raises in taxes and hide it in a giant vault at the base of Mount Trashmore. It spends it, almost entirely in the local economy. In fact, in the hands of the public, money is much more likely to be "taken out of circulation" by being saved or spent overseas. Not that such a fate is a bad thing for your hard-earned dollars, but it is incontrovertibly a bad thing for the local economy.

Is the civil service inefficient? You bet. Governments are inefficient by nature. Is that the same as you and I not getting value for money for our tax dollars? Not necessarily. The Cayman Islands spends an average of around CI$12,000 per resident. It collects from residents less than CI$4,000 on average. The balance is paid by the private sector and tourists. Sacking every single civil servant and completely eliminating capex would reduce government spending to around CI$6,500 per resident. So, under such impossible (or as some would argue, idyllic) conditions, you and I would probably still be getting CI$2 of services for every CI$1 we paid. And who would we accuse of gross inefficiency then?

It is precisely the strategy of demonising taxes in general, and indignantly insisting the government should spend less even though it won’t, that has backed the Cayman Islands government into the corner it is now in, having to borrow money hand over fist and increase private sector "fees" left and right to make ends meet.

Why have so many fund administrators set up and expanded offices in relatively high tax Canada instead of the Cayman Islands? Because the Canadian government doesn’t expect fund administrators to pay for their roads. Canada, like nearly every other developed nation in the world, has the crazy "socialist" notion that public services ought to be paid for by the public.

The ultimate irony is that the best strategy to reduce government spending isn’t constraining revenue, or becoming apoplectic at the mere mention of taxes, it is creating the democratic will to reduce costs by making the electorate pay for the services they receive. The reality is that there will never be any real political will, in the broadest sense, to reduce spending so long as what is being spent is mostly other people’s money (that of private sector shareholders, tourists and government debt-holders).

In any case, our friend need not necessarily worry about his grand-daughter’s financial fate. So long as her peers are as successful scaremongering about taxes in her day as he and his peers have been in ours, neither of them will have anything to worry about.

Category: Viewpoint

As Tim said.. glad this conversation is now at least beginning to be had.

Also interesting that people are keen to jump in to comment on blogs, but loath to write their thoughts down otherwise.

As some will know, I’ve written Viewpoints on CNS before (and got a number of comments), but, though I currently write a monthly column for the Journal and get lots of phone calls and people stopping me when out and about to discuss them… very few emails…just interesting that we will all jump on with a quick comment on a blog, but few take the time to think about what the original Viewpoint writer has to say, then think about and research any response or rebuttal before writing it.. no, far too many "brain dumps".

If this (or any) conversation is to have value, let’s try to do ourselves and Cayman credit by putting as much thought into our replies as most Viewpoint contributors do into theirs…

Meanwhile, hope you all enjoy my August column… the part of this Viewpoint about Denmark you’ll find has some real parallels.

Thanks to CNS for the platform for all… let’s keep the conversations going… and make them as well thought out and meaningful as we can.

Funnily enough the graph for government debt looks very similar to Bermuda as the GDP graph above.

The introduction of taxes didn’t drop government debt but increased it, as government just spent more and more and became more inefficient, in fact the recently just increased their taxes further.

Bermuda has racked up $679,000,000 of public debt in just a few years, even with the introduction of taxes, which the future generations will still have to pay off on top of the all the extra taxes they will have to pay.

The answer: smaller government. The civil service has to stop being used to pick up workers the private sector has left behind. Education is key for younger Caymanians, so they can be employed happily by the private sector.

The stigma against Caymanian workers has to end. Maybe companies can start more secondments with other countries so Caymanians workers get increased world exposure. The audit firms could definately do more of this.

If the introduction of taxes in Cayman is the final coffin in Cayman’s financial industry, then do you think any measures will save Cayman? could Cayman give 30,000 Caymanians a living after the WP holders have left? Government would have less money and so will lay off more people. Who will employ them?

Is the introduciton of taxes worth the risk?

