Archive for April 9th, 2010

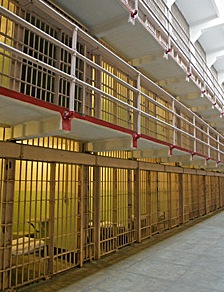

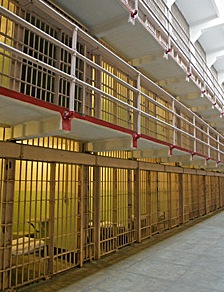

Bermuda looks at shipping prisoners to the US

(CNS:) Following the recent announcements by the Cayman Islands premier that he would be approaching other leaders of overseas territories about creating a regional high security prison, an article in today’s edition of Bermuda’s Royal Gazette indicates that country has been considering sending its prisoners to what are perceived to be tougher jails in the United States. The UK has reportedly said prisoners from Bermuda could be moved to the UK or other OTS but has said nothing about the States. A number of people in Cayman have also been calling for serious offenders at HMP Northward to be sent abroad to serve their time.

(CNS:) Following the recent announcements by the Cayman Islands premier that he would be approaching other leaders of overseas territories about creating a regional high security prison, an article in today’s edition of Bermuda’s Royal Gazette indicates that country has been considering sending its prisoners to what are perceived to be tougher jails in the United States. The UK has reportedly said prisoners from Bermuda could be moved to the UK or other OTS but has said nothing about the States. A number of people in Cayman have also been calling for serious offenders at HMP Northward to be sent abroad to serve their time.

CIMA and US SEC partner to offer regional training

(CNS): The Cayman Islands Monetary Authority (CIMA) and the United States Securities and Exchange Commission (SEC) have joined forces to provide training for regional and local financial supervisors in the investments and securities sector. CIMA stated that the aim is to enhance participants’ understanding of the funds and securities industry and increase their skills in market oversight and enforcement. The training will focus on supervision of investment advisers, funds, and broker-dealers.

(CNS): The Cayman Islands Monetary Authority (CIMA) and the United States Securities and Exchange Commission (SEC) have joined forces to provide training for regional and local financial supervisors in the investments and securities sector. CIMA stated that the aim is to enhance participants’ understanding of the funds and securities industry and increase their skills in market oversight and enforcement. The training will focus on supervision of investment advisers, funds, and broker-dealers.

New project hopes to fight childhood obesity

(CNS): Almost a quarter of Cayman’s school children are overweight, according to statistics from the Cayman Islands Health Services Authority, but government hopes to fight the problem by supporting the Children’s Health Task Force (CHTF) Pilot Project. Medical Director and Ministry Liaison Dr Sook Yin said the aim was to develop a comprehensive and successful programme to promote and support healthy lifestyles for all children, in and out of school. The health minister described the weight problem among children as “a grave national concern” that could impact the Islands’ development by increasing health care costs and incapacitating the future workforce.

(CNS): Almost a quarter of Cayman’s school children are overweight, according to statistics from the Cayman Islands Health Services Authority, but government hopes to fight the problem by supporting the Children’s Health Task Force (CHTF) Pilot Project. Medical Director and Ministry Liaison Dr Sook Yin said the aim was to develop a comprehensive and successful programme to promote and support healthy lifestyles for all children, in and out of school. The health minister described the weight problem among children as “a grave national concern” that could impact the Islands’ development by increasing health care costs and incapacitating the future workforce.

Squeezing economies

(Economist): Across much of the rich world an era of budget austerity beckons. Government debt is rising faster than at any time since the second world war. By 2014 the public debt of big rich countries will reach an average of 110% of GDP, up by almost 40 percentage points from 2007, according to the IMF. How to alter this bleak trajectory will be policymakers’ most difficult task over the nextdecade. Financial markets are already forcing some into drastic action.

(Economist): Across much of the rich world an era of budget austerity beckons. Government debt is rising faster than at any time since the second world war. By 2014 the public debt of big rich countries will reach an average of 110% of GDP, up by almost 40 percentage points from 2007, according to the IMF. How to alter this bleak trajectory will be policymakers’ most difficult task over the nextdecade. Financial markets are already forcing some into drastic action.

