Archive for August 19th, 2009

Ferries to serve 5 islands in Eastern Caribbean daily

(The Examiner): Those seeking a new way to explore the eastern Caribbean islands might soon have another option. A ferry slated to serve Barbados, St. Lucia, Trinidad, Grenada and St. Vincent is expected to start operating daily by late October, according to Grenada-based BEDY Ocean Line. Prices will range from $120 to $140, and some trips will last up to nearly four hours, CEO Benjamin Ross said Tuesday. The announcement comes as travellers face pricier airline tickets, increased baggage restrictions and canceled flights by regional carrier LIAT due to wage disputes.

(The Examiner): Those seeking a new way to explore the eastern Caribbean islands might soon have another option. A ferry slated to serve Barbados, St. Lucia, Trinidad, Grenada and St. Vincent is expected to start operating daily by late October, according to Grenada-based BEDY Ocean Line. Prices will range from $120 to $140, and some trips will last up to nearly four hours, CEO Benjamin Ross said Tuesday. The announcement comes as travellers face pricier airline tickets, increased baggage restrictions and canceled flights by regional carrier LIAT due to wage disputes.

Short Brac economic forum planned

(CNS): An two and a half hour Economic Forum for Cayman Brac has been scheduled for the morning of Friday, 28 August, and Leader of Government Business McKeeva Bush is inviting members of the public to attend. A release indicated that the forum would provide an opportunity for residents of the Sister Island community to voice their opinions on matters affecting them as a result of the current economic downturn and allow government officials to address pressing issues and concerns.

(CNS): An two and a half hour Economic Forum for Cayman Brac has been scheduled for the morning of Friday, 28 August, and Leader of Government Business McKeeva Bush is inviting members of the public to attend. A release indicated that the forum would provide an opportunity for residents of the Sister Island community to voice their opinions on matters affecting them as a result of the current economic downturn and allow government officials to address pressing issues and concerns.

Bush stated in the release, “The depth and severity of thecurrent global crisis that began in 2008 has affected us all, but I am aware that residents of the Brac face even greater challenges as the recession was coupled with the devastation of last year’s Hurricane Paloma. My aim for facilitating this discussion is to speak one on one with the people to get a true understanding of where things stand from their perspective. The information they give me will help us determine and prioritize the way forward.”

Bush will be accompanied by District Administration Minister Juliana O’Connor-Connolly, and District Commissioner Ernie Scott will act as moderator. Representatives from the Cayman Islands Bureau will also be present to lend their assistance in terms of technical advice to small and medium sized businesses.

The event takes place at the Aston Rutty Centre and will run from 9:30am to 12 noon. It is being facilitated jointly by The Ministry of Financial Services, Tourism and Development and the Cayman Islands Investment Bureau.

Join CNS public forum: How should the Brac develop?

Murders harder to solve

(CNS):According to RCIPS statistics, there have been 31 murders in the Cayman Islands since January 2003 to date. Police say they have brought charges in 18 of these cases, several of which are currently awaiting trial. However, the number of unsolved murders is not necessarily a reflection on the capabilities of the RCIPS as research suggests that murders are becoming increasingly harder to solve despite the advances in forensic science and technology because of the nature of modern murder and the lack of willing witnesses.

(CNS):According to RCIPS statistics, there have been 31 murders in the Cayman Islands since January 2003 to date. Police say they have brought charges in 18 of these cases, several of which are currently awaiting trial. However, the number of unsolved murders is not necessarily a reflection on the capabilities of the RCIPS as research suggests that murders are becoming increasingly harder to solve despite the advances in forensic science and technology because of the nature of modern murder and the lack of willing witnesses.

Acting Detective Chief Superintendent Marlon Bodden explained that solving crime is assisted by science but the basics remain the same. “Although we have access to modern day methods of policing such as high tech forensic capabilities, people need to realise that these cannot replace traditional policing methods,” he said. “Most crimes are solved through traditional methods, i.e. talking to people, talking to witnesses and those who knew the victim, taking statements and piecing together the puzzle.”

This is where the RCIPS like many other police forces in the western world faces its most pressing problem — the combination of fewer and more reluctant witnesses. With a solve rate of just over 58%, the RCIPS murder detection rates compare relatively well to other jurisdictions but according to the Federal Bureau of Investigation, the nature of modern murder makes it harder for police to solve the crime. The main reason is the rise in drug and gang related killings, which are often impersonal and anonymous, and therefore harder to solve than killings among family members or friends. Accross the US murder detection solve rates have fallen from over 91% in the 1960s to around 60% at the end of last year.

CID Chief Inspector Peter Kennett told CNS that a major stumbling block for police in Cayman was the willingness of witnesses to come forward. When there is little forensic evidence to go on, and police say real life murder is not like CSI, police are entirely dependent on witnesses. He noted that a number of murders which still remain unsolved in Cayman are likely to stay that way until those who saw what happened are willing to say what they saw and then be willing to testify to it in an open court.