The idea of direct taxation is very familiar to me as I have lived with it my entire life. What about Cayman in the introduction of direct taxation? The collection of garbage fees has been grossly unsuccessful in the country among a portion of the society.

If and when direct taxation is introduced to the Cayman Islands the government needs to be prepared to forclose and seize people’s property for non payment of taxes or send them to Northward for tax fraud as is done in other countries.

To talk about the implementation of direct taxation and not be prepared to accept these responsiblities would be grossly irresponsible.

It is very good to see the real debate starting to take place. We should not assume that the current Cayman model is necessarily correct and sustainable for the long term future. Looking back through rose tinted glasses, as so many are doing, fails to recognise reality.

The recent borrowings have bought us some time…but not much…to reassess the current model and to change it for a sustainable regime. This will involve recognising that the services Government provides, the way in which the Government delivers those services and the way we pay for them will have to change.

Cayman can no longer rely on "renting out the Cayman platform" for tourism and financial services to generate the "landlord’s" income required to deliver the services the community needs and rightfully expects. The users of our tourism and financial services products will simply not pay more for them. They will go elsewhere if we price ourselves out of the markets.

So we need to look closer to home and build a fairer, more efficient and more logical system of revenue raising that relates more directly the payment for services delivered by those who actually use or benefit from them.

It bears repeating that a reasonable community service charge tied to property is a very fair, broadly based and efficient way of raising revenue and is sustainable in times of economic downturns. And it should apply to local and foreign owners alike (with appropriate banding and exemptions).

I agree with those who warn of the danger of an ever increasing levy once it is introduced. But the same arguments apply eqally to stamp duty, import duty, work permit fees etc. The way to protect against egregious rates is to have an aware and responsible voter base that controls errant politicians at the polls every four years. That is how democracy works.

We need to spend within our means and save for a rainy day. It’s simple.

It really is not simple, Dennie. Either we the public have to lower our demands on govt. or we will have to pay taxes to meet those demands. We can’t eat our cake and have it too. No longer will the financial industry pay for our infrastructural needs.

Of course the politicians are also at fault. They say they are reducing govt. expenditure in order to reduce the deficit and then promptly spend any savings on an unnecessary hurricane shelter/recreational centre in Cayman Brac. Th same govt,. that, quite correctly, criticised the previous for extravagant spending in the face of a recession then proceeds to spend extravagantly in the middle of a serious recession when it says we are "broke".

This post is dripping with misinformation as it outlines favorable accolades to other jurisdictions all the while ignoring the obvious geopolitical catalysts behind said accolades.

Why are so many calling for taxation in the Cayman Islands today?

Look at the U.S. economy or the UK’s for that matter – what has taxes done for them? They are both in a deplorable state of disarray.

Furthermore, those two nations have decades of historical deficits … Cayman is in this position for the first time ever since we came into some dosh! Not to mention that our current economic condition is due to a GLOBAL downturn in the GLOBAL economy.

The suggestion to up and introduce taxes after approximately 18 months of hard times (especially in the relatively new exposure of gross over-spending within our government) is nothing short of ludicrous.

The avoidance of the tag of a taxed jurisdiction is paramount to our future success. As it stands our "tax free" tag is actually misleading in itself as we ARE in fact "taxed" up the wazoo by methods other than direct or salary.

Therefore, I do appreciate you taking the time to outline your thoughts poster, but I will have to respectfully disagree with your viewpoint.

I can guarantee you that our Caymanian grand-children will have a substantially smaller burden over the coming decades than the grandchildren of the USA and the UK.

Correction:

After rereading the post (more than once) I now realize that a part of my comment was quite out of place.

In any event, I still stand by the overall gist of my previous post.

So why don’t you enlighten us on some of that misinformation? You start off your post criticizing the author for "ignoring the obvious geopolitical catalysts" and then you proceed onto the notion that taxes are what have the economies of the UK and US in shambles? Aren’t you ignoring a few obvious geopolitical catalysts?

