Archive for August, 2012

Injury dashes Olympic dreams for Hyman

(CIOC): Cayman Islands sprinter Hyman felt an intense pain in his abdomen and core after warming up so decided to pull out of his 100 metres semi-final at the London Olympics just before he was due to race. The Cayman Islands Olympic Committee will make an official statement on Monday after Hyman, 22, has had a full medical examination. The final was won by defending champion Usain Bolt of Jamaica in 9.63 seconds, with his compatriot and training partner Yohan Blake second in 9.75 and Justin Gatlin of the USA third in 9.79. Tyson Gay of the US was fourth in 9.80.

(CIOC): Cayman Islands sprinter Hyman felt an intense pain in his abdomen and core after warming up so decided to pull out of his 100 metres semi-final at the London Olympics just before he was due to race. The Cayman Islands Olympic Committee will make an official statement on Monday after Hyman, 22, has had a full medical examination. The final was won by defending champion Usain Bolt of Jamaica in 9.63 seconds, with his compatriot and training partner Yohan Blake second in 9.75 and Justin Gatlin of the USA third in 9.79. Tyson Gay of the US was fourth in 9.80.

Commonwealth champion Cydonie Mothersill who is also suffering a niggling injury begins her Olympic bid Monday when she races in the heats for the women's 200m today in heat three at around 1:30pm local time.

UK needs to protect endangered species in territories

(The Guardian): Many species in some of the most remote vestiges of Britain's overseas territories face extinction unless a government plan to protect them sets out clearly defined preservation targets, according to wildlife experts. A newly unveiled government white paper pledges to "cherish the environment" in its 14 overseas territories, which include the British Virgin Islands, the archipelago of Tristan da Cunha, the Cayman Islands, Bermuda and the Falkland Islands. However, the RSPB – which claims that 85% of the UK'sthreatened species, including 33 bird species are in the overseas territories – is warning that the plans feature "a notable absence of solid targets and commitments" and provide no new funding.

(The Guardian): Many species in some of the most remote vestiges of Britain's overseas territories face extinction unless a government plan to protect them sets out clearly defined preservation targets, according to wildlife experts. A newly unveiled government white paper pledges to "cherish the environment" in its 14 overseas territories, which include the British Virgin Islands, the archipelago of Tristan da Cunha, the Cayman Islands, Bermuda and the Falkland Islands. However, the RSPB – which claims that 85% of the UK'sthreatened species, including 33 bird species are in the overseas territories – is warning that the plans feature "a notable absence of solid targets and commitments" and provide no new funding.

It claims that, unless the government takes a "once in a decade opportunity" to protect its overseas territories, there will be a potentially disastrous loss of wildlife which will have global consequences. "The UK has to look after its own back yard," said Jonathan Hall, UK overseas territories officer with the RSPB. "Many of these threatened species are unique to these islands."

