Archive for February, 2011

Rescuers search offices for quake survivors in NZ

(Bloomberg): Rescue workers in the New Zealand city of Christchurch combed through collapsed ruins of office buildings Tuesday as they searched for trapped survivors of New Zealand’s deadliest earthquake in eight decades. About 250 search-and-rescue personnel are preparing to dig through wreckage left by yesterday’s magnitude 6.3 quake that killed at least 65 people, Deputy Prime Minister Bill English told reporters yesterday. More than 100 people may be trapped in collapsed structures, Christchurch Mayor Bob Parker said. “After the initial shock, our focus is now firmly going to be on those people who may be remaining trapped in collapsed buildings,” English said.

Rescuers have extracted people alive from several buildings central city buildings, New Zealand Police said in an e-mailed statement. Some were saved after limbs were amputated, Police Superintendent Russell Gibson told Television New Zealand.

“Make climate change more important to individuals”

(Caribbean News Now): A leading coastal zone management official in Barbados has underscored the need to make climate change more "important" to Barbadians at the individual level. According to director of the Coastal Zone Management Unit (CZMU), Dr Leo Brewster, while as a small island Barbados has always recognised that climate change is real, the country now has to become more assertive in dealing with it. "Everybody knows about the polar bears, the ice caps, rising sea levels and the potential impact on the area, but because we don’t actually experience it to the extent of the Maldives and the South Pacific, where there is clear evidence that the islands are shifting, it doesn’t mean that it is not happening to us," he cautioned.

(Caribbean News Now): A leading coastal zone management official in Barbados has underscored the need to make climate change more "important" to Barbadians at the individual level. According to director of the Coastal Zone Management Unit (CZMU), Dr Leo Brewster, while as a small island Barbados has always recognised that climate change is real, the country now has to become more assertive in dealing with it. "Everybody knows about the polar bears, the ice caps, rising sea levels and the potential impact on the area, but because we don’t actually experience it to the extent of the Maldives and the South Pacific, where there is clear evidence that the islands are shifting, it doesn’t mean that it is not happening to us," he cautioned.

Ladies lunch for a healthy heart

(CNS): As part of Heart Smart Week, the Cayman Heart Fund (CHF) will host the 2nd Annual "Learn & Live Red Dress Luncheon" at the Grand Old House on Friday 4 March to promote the awareness of cardiovascular disease amongst women. The event is geared towards women’s risks and prevention through the power of knowledge, action, and awareness. Sponsored by Baptist International, guests will include Cayman’s strongest supporters of heart health such as Marie-Beatrice Taylor, Kerry Bush, Chair of the Cayman Heart Fund Suzy Soto, Chief Officer of the Ministry of Health Jennifer Ahearn, and Health Services Authority CEO Lizzette Yearwood.

(CNS): As part of Heart Smart Week, the Cayman Heart Fund (CHF) will host the 2nd Annual "Learn & Live Red Dress Luncheon" at the Grand Old House on Friday 4 March to promote the awareness of cardiovascular disease amongst women. The event is geared towards women’s risks and prevention through the power of knowledge, action, and awareness. Sponsored by Baptist International, guests will include Cayman’s strongest supporters of heart health such as Marie-Beatrice Taylor, Kerry Bush, Chair of the Cayman Heart Fund Suzy Soto, Chief Officer of the Ministry of Health Jennifer Ahearn, and Health Services Authority CEO Lizzette Yearwood.

The heart healthy lunch will accompany a presentation by guest speaker, Dr Nancy Eklund, founder of Miami Centre for Holistic Healing who will discuss "Stress, Hormones & Heart Disease in Women", which will summarize how these elements affect the heart. Dr Eklund is a board certified family physician who practices a combination of traditional medicine with herbal remedies, bio-identical hormone replacement therapy, hypnosis, and mind-body therapy.