Since the Reagan era, US tax rates have been very low compared to historical levels. Take a look at these figures: http://www.truthandpolitics.org/top-rates.php

The top marginal tax rate was above 90% from 1951-1963! (a time of incredible prosperity for the US) As the author also stated, there are countless examples of countries with extremely high tax rates (US isn’t even close to the top) that have thriving economies and excellent standards of living.

I agree with you that we shouldn’t introduce measures like this in hard times but we need to start thinking about better ways for the government to earn their income rather then off the backs of lower and middle-class Caymanians (duty, gas tax) and the businesses that make our economy prosper (work permit fees).

It’s refreshing to see a bit of honesty on the subject of taxation and our country, a very well thought out and written article, of course we need some type of tax to pay for the vital services that government provides, instead of a real solution we have the likes of Cayman Finance sticking there nose up at economic common sense with sham cures like casinos and hospitals.

The likes of the owners of real estate companies and other influence peddlers will do well from these get rich quick schemes but the clerk at the bank and their family will not see any progress, not to mention the environmental damage that will be caused. Mega cruise liners will make the owners of rum cake companies happy but that’s as far as any benefit will go.

Excellent piece Mr. Neilson. If we take the common sense approach and all ask ourselves "Would I move from the Island if I had to pay 5, 6,7, 10% income tax?" I think most people would say no because the alternate for most people is to move back to their home countries where taxes are much higher, crime is higher, smog exists, and all the reasons you moved to Cayman for are still there.

As you state above, citizens can make government officials more accountable for the government spending when it’s their money. Hard to put the clamps on when the private sector is calling all the shots.

As Benjamin Franklin said "Taxes are a sign of a civilized society".

I would move back immediately. I am coming to the view that theextra money is just not worth it for living here.

The statement "citizens can make government officials more accountable for the government spending when it’s their money" is TOTAL crap!!!

WAKE UP, you’re dreaming!!!

We should be able to make them more accountable NOW!! And they are not listening! What makes you think they will listen any better if we pay taxes??

Or am I being naive??

Do certain finance and property development interest groups have about 10 to 15 people (or different computers with different IP addresses) who go through the CNS comments and automatically give ‘thumbs up’ to no taxes and ‘thumbs down’ to any positive mention of property/pay roll tax?

It seems so when comparing the nature of the comments vs the thumbs up and down.

It is interesting that there are no inteligible arguments here against Mr Neilson’s. Just barely comprehensible tantrums of repetition of the anti tax lines thrown around which contradict historical and present facts. Or very factually inaccurate ones.

The way forward is quite simple:

1) Allow the economy to recover (as will eventually happen along with the global economy, even if it first gets a bit worse)

2) Reduce government salaries top to bottom, but progressively (more at the top, including politicians) – and keep them constant – no automatic cost of living increase – until out of the red and an adjustment is actually justified.

3) Forget any foolish ideas about the CIG actually making anyone redundant/downsizing. It will not happen. Instead try to improve the efficency of the staff there, bettertraining, continuing education, to bring about better outcomes (better social services, education, etc), move people around from unproductive positions into areas where more people are needed (social services, and schools e.g. out of administration and onto the ground). Have a program whichactively encourages and funds civil servants who want to move into the private sector (e.g. supporting study and preparation to become paralegals, lawyers, accountants, electricians, plummers etc).

4) Once the economy has recovered, echoing Mr Ridley, introduce a more sustainable government revenue system (e.g. minimal pay roll tax (7-12%) or small and progressive property/community tax). While I favor a property tax, a pay roll tax would probably be easier and cheaper to administer. While adjusting some of the current indirect taxes which are harmful to the economy (overly burdensome and ever increasing work permit fees, import duty on food and other basics which now unfairly burden low income people). Almost all (all?) of our competitors already have direct taxation. The medical tourism industry has strong potential also (but choose land for it that is not ecologically critical! and how about they also subscribe to the new (unofficial) planning ethos e.g. build in a sustainable manner for an island of its size, no more urban sprawl. There is no way they need 500 acres (unless 75% will remain forrested). Build up!).