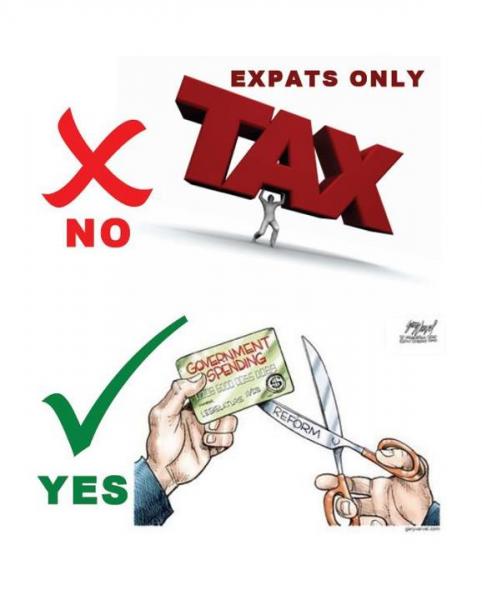

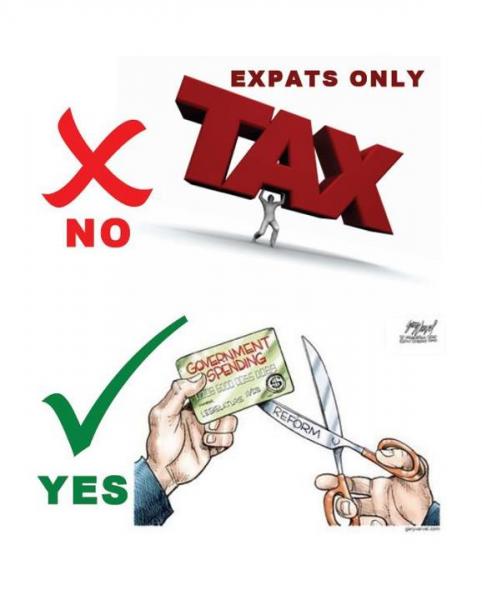

Suggestions for the premier

I write to you today along with my fellow Caymanians, Chaz Hill and Eden Hurlston. Together, we represent the members of a group known as Caymanians & Expats United Against Taxation. As a group we have very little interest in how our country has arrived at the threshold where we now stand. We concern ourselves with the past only so that the mistakes of ourselves and others may be identified, then used to educate ourselves in such a way that history is unable to repeat itself.

Our vision is for the future.

Today we wish to convey to you our thoughts in relation to the Community Enhancement Fee which has been proposed recently. To begin with, we would like to address the title of this proposed legislation.

Despite the euphemistic title you have used to describe a payroll tax it remains just that, a tax. The word tax can be defined as a compulsory contribution to state revenue, levied by the government on workers’ income. Your proposal is therefore a direct tax which is to be levied on a subsection of our population, so please allow us to refer to it as such.

The payroll tax which has been put forth by your administration is discriminatory, and as our group looks forward to the implementation of Human Rights in Cayman on November 6th, 2012, we cannot accept it. Additionally, the proposed tax will reduce the purchasing power of those on whom it is levied, and therefore be detrimental to our economy. Furthermore, the implementation of a direct tax will no longer afford the Cayman Islands the title of a tax neutral jurisdiction, which is the foundation of the way in which most countries of this world see our nation.

Of particular concern to us is the information contained within the Miller-Shaw report. As you know the Miller-Shaw report is within the public domain, and has been since it was commissioned by the current administration in 2009. This report, which was compiled by professional economists, speculated that the implementation of direct taxation in our jurisdiction would result in the contraction of our economy.

Since the announcement of the proposed payroll tax it has been highly scrutinized by the international press. Most notably, an article published on Forbes.com which likens the implementation of this payroll tax to fiscal suicide. To date we have been able to locate no less than six international outlets which have carried this story, and we are yet to find a single one which believes this policy will benefit our country.

We also assume your administration has recently received reports which present evidence contrary to the above. We arrived at this assumption as it is simply impossible for us to believe that our government would be irresponsible enough to implement a policy of this magnitude, which goes directly against the conclusions reached by their own commissioned reports, without first consulting a wide range of knowledgeable economists.

Therefore, on behalf of the Caymanian people, we call for you to release these reports into the public domain so as to alleviate some of our concerns related to the payroll tax which you intend to enact.

On Monday, as representatives of our greater community we wish to present to you, a series of proposals which show how our government can increase existing revenue streams as well as produce new ones, whilst also minimizing the negative effects of such measures on our economy. Together, these proposals, none of which involve direct taxation, amount to an increase of projected government revenues which is by no means insignificant.

Although some of the proposals we intend to propose shall require initial capital injections to create a new stream of revenue our group has aimed to maximize short term return by focusing on alternatives which have preexisting methods of collection. This is strengthened by our opinion that an approach which produces the desired revenue through a series of relatively small gains across a diversified range of government policies provides less risk of a budget shortfall than would otherwise be the case with a single piece of legislation aimed at collecting fifty million dollars.

It is worth noting, however, our group is of the firm belief that the people of the Cayman Islands have not met these difficult times due to low revenues. Rather, we acknowledge the fact that our current budgetary issues are the result of careless and excessive expenditure by our government in recent times. This belief is in fact reiterated by the very definition of deficit; the amount by which expenses exceed income.