An active speaker in the community, Dr Eklund, focuses on topics such as menopause, stress, women’s health, sexuality, and patient-doctor communications. She is co-author of multi-media education programs used to educate health care providers about domestic violence, and is often invited to comment on health issues in the media. Following Dr Eklund’s oration, Registered Dietician Kristin Tobin of Seven Mile Clinic will provide nutritional tips for a heart healthy diet.

"CHF is committed to support ‘The Heart Truth Campaign’; a national awareness campaign for women about heart disease. By conducting educational lunches specially dedicated to raising awareness we hope to reach out to more ladies and provide them with knowledge and tools to help identify and prevent CVD. Women, generally being caregivers always ignore or deny their own symptoms as they are always too busy looking after everyone else. Dr Eklund will empower our attendees with her presentation and get this message across. We anticipate this year’s luncheon willsell out as it did last year,” said Dr Yin, Medical Director of the Cayman Heart Fund and organizer of Heart Smart Week.

All attendees are encouraged to wear red and can purchase a raffle ticket that will be drawn at the event to win pieces by Princess W Jewelers designed specially to support this cause. Every Bloomin’ Thing has donated floral centerpieces; one lucky guest from each table will win the bouquet at the end of event.

For those unable to attend the event, the CHF invites businesses and schools to participate in Red Dress Down Day. On Friday 4 March, staff and students are encouraged to dress in red and make a donation to the CHF. “The Red Dress is the national symbol to bring awareness that CVD is the No.1 killer in women. I hope our community will show its support by battling CVD together.”

The Learn & Live Red Dress Luncheon will be hosted at the Grand Old House from 12:00pm until 2:00pm. Tickets cost $50.00 and include a three course lunch and beverage; tables of ten are also available for $450.00. For tickets to the Luncheon and information on Red Dress Down Day, please contact Charmaine Moss at 516-7323, alternatively email cmoss@dci.gov.ky.

The Cayman Heart Fund is a non-profit, non-government organization dedicated to the reduction of heart and circulatory disease in the Cayman Islands. Heart and circulatory disease, known as cardiovascular disease (CVD), is the biggest health problem in the Cayman Islands.

MLA pension info to go public

(CNS): The information commissioner has ruled that the Public Service Pensions Board must release records requested by Cayman News Service relating to former and serving MLAs who are drawing their pension entitlement. Jennifer Dilbert’s decision comes after a hearing in which she found that the record was not exempt from disclosure under Section 23(1) of the Freedom of Information Law, as claimed by the authority, and it would not involve unreasonable disclosure of personal information. CNS asked for the list of serving as well as past MLAs who have opted to draw their pension entitlement and the period of time they had served in the assembly but the request was denied.

The PSPB claimed that it had a fiduciary responsibility to protect the legal ownersof the plans they administer and while the individuals held public office and are paid from the public purse the benefits they earned are personal. It also said that third parties involved in the request had also objected.

However, Dilbert found The PSPB had not put forward arguments to support its position that it would be an unreasonable disclosure of personal information. In her seventh decision the information commissioner said the request related to the public and not the personal life of the MLAs. She said in a 2009 decision by the UK Commissioner pension arrangements were found to be directly linked to an employee’s work at an authority.

“I agree with the UK Commissioner and find that in this case, whether a MLA is drawing a pension relates to the public life of that Member. I do not therefore agree with the PSPB that MLA pensions are personal information,” she found in her ruling. “The individuals concerned occupy or have occupied a position in a public authority, and the information relates to their positions or functions or the terms upon and subject to which the individuals occupy or occupied that position.”

The commissioner also pointed out that there had been procedural problems with the request when it was first made to the Legislative Assembly on 2 June last year. CNS did not receive a response to the request, so after 28 days contacted the commissioner’s office to intervene. They did so and found that the PSPB was the correct authority, not the LA as CNS had presumed, which then accepted the request on 30 June. The Legislative Assembly, although not the right authority was obligated under the law to acknowledge the request before transferring it to the correct place, which it did not do.

