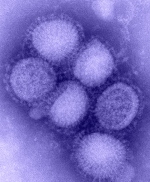

Swiss Re bond lets investors bet against swine flu

(InvestmentNews): Swiss Reinsurance Co. Ltd. today introduced a $75 million catastrophe bond that covers extreme mortality risks related to a swine flu epidemic. The offering, which was sold through a private placement, guards against unexpectedly high mortality rates in the United States and the United Kingdom for five years. Essentially, investors will bet that mortality rates related to the H1N1 flu virus won’t be unusually high. Vita Capital IV Ltd., a special-purpose vehicle in the Cayman Islands, issued the H1N1 bond in the capital markets.

(InvestmentNews): Swiss Reinsurance Co. Ltd. today introduced a $75 million catastrophe bond that covers extreme mortality risks related to a swine flu epidemic. The offering, which was sold through a private placement, guards against unexpectedly high mortality rates in the United States and the United Kingdom for five years. Essentially, investors will bet that mortality rates related to the H1N1 flu virus won’t be unusually high. Vita Capital IV Ltd., a special-purpose vehicle in the Cayman Islands, issued the H1N1 bond in the capital markets.

Category: Business