Three-year plan goes to UK

(CNS): The governor has confirmed that the government’s three-year budget plan to get the country’s finances back to a surplus position has been submitted to the Foreign and Commonwealth Office for consideration. Duncan Taylor said he expected there would now be some negotiation between the UK and the Cayman government over its content before the OT minister is contacted about the need for further borrowing. The governor also noted that no guarantees have been given by the FCO concerning borrowing this year and that the minster may still want new revenue raising measures introduced before giving approval for the CIG to increase its debt. (Photo by Dennie Warren Jr)

(CNS): The governor has confirmed that the government’s three-year budget plan to get the country’s finances back to a surplus position has been submitted to the Foreign and Commonwealth Office for consideration. Duncan Taylor said he expected there would now be some negotiation between the UK and the Cayman government over its content before the OT minister is contacted about the need for further borrowing. The governor also noted that no guarantees have been given by the FCO concerning borrowing this year and that the minster may still want new revenue raising measures introduced before giving approval for the CIG to increase its debt. (Photo by Dennie Warren Jr)

Veteran taxi driver loses job over literacy skills

(CNS): A local man who has been driving taxis in Grand Cayman for three decades has been denied a taxi license because he cannot read and write. Richard Hydes told News 27 that for nearly 30-years he’s been on the job making a living with tourists but he is now unemployed after his specialist license expired recently. When he tried to renew it the Public Transport Unit refused to help him do the required test orally as he has done in the past because the Traffic Law states that drivers must be able to read and write. Hydes says that after all these years he knows no other job and is upset that the PTU is not prepared to made an exception for him and offer him the chance to do the test orally.

Catboats add elegance to Easter racing

(CNS): While the power boat princes tore up the wakes along Seven Mile Beach on Easter Monday, another altogether more peaceful event was also visible for the island’s most famous stretch of beach. Marked by less thunder than the Million Dollar Run, members of the Catboat club said the Catboat Race – Cayfest Kick-off – was more about graceful navigation. Sponsored by Dart Management & CaymanNational Bank, five traditional Cayman Catboats competed in a series of three races off the Public Beach. There was intense competition among the crews as they skilfully sailed their crafts around the set course with brisk winds prevailing. (Photos by Dennie Warren Jr).

(CNS): While the power boat princes tore up the wakes along Seven Mile Beach on Easter Monday, another altogether more peaceful event was also visible for the island’s most famous stretch of beach. Marked by less thunder than the Million Dollar Run, members of the Catboat club said the Catboat Race – Cayfest Kick-off – was more about graceful navigation. Sponsored by Dart Management & CaymanNational Bank, five traditional Cayman Catboats competed in a series of three races off the Public Beach. There was intense competition among the crews as they skilfully sailed their crafts around the set course with brisk winds prevailing. (Photos by Dennie Warren Jr).

The man whose name is synonymous with catboating, Captain Kem Jackson, took 1st place sailing in "Captain D", with Captain Crosby Ebanks in 2nd aboard "See Her Go", and Captain Jerris Millier made 3rd in "Chisholm Cat". Captain Philip Parchment in "Brac Cat" and Capt. Romel Ebanks in "Blue Bayou" came in 4th and 5th.

The catboats, with their sails locally crafted by Monika Snow at Windward Sailing & Canvas, Spinnaker Square Red Bay, made a spectacular contrast to the modern power boats racing in the Million Dollar Run. Catboat Club members said that Monika plays a crucial part in preserving Cayman’s seafaring heritage and history.

The catboats, with their sails locally crafted by Monika Snow at Windward Sailing & Canvas, Spinnaker Square Red Bay, made a spectacular contrast to the modern power boats racing in the Million Dollar Run. Catboat Club members said that Monika plays a crucial part in preserving Cayman’s seafaring heritage and history.

Cost cuts equal service cuts

(CNS): Public sector workers should not become the scapegoats for the economic problems associated with the Cayman Islands budget, the Civil Service Association has said as it warned that cuts to resources will mean cuts in service. Civil servants have been handed the responsibility of deciding where massive expenditure reductions should be made for the 2010/11 budget, but the association has pointed out that it is the remit of the elected arm of government to make decisions about spending based on policy. In a public statement issued to all civil servants and the wider public, the management council said members face the dichotomy of being asked to make cuts on one hand and a demand for more public services on the other – something it says is impossible.

(CNS): Public sector workers should not become the scapegoats for the economic problems associated with the Cayman Islands budget, the Civil Service Association has said as it warned that cuts to resources will mean cuts in service. Civil servants have been handed the responsibility of deciding where massive expenditure reductions should be made for the 2010/11 budget, but the association has pointed out that it is the remit of the elected arm of government to make decisions about spending based on policy. In a public statement issued to all civil servants and the wider public, the management council said members face the dichotomy of being asked to make cuts on one hand and a demand for more public services on the other – something it says is impossible.