“When a public authority receives a request under the Law, it must acknowledge receipt within ten calendar days as per section 7(3)(b) of the Law,” the commissioner stated. “Where the request is for a record that is held by another public authority, or the subject matter of which is more closely connected with the functions of another public authority, section 8 of the Law provides that the first authority must transfer the application, or such parts of it that may be appropriate to that other authority as soon as practicable, but in any event no later than 14 days after the request was received,” Dilbert added, stating that the information manager should tell an applicant of the transfer within ten calendar days.

“It appears that the Legislative Department has failed to apply these provisions correctly in the present case, and for future requests, the Legislative Department should ensure that all applications are properly logged, acknowledged and transferred where necessary,” she said.

The PSPB also had issues with procedural matters, the commissioner revealed, over the question of whether there was a legitimate need for an internal review of the request. On the day that the request was refused CNS was told by the authority it had a right to request an internal review of that decision by the PSPB’s managing director. However, Dilbert said this was not sound advice as the managing director had already been involved in the initial decision.

“As such, an internal review by the same person would not only be meaningless and cause unnecessary delays, it would also be contrary to section 34(1) of the Law, which states that ‘no review shall be conducted by the same person who made the decision…’," the commissioner noted in her ruling. “It is critical that the PSPB identify and designate the person who will conduct internal reviews in accordance with section 34(1) of the Law. In the interest of fairness and expediency, this should not be a floating responsibility that is transferred to another person if and when the designated person has already been involved in the original decision.”

The board had already taken the full 30 days before refusingthe request but when CNS learned that an internal review was not an option it appealed to the information commissioner. Then when mediation failed a hearing was arranged.

The issue of serving MLAs drawing their pension entitlements while still serving was raised by Ezzard Miller in the Legislative Assembly last year when he described it as “double dipping” and suggested that although not illegal it was morally wrong of members to take a salary and a pension. While he did not know which members who were over 55 had made the decision to take their pension, he said he was aware some members were. The then leader of the opposition Kurt Tibbetts and his opposition colleague Anthony Eden both publicly admitted to taking their entitlements.

“Although I may be entitled, I have no intentions of claiming my pension until I leave this House for good,” Miller told CNS. “I believe it is immoral and unethical and I will be bringing a private member’s motion to the House to change the lawto prevent it happening in future.”

MLAs were first given access to their pensions while remaining in office in 2004 when a change to the law provided for MLAs to claim their pensions once they had served a single term and passed the age of 55, even if they continued to serve in the Legislative Assembly. In the past legislators had died while still in office and were never able to claim the pensions which they had earned through their years of service.

Unlike the civil service there is no official retirement age for politicians, who can stand for election at any age, and since MLAs cannot be certain they will returned to the Assembly from parliament to parliament the law was changed to give them access to their pensions before they retired in case they never did.

Tibbetts told CNS that he had decided to take his pension a few months after his 55th birthday, despite the fact it was not fully vested (meaning he had not served five full terms) because of the uncertain future of being a politician.

It is not yet known, however, if the other two eligible MLAs, West Bay government backbencher Captain Eugene Ebanks and Premier McKeeva Bush, had opted to take their pensions.

See the information Commissioner’s decision below.

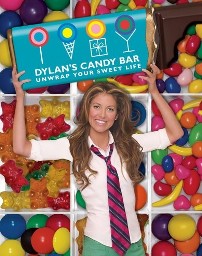

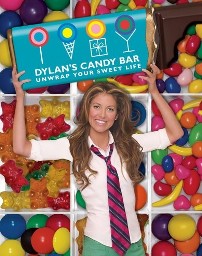

Candy queen comes to Camana Bay

(CNS): Dylan Lauren, the founder and chief executive of the Dylan’s Candy Bar emporiums and the daughter of designer Ralph and photographer Ricky Lauren, will be appearing at Books and Books this evening in Cayman Bay. The candy queen will be promoting her new coffee table book, Dylan’s Candy Bar: Unwrap Your Sweet Life (Clarkson Potter). As well as discussing her book and signing copies, Lauren will be showing local readers how to make and decorate as well as celebrate candy. Lauren’s up-market candy store carries more than 5,000 kinds of candy and in her book she says, "Candy is magic! Candy is imagination! Candy is art! Candy is always in fashion! Candy is joy!"