As stated, our vision is for the future and we consult the past to learn from the mistakes of ourselves and others. Last year your administration successfully proposed a budget which did not include long term borrowings and perhaps generated a small surplus. However, the budget which has just been submitted to the FCO appears to propose total expenses which exceed last year’s projections by nearly sixty million dollars.

To achieve the positive results of last year your administration asked the public to provide you with greater amounts of revenue. Although there were several, the request which stands out most significantly is the two percent increase in duty charges on all dutiable items. Despite the public obliging these requests we again find ourselves being asked to provide government with additional revenues.

Although the revenue generating measures we shall propose include both short term and long term measures, we refuse to once again allow our government to use these measures as a temporary patch over our increasingly unsustainable budget. Doing so would simply postpone the inevitable and we would once again find ourselves in this situation within a few years. We will therefore also present to you a series of proposals which are aimed at reducing government expenditure.

Mr. Premier, you have stated that you are open to hearing alternate solutions, as you do not desire to impose a policy of direct taxation. Our group feels that we will be able to provide you with a list of reasonable and economically viable alternatives. We will therefore look forward to your response, and respectfully as that it be made within the public forum as the group which addresses you today is nothing more than the voice of Cayman.

The above has been forwarded to the office of the premier in response to his recent invitation for suggestions to help raise a budget surplus of $76million.

Mac clinging to expat tax

(CNS): Updated — Despite the statement from the representatives of the business community on Saturday morning, the premier has not yet given up on the proposed tax on work permit holders' earnings. In a short statement in the afternoon McKeeva Bush said he had not yet agreed to stop the tax. "The proposed Community Enhancement Fee will only be withdrawn if alternative revenue measures that do not affect the ordinary Caymanian can be implemented," Bush said, adding that further announcements would be made on Monday night at a public meeting at the Mary Miller Hall at 7:30. However, on Saturday evening the business group released a further statement denying that they had “jumped the gun” over the tax withdrawl.

The group signed by Woody Foster and six others stated that they were "unable at this time to explain the discrepancy between the news reports" and the clear understanding it has in writing with the premier.

The business leaders said the earlier press release had also been agreed by the premeir before it was issued.

Check back to CNS for more on this developing story.

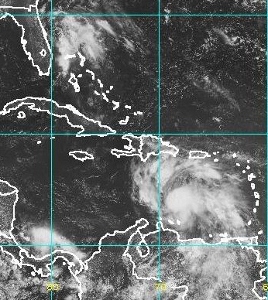

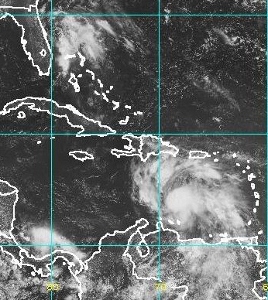

TS Florence forms as Ernesto rolls towards Jamaica

(CNS): The sixth tropical storm of the 2012 Atlantic hurricane season formed on Friday night in the far eastern Atlantic the national hurricane centre in Miami reported. The storm posed no threat to Cayman and on Saturday morning was located about 415 miles from the southernmost Cape Verde Islands. Meanwhile, Ernesto was weakening and heading towards Jamaica as the country celebrated its 50th anniversary of independence. Forecasters said the storm should pass south of Jamaica Sunday evening and the move over the northwestern Caribbean Sea and south of the Cayman Islands when it may become a hurricane.

(CNS): The sixth tropical storm of the 2012 Atlantic hurricane season formed on Friday night in the far eastern Atlantic the national hurricane centre in Miami reported. The storm posed no threat to Cayman and on Saturday morning was located about 415 miles from the southernmost Cape Verde Islands. Meanwhile, Ernesto was weakening and heading towards Jamaica as the country celebrated its 50th anniversary of independence. Forecasters said the storm should pass south of Jamaica Sunday evening and the move over the northwestern Caribbean Sea and south of the Cayman Islands when it may become a hurricane.

Local hurricane officials are meeting on Sunday and will make an announcement about the possible closure of government services on Monday as Cayman remains under a storm alert.