5) Consider some of the get rich schemes – choose one or two which will have the biggest economic impact balanced with least harmful social and environmental impact e.g. No: oil refinery, mega yacht harbour and north sound dredging. Maybe: casino, sell some unprofitable government assets. Yes: lottery (which already illegally exists and will not go away, currently all profits are made by individuals vs the government).

But do not build your sustainable model on the get rich schemes, these are extras, sprinkles on the cake.

Dear Adam,

Try not being so verbose next time and you may get someone to finish your contributions. I really wanted to finish this but when I reached the word "propounded" I quit. Why not just use the word "considered"?? Who exactly are you expecting to read this through much less understand what you are saying? Certainly not the ordinary "layman".

Beachboi- whazza matta? can’t handle the stretching of your vocabulary? by forcing yourself to read & understand pieces a bit above your head, you become more educated. try it sometime.

Pathetic and unnecessarily arrogant response in my honest opinion. If you prescribe to this "stretch your vocabulary" approach then I regret to say you are falling way behind the times and need to get up to speed with the rest of the world.

Many writers think that using formal language guarantees technical accuracy, but it actually increases the risks of vagueness. Studies have shown that plain English can increase reader comprehension by at least 30 to 60%, and often by as much as 90%, and as such, strengthens professional credibility. Good writing is also easy to read and absorb at one sitting. We often dress up our language to sound authoritative, but don’t consider the costs to readability.

In this day and age the ‘plain English’ approach in allpublic communications is to be advocated. Everyone should have access to clear and concise information – they shouldn’t have to reach for a dictionary to check meanings of certain words and then have to interpret them into the context of the article or document they are trying to read and understand. You see without the cliché and unnecessary jargon, its easy to understand and easily imparts knowledge to those who would otherwise not understand. This is why courts and government bodies all over the world are reverting to the plain english approach – it works – and it reaches and is understood by far wider audiences.

So rather than get all pompous and criticize Beachboi, perhaps understand that all he is asking for is plain English, and pointing out that a far wider audience could participate in this discussion if plain English was used.

"if plain English was used" Oh dear. How jarring.

Why not end with the more elegant "were plain English to be used". Why have we stopped using the future subjunctive?

Are we surrendering style in favour of pandering to the vernacular of the lowest common denominator? Did we all study Cicero at school for nothing?

Because "propounded" was more accurate in the context than "considered". They are not synonyms. "Propound" refers to the act of putting something forward for consideration.

Those that cannot understand the straightforward language in this piece have no prospects of evaluating the questions of fiscal policy that are central to it. It is one of the reasons I have never been convinced of the merits of the universal franchise.

Nice arguement but I’m not buying the crap being sold. Taxes will affect local businesses also because no one taxes a 10% less take home and doesn’t go back to his employer and say my cost of living just rose 10% and you will have to pay.

Just take a look at the Civil Servants and to a further extent our politicians. See how will they were to take cuts. Now your arguement of this not being a cut per say but it will be drown out by the thousands of us screaming at the end of the day I get 10% less.

You can put a dress and a donkey but in the end it’s still a donkey.

This is what I woudl term classic misdirection. Try to fix the problem by throwing duck tape into the mix. CIG is over spending and this needs to be addressed. Give them more of our hard earned money and they will spend it and come back for more.

Our way forward must be diversification of our revenue sources combined with strngent government expenditure.

Our problem has a lot to do about accountability. During good times when the country was flourishing who cared that we did 4 steps in a process instead of 2. Problem is now all those extra steps are catching up with us.

A classic example of accountability is the audited financials of each department. How in the world could a department be 3 or 4 years behind and someone not be sacked?

I’m tired of bandaids. Let’s stop throwing good money at bad things. The ship is broken and we need to fix it.

Let’s keep one final thing in mind. We are none of these countries and what might work for one country may not work for us because of any number of reasons.

I don’t disagree that the government should do everything possible to cut costs. I merely say that when it inevitably fails to do so we can either pay for that today or make all our grandsons and granddaughters pay later. If we deliberately choose the latter, we forfeit the right to complain about it.

It is a false choice to say we should cut spending rather than raise revenue. If you’re not willing to do both, then you don’t really care about the deficit or who pays it. You only care about your own pocket book (which you are entitled to, just don’t pretend to be against deficits).