(CNS): Dylan Lauren, the founder and chief executive of the Dylan’s Candy Bar emporiums and the daughter of designer Ralph and photographer Ricky Lauren, will be appearing at Books and Books this evening in Cayman Bay. The candy queen will be promoting her new coffee table book, Dylan’s Candy Bar: Unwrap Your Sweet Life (Clarkson Potter). As well as discussing her book and signing copies, Lauren will be showing local readers how to make and decorate as well as celebrate candy. Lauren’s up-market candy store carries more than 5,000 kinds of candy and in her book she says, "Candy is magic! Candy is imagination! Candy is art! Candy is always in fashion! Candy is joy!"

Lauren turned her love of sweets into a lifestyle, when she opened Dylan’s Candy Bar in New York City in 2001. A decade later, she now has a chain of these smile-inducing shops around the US. Lauren is expected to bring some of her treats with her to Cayman to share with guests at Books & Books, where she will chat about the book, which she says is about seeing the beauty of candy and how artistic its colours, shapes and textures are.

Part of the visiting author series, guests are invited from 7pm Tuesday 22 February to indulge their sweet tooth.

Local insurance firm to launch new product

(CNS): Sagicor Life, a Cayman Islands based insurance firm, will be hosting a Business After Hours event on Thursday, 24 February, where it will launch a new insurance product. The Chamber of Commerce said the new Ultra Lifeline Plan provides protection in the event of a first diagnosis of any one from a list of twenty-one different lifeline conditions, and encouraged members to come to the event to find out more. The event will take place at the Sagicor offices on the 1st floor of Harbour Place, South Church Street, from 5 pm – 7pm. Refreshments will be served and a number of prizes will be drawn.

(CNS): Sagicor Life, a Cayman Islands based insurance firm, will be hosting a Business After Hours event on Thursday, 24 February, where it will launch a new insurance product. The Chamber of Commerce said the new Ultra Lifeline Plan provides protection in the event of a first diagnosis of any one from a list of twenty-one different lifeline conditions, and encouraged members to come to the event to find out more. The event will take place at the Sagicor offices on the 1st floor of Harbour Place, South Church Street, from 5 pm – 7pm. Refreshments will be served and a number of prizes will be drawn.

Chamber members can register online at www.caymanchamber.ky

Local designer featured in leading US magazine

(CNS): Caymanian fashion designer and celebrity fashion stylist, Tigerlily Tamara Hill, is featured in Essence Magazine this month as one of ‘The Next Top Designers’ to watch. Hill began her clothing line Crown Atelier in 2006 and business is going from strength to strength. She says her Cayman home inspires her chic flexible designs. The magazine, which has a circulation of over one million in the United States, is now available at local book stores in Cayman. This is the second month in a row that Caymanian women have featured in the leading US publication as last month Cayman’s very own supermodel Selita Ebanks was also featured in the magazine.

(CNS): Caymanian fashion designer and celebrity fashion stylist, Tigerlily Tamara Hill, is featured in Essence Magazine this month as one of ‘The Next Top Designers’ to watch. Hill began her clothing line Crown Atelier in 2006 and business is going from strength to strength. She says her Cayman home inspires her chic flexible designs. The magazine, which has a circulation of over one million in the United States, is now available at local book stores in Cayman. This is the second month in a row that Caymanian women have featured in the leading US publication as last month Cayman’s very own supermodel Selita Ebanks was also featured in the magazine.