Ernesto is travelling at near 18 mph with maximum sustained winds of 50 mph with higher gusts. No significant change in strength is expected today but some intensification is possible on Sunday. Ernesto is forecast to become a hurricane in the northwestern Caribbean in a day or two. Tropical storm force winds currently extend outward up to 105 miles mainly to the north and east of the centre.

Check back to CNS over the weekend for announcements regarding the storm.

Cayman sprinter makes it through to 100m semis

(CIOC): Kemar Hyman is safely through to the men’s 100 metres semi-finals at the London Olympics. The 22-year-old Caymanian ran 10.16 seconds in his heat, coming fourth behind the USA’s Ryan Bailey (9.88), Ben Youssef Meite of the Ivory Coast (10.06) and Canada’s Justyn Warner (10.09). Only the top three in each of the seven heats qualified automatically and Hyman qualified as one of the three fastest finishers outside of the top three. There were no surprises in the other heats. Defending Olympic champ Usain Bolt of Jamaica cruised home in 10.09 seconds to win his heat.

(CIOC): Kemar Hyman is safely through to the men’s 100 metres semi-finals at the London Olympics. The 22-year-old Caymanian ran 10.16 seconds in his heat, coming fourth behind the USA’s Ryan Bailey (9.88), Ben Youssef Meite of the Ivory Coast (10.06) and Canada’s Justyn Warner (10.09). Only the top three in each of the seven heats qualified automatically and Hyman qualified as one of the three fastest finishers outside of the top three. There were no surprises in the other heats. Defending Olympic champ Usain Bolt of Jamaica cruised home in 10.09 seconds to win his heat.

Other heat winners were America’s Tyson Gay (10.08) and Justin Gatlin (9.97) and Jamaica’s Asafa Powell (10.04 and Yohan Blake (10.00). Britain’s Dwain Chambers won the final heat in 10.02 seconds.

The 100m semi-finals and finals are on Sunday. The semis are from 1.45pm Cayman time and the final is at 2.50pm Cayman time.

Expat tax on hold

(CNS): A group of local business people claim that they have proposed alternatives to the expat tax which the premier has accepted. Although there has been no confirmation yet from the premier himself, the group of private sector representatives said McKeeva Bush has agreed to make a statement on Monday evening at a public meeting at the Mary Miller Hall, where he will outline the proposals made by them and others to replace the controversial 10% payroll tax on work-permit holders. The six men and one woman released a statement Saturday morning about the development in order to “relieve the anxiety” that they said had arisen in the wake of the announcement by Mckeeva Bush just ten days ago about the tax.

On Wednesday, 25 July, Bush made the announcement that he had been forced to introduce the payroll fee because of pressure from the FCO. He described the tax as “a community enhancement fee”, which he said was needed to meet the UK's demands for a budget with a $76 million surplus. At first, Bush had targeted all work-permit holders earning $20,000 but on Wednesday it was revealed the threshold would be raised to $36,000 and the money would be collected by the immigration department.

The proposal was greeted with opposition from almost every corner of the community. Every single business body, from the Chamber’s Council of Associations to the law society, as well as the Facebook community pointed out the potential dangers the introduction of any kind of tax on earnings posed.

The business group said that during a meeting on Friday with Bush “and after many hours of careful review and input from most sectors of the business community” they were able to come up with alternatives that the premier had found acceptable, they said.

“We support the premier and his efforts to meet the parameters set for the budget," stated the group, which is led by Woody Foster, the owner of Cayman’s largest supermarket chain and wholesale distributor. “We recognize that in order to reach this point, it will require all areas of the economy to participate and contribute to the revenue enhancements and they should not be borne by any single sector."

The statement said the proposed Community Enhancement Fee had created polarity and division in the community that had caused great concern. However, on the social media circuit itwas apparent that the proposal had united Caymanians and expatriates more than ever before, as illustrated by the lightning speed with which the Facebook page Caymanians and Expats United Against Tax formed.

There were very few Caymanians who spoke out in support of the proposed discriminatory tax, as most recognized that it would detrimental to the wider economy and the impact would not be limited to the 5,000 or so work permit holders earning over $36,000 per annum that Bush had planned to target.