Kennet gave an example of one case in West Bay in August 2007, where there was limited forensic evidence or apparent motive when the victim was shot and killed under the cover of darkness while alone. he said without an eye witness coming forward or the gun turning up, it is going to be a very difficult case to solve.

He sighted other unsolved cases in West Bay where police know that there were eye witnesses to the crime but who have refused to admit their knowledge and give statements. “There is little we can do in such circumstances other than hope the people involved change their minds," he added.

When 28 year old Omar Samuels was shot last month in the area of McField Lane, it is understood there were literally hundreds of people in the area but police have struggled to find willing witnesses. Speaking at a recent police press conference following the killing of Samuels and then Marcus Ebanks in West Bay, Police Commissioner David Baines said in both cases people had not come forward.

“There are people who know and saw more than they are saying,” said Baines. “The police rely on the people to help. The community are the eyes and the evidence of the police.”

Despite the struggle, however, the RCIPS said that it does not give up on any murder or violent crime, and despite how cold the trail may be they continue to work on cases until some tiny piece of information leads them to the killers. Recently, the RCIPS gained a conviction in cold case rape where DNA evidence eventually helped catch the perpetrator who raped a female tourist back in 2002.

However, Bodden noted that while the RCIPS does have access to modern tools, which can as in this case, help police close a cold case, such tools cannot replace the traditional style, which really comes down to talking to people. “The two methods must work hand in hand. Assistance from the public is absolutely vital, we rely on it — it is our lifeblood,” he said.

If you like this article, click here to find out how to support CNS

End embargo says church

(AP): A delegation of U.S. Roman Catholic Church leaders urged Barack Obama’s administration to seize what they called a rare political opportunity to lift the 47-year-old economic embargo against Cuba’s communist government. Bishop Thomas Wenski of Orlando, Florida, said the U.S. church welcomed a recent move by Washington to relax travel restrictions on Cuban Americans with family in Cuba as well on the remittances they can send to those families. But he said there is much more to be done.

(AP): A delegation of U.S. Roman Catholic Church leaders urged Barack Obama’s administration to seize what they called a rare political opportunity to lift the 47-year-old economic embargo against Cuba’s communist government. Bishop Thomas Wenski of Orlando, Florida, said the U.S. church welcomed a recent move by Washington to relax travel restrictions on Cuban Americans with family in Cuba as well on the remittances they can send to those families. But he said there is much more to be done.

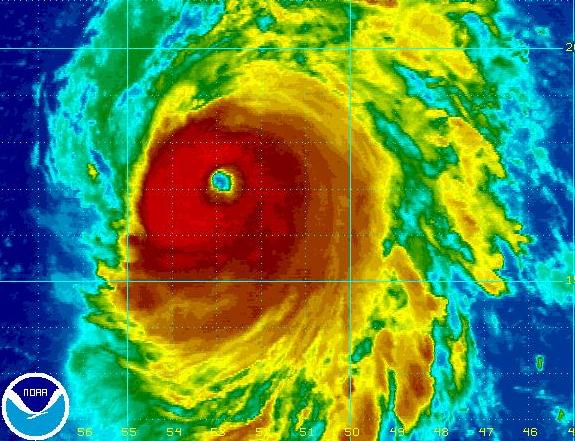

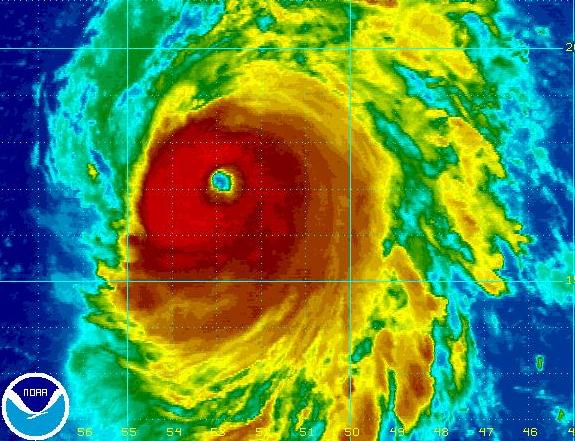

Bill becomes a major category four hurricane

(CNS): The first hurricane of the 2009 Atlantic season has wasted no time in reaching ‘major’ status. At 8:30pm (AST) the National Hurricane Centre in Miami announced that Bill had become a category three hurricane with maximum sustained winds near 125 mph. By 5:00 am AST however, Bill was a category four with winds up to 135 mph.

(CNS): The first hurricane of the 2009 Atlantic season has wasted no time in reaching ‘major’ status. At 8:30pm (AST) the National Hurricane Centre in Miami announced that Bill had become a category three hurricane with maximum sustained winds near 125 mph. By 5:00 am AST however, Bill was a category four with winds up to 135 mph.

Located less than 460 miles east of the Leeward Islands moving toward the west-northwest near 16 mph hurricane force winds extend outward up to 45 miles from the centre and tropical storm force winds up to 175 miles.