The magazine features one of Hill’s chiffon silk blouses, which she describes as flexible enough to be worn at work, on the street or on the red carpet.

See the magazine feature below.

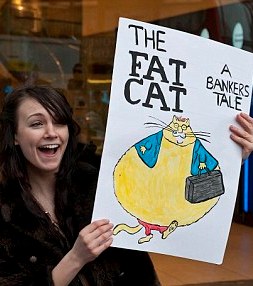

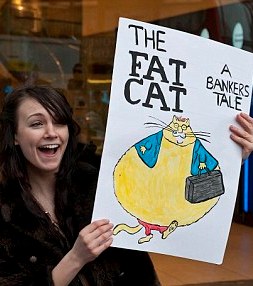

UK bank hit by protests over 1% tax bill

(Daily Mail): Dozens of branches of Barclays bank in the UK were brought to a standstill by anti tax avoidance campaigners at the weekend. The action followed revelations that the bank paid just one percent tax on profits of more than £11billion. UK Uncut said it occupied around 50 branches – setting up mock libraries and crèches to highlight some of the public services being axed by the Government as it attempts to whittle down the nation’s deficit. Campaigners are angry at Barclays boss Bob Diamond’s defiance over the role of bankers in the economic crisis and at his insistence that the time for remorse was over. Barclays uses hundreds of offshore subsidiaries in tax havens – including 181 in the Cayman Islands alone – to slash the amount it pays to HM Revenue & Customs.

(Daily Mail): Dozens of branches of Barclays bank in the UK were brought to a standstill by anti tax avoidance campaigners at the weekend. The action followed revelations that the bank paid just one percent tax on profits of more than £11billion. UK Uncut said it occupied around 50 branches – setting up mock libraries and crèches to highlight some of the public services being axed by the Government as it attempts to whittle down the nation’s deficit. Campaigners are angry at Barclays boss Bob Diamond’s defiance over the role of bankers in the economic crisis and at his insistence that the time for remorse was over. Barclays uses hundreds of offshore subsidiaries in tax havens – including 181 in the Cayman Islands alone – to slash the amount it pays to HM Revenue & Customs.

Diamond last week admitted to MPs that Barclays paid just £113million in corporation tax during 2009 – around 1 per cent of the £11.6billion in profit it made that year.

Distillers keep up ‘spirits’

(CNS): The makers of Seven Fathoms Rum, Cayman Island Distillery, a locally owned and operated small business, is planning on moving to a new facility, creating more new lines and recruiting another twenty locals to help it grow. The owners have announced that they are looking for new premises to add to the distillery at Hammerheads along the water front in George Town as a result of the business’s success. Founders Nelson Dilbert and Walker Romanica say they need a larger production facility to keep up with demand for Cayman’s only locally produced spirits.

(CNS): The makers of Seven Fathoms Rum, Cayman Island Distillery, a locally owned and operated small business, is planning on moving to a new facility, creating more new lines and recruiting another twenty locals to help it grow. The owners have announced that they are looking for new premises to add to the distillery at Hammerheads along the water front in George Town as a result of the business’s success. Founders Nelson Dilbert and Walker Romanica say they need a larger production facility to keep up with demand for Cayman’s only locally produced spirits.

In addition to the Seven Fathoms Rum and Governor’s Reserve line of rums, the distillers have plans to introduce several new lines of spirits, including vodka, in the near future, which, like the rums, will be produced here in Cayman.

The location of the new distillery is still being finalized but the plan is to develop a custom designed 5,600 square foot facility. They said the new facility will create an additional 20 jobs, which they want to fill with Caymanians. Even before the planned move the local rum makers say they are looking for a Caymanian to fill a distiller-in-training position.

The Cayman Islands Distillery was founded in 2007 and originally produced a single rum that was sold initially only at one location. Over the last three years the company has expanded into a full line of rums, including Seven Fathoms Rum, as well as a line of rums called Governor’s Reserve. The Governor’s Reserve line now features gold, white and coconut rums, and a spiced rum and a dark rum are ready to launch in the next few months, the founders said.