“We are a welcoming diverse society that recognizes the contributions of Caymanians and expatriates alike, and we are confident that the new revenue measures will provide a way to share equitably the responsibility of providing revenue to the Government," the business group said. “The premier has committed to making a public statement on Monday night at the Mary Miller Hall agreeing to suggestions – proposed by us and others – and removing the Community Enhancement Fee from further consideration. At this time, he will provide details on the new revenue measures that government is considering.”

It is not clear now where this move will leave Bush with regards to the timeline for the budget, which must be presented, examined by Finance Committee and passed into law before the 31 August. He revealed last Wednesday evening at a meeting in West Bay that his government’s latest proposed budget containing the new direct tax had gone to the UK for approval and he had planned to deliver his budget address in the LA this coming Thursday 9 August.

Check back to CNS for more on this latest development.

See both the statement from local business people and Friday’s statement from the Council of Associations below.

Community on alert over TS Ernesto

(CNS): As Tropical Storm Ernesto moved quickly through the south-eastern Caribbean Sea on Friday evening government officials were warning the community to be prepared for the storm to pass about 123miles southwest of Grand Cayman late Monday night when Hazard Management said tropical storm force winds would brush the island. The Core Group of the National Hazard Management Council will meet at around 4.30 p.m. on Sunday afternoon and make a decision about the closure of government offices on Monday.

(CNS): As Tropical Storm Ernesto moved quickly through the south-eastern Caribbean Sea on Friday evening government officials were warning the community to be prepared for the storm to pass about 123miles southwest of Grand Cayman late Monday night when Hazard Management said tropical storm force winds would brush the island. The Core Group of the National Hazard Management Council will meet at around 4.30 p.m. on Sunday afternoon and make a decision about the closure of government offices on Monday.

Officials said after the meeting the decision would be communicated via the local media and the Cayman Prepared website.

At 5pm local time Ernesto was about 210 miles west of St. Lucia and travelling through the eastern Caribbean t around 21 miles per hour. Maximum sustained winds remained at 50 mph with higher gusts but the National hurricane Centre in Miami predicted some strengthening in the coming days. Tropical storm force winds extend outward up to 105 miles mainly to the north and east of the centre.

Cayman residents were advised to begin preparations for the possible arrival of the storm on Monday. Government began its own preparations at the new building in Elgin Avenue on Friday afternoon after the NHMC convened its first meeting of this year’s hurricane season. Some 30 senior officers, representing critical response agencies, such as the Meteorology Office, the Health Services Authority and RCIPS, attended the meeting.

Grand Cayman is now in the ‘Alert’ phase – 72 hours before possibly being affected by Ernesto and the

‘Watch’ stage begins tomorrow afternoon. Government workers spent Friday afternoon securing the main government building, while PWD shuttering crews and the hurricane shelter staff have been put on alert.

“The civil service should ensure the continuity of government’s operations,” said Deputy Governor Franz Manderson,

Meanwhile, the RCIPS urged home and business owners to start taking precautions to secure their property and belongings in preparation for any potential evacuation.

“If you do have to leave your property, please make sure that your doors and windows are locked and that you close your hurricane shutters if you have them,” said Acting Chief Superintendent Kurt Walton.

“If you have to leave any valuables behind, make sure that they are safely protected within your homes and that you take all necessary steps to make your premises as safe and secure as possible. You should also make sure that your valuables are security marked and that you take notes of makes, models, serial numbers and take photographs. These simple security steps will assist in the recovery of your property if it goes missing,” he added.

Walton explained that during a storm or hurricane the police have a number of jobs and include shelter security, protecting critical infrastructure and, of course, maintaining law and order.

“Any criminal activity before, during or after any storm activity will not be tolerated and those who engage in it will be dealt with appropriately,” the senior officer warned.

Business owners are reminded that they should make immediate application for curfew exemption passes. In the event of a Hurricane and the declaration of a curfew, the passes will be issued to key personnel who work within the private sector to allow them to work past the curfew times, as and when required, to assist in the post-hurricane recovery process.

