UK bank hit by protests over 1% tax bill

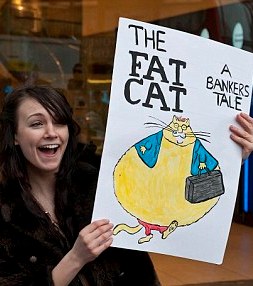

(Daily Mail): Dozens of branches of Barclays bank in the UK were brought to a standstill by anti tax avoidance campaigners at the weekend. The action followed revelations that the bank paid just one percent tax on profits of more than £11billion. UK Uncut said it occupied around 50 branches – setting up mock libraries and crèches to highlight some of the public services being axed by the Government as it attempts to whittle down the nation’s deficit. Campaigners are angry at Barclays boss Bob Diamond’s defiance over the role of bankers in the economic crisis and at his insistence that the time for remorse was over. Barclays uses hundreds of offshore subsidiaries in tax havens – including 181 in the Cayman Islands alone – to slash the amount it pays to HM Revenue & Customs.

(Daily Mail): Dozens of branches of Barclays bank in the UK were brought to a standstill by anti tax avoidance campaigners at the weekend. The action followed revelations that the bank paid just one percent tax on profits of more than £11billion. UK Uncut said it occupied around 50 branches – setting up mock libraries and crèches to highlight some of the public services being axed by the Government as it attempts to whittle down the nation’s deficit. Campaigners are angry at Barclays boss Bob Diamond’s defiance over the role of bankers in the economic crisis and at his insistence that the time for remorse was over. Barclays uses hundreds of offshore subsidiaries in tax havens – including 181 in the Cayman Islands alone – to slash the amount it pays to HM Revenue & Customs.

Diamond last week admitted to MPs that Barclays paid just £113million in corporation tax during 2009 – around 1 per cent of the £11.6billion in profit it made that year.

Category: Business

Regrettably the article is inaccurate. If Barclays had made the profit attributed to it then it would, as a matter of law, have had to pay tax at the relevant scale to the Revenue. As there is no reference to any criminal proceedings being brought against Barclays one must assume that the tax paid was the proper amount of tax payable.

What many choose to overlook is that one (whether an individual or company) may properly limit one’s exposure to tax (and other liabilities). This is done by using structures that limit one’s liability to tax according to the laws of the country imposing the tax. There can be nothing objectionable to that. Are we to assume that all those UK citizens resident outside the UK are avoiding tax simply because they are not voluntarily remitting tax (that they need not pay) to the UK to feed and clothe the indigent ?