(CNS): The Complaints Commissioner submitted her first own motion report to the Legislative Assembly on Friday highlighting the systematic failure of the National Pensions Office (NPO) to enforce the pensions law and bring justice to hundreds of people whose employers have literally stolen their contributions. Nicola Williams found that the NPO had failed to use its powers under the law effectively, as well as a lack of political will to address the problem, a break down of inter-agency communication and a host of other problems that has led to a complete loss of trust by the public in the NPO. Despite the worrying findings in the report presented to members by MLA Cline Glidden, he made no comment about them and there was no debate in the House.

(CNS): The Complaints Commissioner submitted her first own motion report to the Legislative Assembly on Friday highlighting the systematic failure of the National Pensions Office (NPO) to enforce the pensions law and bring justice to hundreds of people whose employers have literally stolen their contributions. Nicola Williams found that the NPO had failed to use its powers under the law effectively, as well as a lack of political will to address the problem, a break down of inter-agency communication and a host of other problems that has led to a complete loss of trust by the public in the NPO. Despite the worrying findings in the report presented to members by MLA Cline Glidden, he made no comment about them and there was no debate in the House.

The Legislative Assembly has never once debated a report produce by the Office of the Complaints Commissioner since the establishment of the office in 2005. Although this is Williams’ first Own Motion, her predecessor John Epp also published a widelist of reports highlighting various failures in government systems that were also ignored by the members of the LA.

However, the report is now a public document which can be obtained from the OCC at the Piccadilly Centre. It reveals how administrative failures have allowed employers to take contributions from employees but not pay that or their matched obligation into a pension over and over again and escape prosecution.

Williams says that the system has given delinquent employers too many chances pay back arrears which has never happened and simply seen the debt grow, and when a decision to prosecute had finally been made it has taken too long.

“Too many chances are given to non-compliant businesses to pay the pension arrears, which are routinely ignored,” the OCC wrote in her report. “In the meanwhile, the outstanding level of arrears increases. Once a decision has been made to prosecute a delinquent employer prosecutions through the court system are too slow and are not an effective enough deterrent to prevent non-compliance.” She pointed out it could take as much as five years for a case to be heard.

While the OCC said the legislation and the regulations regarding the pension law needed substantial revision, she also pointed to other remedies earlier in the process which have not been utilised.

“There is still clear evidence of the inability of related government departments (immigration and health) to share communication,” the report stated. It notes that there has been a lack of will to withhold work permits from delinquent employers or to force them to pay their pensions or cease trading.

The OCC further warned that many employees fear being victimized if they take action against an employer and there is little or no protection for whistleblowers.

Williams explained that the report was initiated as a result of numerous complaints received by the office, which she described as theft. In one case a complainant had reached retirement and found his pension empty because of the failure of his employer to pay the contributions he had collected from him as an employee as well as the employer’s share.

“This is far from an unusual story,” Williams stated. “This is a ticking time bomb for the people of Cayman.”

Despite complaints and evidence that numerous employers are not complying, many of them are still issued trade and business licenses as well as work permits, and some have even received government contracts. She also points out that the problem has spanned a ten-year period and both political parties have failed to tackle the problem.

Recommending a complete overhaul of the system and the law and noting that simply throwing money at the problem wouldn’t work, Williams said that employers were taking advantage of the weakness of the system. She acknowledged that resources had been a problem and that there had never been enough inspectors at the NPO from the start, but the commissioner said the problems with the system went far beyond a shortage of staff.

Williams also said that at the start of the investigation the NPO estimated 670 businesses were non-compliant but as the OCC investigation progressed, Williams said, it became apparent the figure was wide of the mark.

“At present the NPO does not know exactly how many complaints against delinquent employers they are charged with investigating,” the report revealed.

The OCC’s annual report for year ending June 2008 was also submitted to the Legislative Assembly and is now a public document. During the year 2007-08 the office dealt with almost 500 complaints and undertook three own motion investigations.

Continue Reading

(CNS): The government has backed a private member’s motion to begin the process of passing legislation that would allow the removal, storage and use of human organs and tissues in the Cayman Islands. The motion was brought by Ellio Solomon, backbench MLA for George Town, who said that at present the law does not easily facilitate donation either by living or dead donors and the subsequent transplant to patients, even though Cayman has many people in need. Despite warnings from the North Side member that Cayman does not yet have the necessary facilities or expertise to carry out transplants, the Minister for Health said government planned to move towards establishing a law for organ donation.

(CNS): The government has backed a private member’s motion to begin the process of passing legislation that would allow the removal, storage and use of human organs and tissues in the Cayman Islands. The motion was brought by Ellio Solomon, backbench MLA for George Town, who said that at present the law does not easily facilitate donation either by living or dead donors and the subsequent transplant to patients, even though Cayman has many people in need. Despite warnings from the North Side member that Cayman does not yet have the necessary facilities or expertise to carry out transplants, the Minister for Health said government planned to move towards establishing a law for organ donation.