The application form for the exemption passes can be found on the Hurricane Section of the RCIPS website.

The curfew applications should be filled in and taken to the nearest police station within your district. The District Commander will vet the applications which must be accompanied by a photo ID of the person whom the application is for. The District Commander will decide whether the application meets the criteria, in accordance with the Police Law 2010 Revision, Section 49 and the Police (Emergency Powers) Regulations 2004 Revision.

Residents and businesses may see regular updates about Ernesto on the HMCI’s website (CaymanPrepared.ky) on Facebook and Twitter accounts, Radio Cayman and all local media.

Taylor calm over Mac attack

(CNS): Although the governor said he is “disappointed by the tone and content” of the remarks made by the premier about him this week, Duncan Taylor has remained measured in his response to the premier’s attack. The governor stated Friday that he is committed to the vision of a flourishing Cayman Islands and in the “spirit of co-operation” was keen to work with the premier to address the budget challenges. During a meeting in West Bay on Wednesday night about the proposed tax on work permit holders Premier McKeeva Bush condemned the governor for not helping Cayman but being “hell bent” on its destruction and told him to stop interfering with the political arm of government.

(CNS): Although the governor said he is “disappointed by the tone and content” of the remarks made by the premier about him this week, Duncan Taylor has remained measured in his response to the premier’s attack. The governor stated Friday that he is committed to the vision of a flourishing Cayman Islands and in the “spirit of co-operation” was keen to work with the premier to address the budget challenges. During a meeting in West Bay on Wednesday night about the proposed tax on work permit holders Premier McKeeva Bush condemned the governor for not helping Cayman but being “hell bent” on its destruction and told him to stop interfering with the political arm of government.

Bush accused the governor of not helping with the budget process and not going to bat for Cayman with the UK. He criticised him for interfering and stalling government policy to divest government assets and said he and his "hit man", the auditor general, were frightening everybody.

In response to queries from the media regarding the comments made at the public meeting, the governor released a statement Friday afternoon stating that he was aware of what had been said but he supported well managed public finances and adherence to international standards of governance to enhance Cayman’s reputation as a good place to live, work and do business.

“I am committed to do everything I can to contribute to that vision,” he said. “I have worked hard to this end since my arrival in the Cayman Islands two and a half years ago and I will continue to do so for the remainder of my time as Governor.”

He said that while his particular responsibilities include security and policing, as well as supervision of the civil service and promotion of good governance, wherever he believed there was a role for him he would do what he could to help.

“That includes contributing to the efforts of the Cayman Islands Government and the Foreign and Commonwealth Office to reach agreement on the budget,’ Taylor said.

“These are challenging times for the Cayman Islands, as for so many countries around the world. I am keen to work with the Honourable Premier and his Government, in a spirit of co-operation, to address these challenges.”

Speaking to CNS, the governor confirmed that while he is responsible for appointing and supervising the civil servants, a job delegated to the deputy governor, the cuts to the headcount could only be made based on policy decisions by the elected arm.

He said that he and the deputy governor could reduce numbers once the ministers made clear what the priorities are and what services could be cut. Taylor explained that if ministers identified policy changes and specific reductions in their ministries, the deputy governor would then work out how that could be achieved and then bring back the plan for ministerial approval.

Although at Wednesday’s meeting the premier had pointed the finger at the governor for the size of the civil service, he admitted that if the deputy governor tried to make cuts or reductions to services, the elected arm of Cabinet would need to approve them and he was not going to support any job losses.

In the Whitehall system, adopted by Cayman, ministers do not appoint or direct public servants. They create policies, which the civil service then implements in the most effective way to achieve the goals of the minister. It is the ministers that must direct the policy changes which will allow the civil service management to recommend cuts to reflect those changes.

Anti-tax campaign steps up

(CNS): Organisers of the Facebook group opposed to government’s proposal to introduce a tax on expatriate workers' earnings are stepping up the campaign and offering government other solutions. The group’s founders say there have been numerous suggestions from the community about how the targeted $76 million surplus budget can be achieved and they intend to collate the suggestions and submit them all to government as soon as possible. The group will also be videoing and documenting public opinion on Friday evening, which will be posted on the Facebook page to give people a chance to voice their views.