Unfortunately, deficits can’t be wished away upon a star. Or complained away for that matter. Someone has to pay for them and if we don’t pay for it today, we and our successors will in the future, with interest.

Whether employees or employers bear the cost of a payroll tax depends very much on employment market conditions. Two years ago, you’re correct, many employers would have had no choice but to increase salaries or face some turnover. But then, they would have been able to afford to do so. In today’s employment market, if an employee demanded an offsetting pay increase under threat of resignation, most employers would say "good luck" and be grateful for the attrition or simply hire one of the forty qualified people that are waiting to apply for their job and more than willing to bear the cost themselves.

Don’t take my word for it. Here is the Miller Shaw Report (Page 73):

"…payroll taxes often are at least partly paid by the employer, though labor economists widely agree that the burden (in the form of foregone wages) is borne by workers."

Employees in Bermuda pay up to 5.75% of salary in payroll tax. The employer’s share is typically less than half the cost of a Cayman Islands work permit (Bermuda work permits are a flat US$700 regardless of job title or salary). And it’s progressive so that large international companies pay more, smaller local companies pay less.

So, I ask you, which island has the most "unattractive business conditions"? Cayman with no personal taxes, or Bermuda with its payroll tax?

I’m probably being extremely naive, butwhy do you assume our grandchildren will have to foot the bill? surely the intention is to repay the loans when the going gets good again?

Income taxes will just lead to the cost of everything raising, as the key talent will demand higher gross pay to cover their loss of income (or will likely move elsewhere).

And as for publishing misinformation without question, you didn’t give a link for the source of your figures for average spend/collection per resident – are we to assume that CNS has verified them?

I agree with almost everything you have written. However, you last two paragraphs re Bermuda are a bit misleading.

1. The standard rate of payroll tax in Bermuda is 16%. The salary cap for payroll tax is $750,000. If an employee earns $750,000, $120,000 will be spent in payroll taxes. On top of this the $700 is paid for the work permit. I do not see how the aggregate costs could be less than 1/2 of the cost of any Cayman work permit. Even if you wish to use the employer share at 10.75% this would equate to $76,875.

2. The cost of living in Bermuda is SUBSTANTIALLY higher than in Cayman. E.g. the cost of rental accommodation is probably 100% more than you would pay for equivalent accommodation in Cayman. For example, a small, unfurnished, executive one bedroom apartment in Bermuda will set you back $3,300 while the equivalent in Cayman can be had for $1,500 or less. There are also property taxes for those who own property on the annual rental value of the property starting at 0.6% for annual rents less than $11,000 up to 18.43% for annual rents of over $110,000. In addition, you pay an Acquisition Licence fee to purchase property – 25% on houses and 18% on condos. In addition, there is an ad valorem stamp duty payable on transfers.

Cayman supermarkets are cheap by comparison.

Bermuda wins hands down in the "unattractive business conditions" category. Were you kidding?

No one is saying don’t implement new revenue measures. But make those NEW measures like the hospital or the casinos not more duty hikes.

You know what I am getting right now is this.

We have one set of people who support this action and my feel from the properness of their speech is these people are very well off. The impact of taxes on them especially payroll tax will be far less than that on someone who’s already struggling to make ends meet which seems to be the other end of the spectrum of those who are saying NO MORE.

Me I fall with those who struggles to make ends meet and who operate from a base of logic and my logic states it is sheer stupidity to say we must simply accept blindly that governments are inherrently always bloated and wasteful. And that the citizens should make up for the difference without any need or seeming desire to fix any problems.

I remain simply baffled by the lack of accountability of the government.

I will under no circumstances simply accept taxes on a just because all governments are bloated and wasteful basis new taxes and I am sure that the larger majority of the Cayman population is of the same mindset.

Let me explain what will happen. You will continue to widen the gap between you the HAVES and us the HAVENOTS and then as our lower ends get more desperate to keep food on the table they will start to commit crimes. Does this sound familiar? It should cause it’s already starting to happen.