(CNS):

(CNS):

(CNS): The manager of a small grocery store in George Town was knocked out by a gunman during an armed robbery late Saturday night (11 September), police said on Sunday morning. George Town detectives are now appealing for witnesses to the incident, which occurred at 22:15 outside the convenience store in the vicinity of Money Gram on Shedden Road. Two men, one armed with a gun, held up the operator of the store as he was leaving. They ordered him to hand over the money and he gave them the bag he was carrying, which contained an undisclosed sum of money, a Blackberry phone and keys. He was then struck on the head by the man with the gun and was unconscious for a short while.

(CNS): The manager of a small grocery store in George Town was knocked out by a gunman during an armed robbery late Saturday night (11 September), police said on Sunday morning. George Town detectives are now appealing for witnesses to the incident, which occurred at 22:15 outside the convenience store in the vicinity of Money Gram on Shedden Road. Two men, one armed with a gun, held up the operator of the store as he was leaving. They ordered him to hand over the money and he gave them the bag he was carrying, which contained an undisclosed sum of money, a Blackberry phone and keys. He was then struck on the head by the man with the gun and was unconscious for a short while.

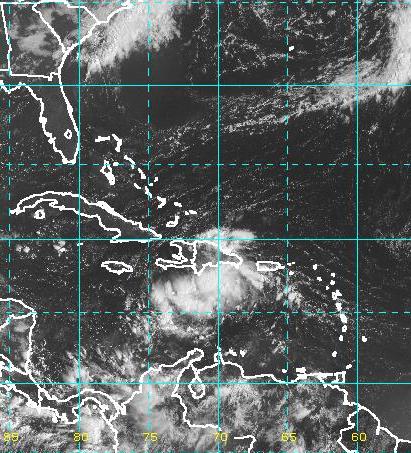

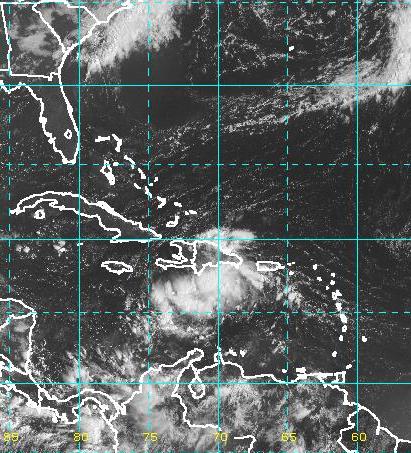

(CNS): As Igor strengthened into a category four hurricane on Sunday afternoon an area of showers and thunderstorms in the Caribbean remained less organised. However, forecasters from the NHC say it could still turn into a cyclone over the next few days. Regardless of development it is expected to bring some bad weather to the Cayman Islands on Monday or Tuesday. This broad area of low pressure located over Hispaniola has a fifty percent chance of developing over the next 48 hours the NHC said as environmental conditions appear favourable. Across the other side of the Atlantic TD12 also sprang to life as the season, true to predictions, continues to churn up turbulent weather.

(CNS): As Igor strengthened into a category four hurricane on Sunday afternoon an area of showers and thunderstorms in the Caribbean remained less organised. However, forecasters from the NHC say it could still turn into a cyclone over the next few days. Regardless of development it is expected to bring some bad weather to the Cayman Islands on Monday or Tuesday. This broad area of low pressure located over Hispaniola has a fifty percent chance of developing over the next 48 hours the NHC said as environmental conditions appear favourable. Across the other side of the Atlantic TD12 also sprang to life as the season, true to predictions, continues to churn up turbulent weather.

(CNS): As a result of hardship suffered by a number of young people being hit by drivers who are either uninsured or drunk, making their policies void, the YUDP is lobbying government to do something about the law and regulation of the industry. The young politicians said that some of the difficulties experienced are largely due to the fact the there is no government body responsible for monitoring and regulating the policies for general and motor insurance. Although insurance providers are licensed by Cayman Islands Monetary Authority (CIMA), the YUDP has called for an industry “watchdog” to monitor the sector and deal with complaints. (Photo Dennie WarrenJr)

(CNS): As a result of hardship suffered by a number of young people being hit by drivers who are either uninsured or drunk, making their policies void, the YUDP is lobbying government to do something about the law and regulation of the industry. The young politicians said that some of the difficulties experienced are largely due to the fact the there is no government body responsible for monitoring and regulating the policies for general and motor insurance. Although insurance providers are licensed by Cayman Islands Monetary Authority (CIMA), the YUDP has called for an industry “watchdog” to monitor the sector and deal with complaints. (Photo Dennie WarrenJr)