The NHC said the west-northwest motion is expected to continue with a turn toward the northwest is expected during the next 24hr, Forecasters are also predicting that Bill will intensify. On this track the core of Bill will be passing well to the northeast of the northern Leeward Islands late Wednesday and early Thursday. At this stage Bill still poses no threat to the Cayman Islands

Local e-retail lags behind

(CNS): Although the vast majority of Cayman Islands businesses now have websites, very few offer their customers the ability to buy goods or services directly online. While e-retail generates billions of dollars around the world, in Cayman very little money is generated through this potentially lucrative route. One local business owner told CNS that she believes the fundamental problem is local retail banks, which are not offering the necessary facilities to enable their business account holders to accept online payments, acting as a barrier to the development of local e-retail.

(CNS): Although the vast majority of Cayman Islands businesses now have websites, very few offer their customers the ability to buy goods or services directly online. While e-retail generates billions of dollars around the world, in Cayman very little money is generated through this potentially lucrative route. One local business owner told CNS that she believes the fundamental problem is local retail banks, which are not offering the necessary facilities to enable their business account holders to accept online payments, acting as a barrier to the development of local e-retail.

At present there is only one retail bank, out of seven in Cayman, currently offering online merchant accounts, with one other preparing to introduce the service by the end of 2009.

Before a business can accept money online it must set up an internet payment gateway and then have that gateway pass the money to their bank, but without a special online merchant account the business owner cannot receive the payments.

Lynne Byles of Tower Market says she introduced a gateway to Cayman some five years ago expecting it to facilitate the take off of online shopping, but because of the slow uptake by local banks to offer online merchant accounts, e-retail still only accounts for a tiny percentage of trade in Cayman.

Byles explained that C-pay offers local business a secure gateway for them to sell their goods andservices to the local market, but unless they bank with Butterfield they have no way of receiving the funds. “C-pay is designed to offer the interface between a website, where a customer is buying goods, and the seller’s bank account but to accept that money the seller has to have a special internet merchant ID which C-pay uses to credit the online business.”

Byles went on to explain that an internet merchant account is just an extension of a regular merchant account, which nearly all retail businesses have with their banks so they can accept credit cards. “Cayman is so far behind the rest of the world in online retail because of the failure of local banks to offer the upgraded facility,” she added.

Byles said that the C-Pal service is finally starting to attract considerable local interest but the first thing she has to tell any Cayman business looking for the gateway is that she can’t offer it to them unless they bank with Butterfield. “Shopping on line is big business everywhere else, but here, one of the world’s most sophisticated financial centres offering untold innovative financial products, we can’t find a way to help our own merchants sell goods and services through their websites,” Byles said.

Cayman’s broadband internet use has grown rapidly in the last few years, and according to the latest Labour Force Survey from the Economics and Statistics Office, more than 60% of households now have broadband internet access. And while Caymanians are now doing more and more things on-line, not least reading and commenting on the news, local businesses are unable to tap into that ready market of potential buyers.

Ormond Williams, the President of Cayman National Bank, disagrees that it is the fault of local banks that e-retail has not been as quick off the mark in Cayman as in other jurisdictions as he explained it has not necessarily been a top priority service for his customers. However, he did say that CNB hopes to be offering the facilities by the end of the year.

“We have been looking at this for some time but when we introduce the service we want to ensure we have got the quality of the service and the integrity of the system right,” Williams added. He noted that there were risks associated with the systems, especially fraud, but there were also other issues which the bank had to consider.

As a smaller organisation than his competitors, Williams explained that CNB can’t just take a system off the shelf from another jurisdiction but has to create the system from scratch. He said that given the amount of projects with which CNB, as a small bank, is engaged the demand regarding merchant internet accounts and the facilities to enable businesses to receive on-line payments has not until now been a priority. Williams said the bank had chosen not to be aggressive about this particular service, though he admitted that there was growing interest which would make it commercially viable for the bank to get involved sooner rather than later.

There are also issues of security and fraud which have held banks back from offering the service, but local businesses disagree and a number of traders told CNS that the internet sales transaction is no more insecure than a normal credit card purchase, but what is putting the banks off is the economy of scale.

Of the few local businesses that are offering an on-line shopping such as major players like Tortuge Rum Company are using Butterfield bank’s on line services but others are using US banks to receive the transactions, while others are using considerably less secure means by having customers e-mail credit card details. Companies can use Pay-Pal but the money has to be paid into a US account or another country in which the service operates.

Byles says that she has begun to take on a number of new accounts with the C-pay system that hold Butterfield accounts, but given the business potential that is out there, she says the only way e-commerce can really take off is if all of the local retail banks embrace the concept and finally open up what she says is an untapped market of potential income for many business.

Byles also noted the possibilities for government to become more efficient by offering people the opportunity to pay a number of different fees on line, from trade and business licences to garbage fees. She said that while it may still be some time before the supermarkets are set up to offer internet grocery shopping, there are still many small businesses that would benefit enormously from being able to ply their trade online. “It’s astounding really that we are so far behind,” Byles lamented.

If you like this article, click here to find out how to support CNS