(CNS): Organisers of the Facebook group opposed to government’s proposal to introduce a tax on expatriate workers' earnings are stepping up the campaign and offering government other solutions. The group’s founders say there have been numerous suggestions from the community about how the targeted $76 million surplus budget can be achieved and they intend to collate the suggestions and submit them all to government as soon as possible. The group will also be videoing and documenting public opinion on Friday evening, which will be posted on the Facebook page to give people a chance to voice their views.

Eden Hurlstone and Nick Pitman from the group Caymanians and Expats United Against Taxation, which now has close to 11,000 members, said that after some people were cut short during Wednesday evening’s meeting with the premier in West Bay and others were too intimidated to talk, they wanted to offer everyone the chance to record their views on how they feel about the discriminatory proposal to tax work-permit holders.

They were particularly concerned about a woman who was asking valid questions and opposing the tax who was cut short by the premier when he referred to her as a "little girl" and told her to give the microphone to someone else. The group has located her and she will be the first of the vox-pops the organisers plan to record.

“We will interview her today at Heroes Square at 5:15pm,” Pitman said. “We are inviting everyone who wants their questions or points recorded on this issue to come along. We plan to post them on the Facebook page and to give them to the media and the premier. We are also creating a United Cayman video.”

Pitman said many people were upset by the way the meeting went on Wednesday and felt the premier had shown a disregard for those who did not agree with him, but the world was changing and he pointed out that there were now many more ways for the people’s voices to be heard.

“The old methods are failing,” Pitman said as he pointed to the power of social media and the fact that the younger generation of Caymanians were waking up.

The group is now working hard in response to the premier’s invitation for people to submit solutions to come up with comprehensive and credible alternatives.

Speaking at his first public meeting on the proposed new tax on Wednesday evening, the premier said that if another source of revenue could be found, the government would not impose the so-called “community enhancement fee” as he said it was not a “desirable” option.

“If we can find an alternative that meets the revenue the United Kingdom says we must meet, then we have no problem,” he said, adding that the UK had imposed stringent parameters. He invited people to submit suggestions to the premier’s office for consideration, even though he has already sent the budget to London with the 10% expat tax on permit holders earning $36k per annum.

The Facebook group organisers plan to pull the alternatives together and present them to government on Monday before the evening’s rally, where these solutions will be discussed and displayed at the Heroes Square gathering.

“We need to approach this from as many angles as possible and present credible solutions on how government can raise the revenue it needs to meet the requirements set by the UK,” Hurlstone said. “Many solutions appear to have been posed and so far the premier has not explained why these numerous alternatives have all been rejected. If the community can demonstrate that there are other options, I feel the government will have to take note. It is quite clear from the reaction of the wider Cayman community that this discriminatory tax has virtually no support.”

The premier confirmed Wednesday that the tax will kick in at a rate of 10% on all work-permit holders earning $36,000 and above. Workers earning $35,999 will pay no tax but those that are salaried at $36,000 will pay $3,600 for the year, since the tax is not incremental.

Government has not yet answered all of the questions surrounding this new tax, which experts all say will be very difficult to collect, but what it has revealed so far is that it does not apply to any Caymanian or permanent resident. It is not clear, however, if it applies to key employees or those working in operation of the law. It does not apply to expat civil servants or any work-permit holder earning less than $36k.

It will be collected by the immigration department but government has not said when or how it will have to be paid. It will be on all remunerations earned by those who fall into the new tax-paying group, including bonuses and expenses. The legal requirement for employees and employers to pay 10% of salaries into a pension fund will now be removed. The premier claimed that eliminating this obligation would make the fee easier for employees to bear.

However, much of the opposition to the tax is not the actual issue of paying it. Most of those who oppose it are concerned about the inequality of the new direct tax and, in particular, the paradigm shift it represents for Cayman and the potential harm to the entire community.

Questions have also been raised about government failing to do the necessary research or analysis on the impact of the tax on the wider economy, the offshore sector or its sustainability, given it is targeting the country’s most transient group of workers.