So while many of you aristocrats with your porshes, mercedes and hummers keep trying to pound accept taxes into our heads we civic drivers will keep fighting for our government to find new ways and fix old problems.

wow you just don’t seem to get it do you? casinos and hotels are not new revenue measures, the profits from such ventures go into the owners pockets not the governments, meanwhile the costs to the country in increased burdens on the infrastructure are increased.

You are so poorly informed. The Bahamas government bank 20 million dollars annually from casinos.

That little figure represents 40% of the deficit we will end up with this year. The next thing is who says we can’t do better? I believe we have more lure as a taboo destination and a more high profile location thanks to Hollywood.

Let’s make them say it.

"Government officials have credited the Bahamas’ position as one of the leading tourist destinations in the region, with more than US$2 billion in visitor spending in 2007, to the enhancement provided by casino gambling.

And while Bahamas’ white sand beaches and crystal-clear waters still remain the biggest motivation for visitors to that island, Vanderpool-Wallace said casinos act as a tie-breaker."

Here are some staggering figures about what is coming out of Florida.

"Proponents to the bill revel in the fact that over us$ 400 million dollars can be infused into the state’s budget on an annual basis. Revenue sharing, as well as up front costs, were included in the Bill. The Seminole Tribe will be required to pay a minimum of us$ 150 million a year for two years, with a minimum of us$ 223 million a year for the next three years after that."

There is not just some money to be made from Gambling there is in fact a lot of money to be made and with the reputation of Cayman to be a place for the rich and famous the Cayman Islands would jump right into a major hotbed and could stand to land major annual tournaments which would attract people to the Cayman Islands from all over the Globe.

Let’s be completely clear here. Casino business is big business. It could mean big changes not only to the government coffers but also provide many jobs to locals and even more revenues to government via work permits.

Again as I said previously you are so ill informed it is not funny. You have ABSOLUTELY NO CLUE what you speak of.

Well that is once a system is put in place which requires the casino owners to share significant percentage of profits with the government.

And NOT, Cayman business as usual.

ie you put your casino in, we waive all the government fees, you give me a cut (or let the business that I and my buddies own service your casino so I can personally make lots of money)

and the country benefits marginally from some extra work permit fees, while in fact, probably, due to the increasing demands on infrastructure – and minimal additional revenue, the country does not actually benefit as it has to spend more to build infrastructure to support all the extra tourists and casino employees.

Did you understand any of the article?

I think I got a fairly good grasp of the statement.

The point that I drew ire on is the fact that the writer seems to want us to be OPEN to the idea of taxes especially in these tough economic times and he is willing to overlook the overbloated government saying basically it’s normal and we should just simply accept it for what it is.

My answer is simply no. No we are not going to take money out of my pocket to pay for 3 people to do what 1 person should do not without a fight.

I don’t want your bandaides. I want real solutions. I want CIG departments doing their job of 1) Managing their finances 2) Doing their darn books 3) Seeking to improve the way they do things. In my world if I did the same I would be out on the street. I expect the same from them.

If you want to create new revenue resources so you don’t have to tax me I am happy to oblige and support you however I am still not happy with your bloated government but I am happy you took the initative to find anotherway around the problem, for now.

So if you decide to swallow this down that is your right. My contension stays the same. I do not believe in adding taxes into the equation while not addressing the root of our problem. Now if they did everything they could to lower their expenses and introduced revenue measures and we were still where we were then maybe I would take a different approach at this but as I see it right now it’s just the easy way out. Yeah it helps the government but it kills the people. Creating more poverty only leads to more crime.

Dred you said it well! Took the words out of my mouth and I am sure many others. I SO agree with every word you typed.

Give the government more and they will spend more. And that’s THAT!

This statement "During good times when the country was flourishing who cared that we did 4 steps in a process instead of 2." is exactly why we can’t blame the previous government only. It has been successive governments!

Like nobody thought the world wide recession would affect this 2 by 4 island….

We need to get our children prepared with integrity and intelligence to run this country better than the choices we have now!