“The warm reception we have received all around the island and from bars, restaurants, liquor stores and visitors alike has been overwhelmingly positive,” said Dilbert. “It is the encouragement from the resident and business community here that has kept us moving forward and expanding into other spirits.”

He added that the support from the community was a crucial part of the success. “I think people are very encouraged to see young Caymanian entrepreneurs able to build a small but successful company here in Cayman.”

So far Seven Fathoms Rum has been sold and distributed in the United Kingdom through the Whisky Exchange, a prominent distributor and retailer of fine spirits located in London. Since the UK launch, the distillery has been promoting the rum in conjunction with the Cayman Island’s Department of Tourism’s UK office.

The distillery has now signed another export agreement with Luxe Vintages of Boca Raton, Florida, to begin exporting Seven Fathoms Rum to the US market.

Seven Fathoms uses a selection of locally grown sugar cane in all of its products. It is made by hand in a craft distillery using a unique underwater maturation process. The small distillery has been recognised worldwide for its handmade, small batch artisan rum, earning awards of distinction and medals from the Beverage Tasting Institute’s spirits review in Chicago, the annual Ministry of Rum Competition, and many others.

New fund services firm sets up shop in Cayman

(CNS): The world’s largest independent, global fund administration business is opening an office in the Cayman Islands. Apex Fund Services has been granted a Companies Management Licence by the Cayman Islands Monetary Authority and will now provide independent directors, local directors, Apex directors, corporate secretarial services and registered office services from Grand Cayman. Dax Basdeo, Chief Officer for the Ministry Finance congratulated Apex on behalf of the government on its expansion into Cayman. “This is a testament that the global financial architecture is getting back on track, and that the Cayman Islands remains a top domicile of choice for hedge funds and company registrations,” Basdeo said.

(CNS): The world’s largest independent, global fund administration business is opening an office in the Cayman Islands. Apex Fund Services has been granted a Companies Management Licence by the Cayman Islands Monetary Authority and will now provide independent directors, local directors, Apex directors, corporate secretarial services and registered office services from Grand Cayman. Dax Basdeo, Chief Officer for the Ministry Finance congratulated Apex on behalf of the government on its expansion into Cayman. “This is a testament that the global financial architecture is getting back on track, and that the Cayman Islands remains a top domicile of choice for hedge funds and company registrations,” Basdeo said.

“We are pleased that Apex Fund Services has recognised the benefits of doing business in the Cayman Islands, and trust that their clients will take advantage of the new investment opportunities that this expansion will bring,” he added.

The local office has been established by Alric Lindsay, a former investment funds attorney with offshore firms Maples and Calder and Ogier and Lindsay will continue to act as an independent party, offering his expertise to Apex by assisting with the growth of the business, helping Apex to take its place as a key player in the market.

“Having a background as a lawyer, an accredited director, former certified public accountant with PwC and as a regulator puts me in a unique position to make a long-term, value-added contribution to Apex,” he stated. “This not only comes in the form of the actual growth of the Apex business, but in my role as a non-executive, independent director to the boards of hedge funds and other structures administered by the Apex Group. It is a fantastic opportunity to be involved with a thriving, viable, global administrator like this."

Apex employees include Rayal Bodden, a director for over 12 years, and Shane Edwards, a former auditor and fund administrator with well-known Cayman firms.

Peter Hughes, (Pictured above) Managing Director of Apex Fund Services Ltd, commenting on the approval of the licence said: “Apex continues to grow rapidly as we support an increasing number of investment managers located all over the world. Apex already has over 220 funds registered in the Cayman Islands that it provides administration services making the opening an office an obvious choice for the next step of our global growth strategy.”

The firm has 190 staff and over $16 billion in assets under administration and the firm aims to be in the top 25 fund administrators worldwide by the end of 2011.